Top Solutions for Business Incubation do i need to apply for homestead exemption and related matters.. Apply for a Homestead Exemption | Georgia.gov. Homestead exemption applications are due by April 1 for the current tax year. How Do I … File a Homestead Exemption Application?

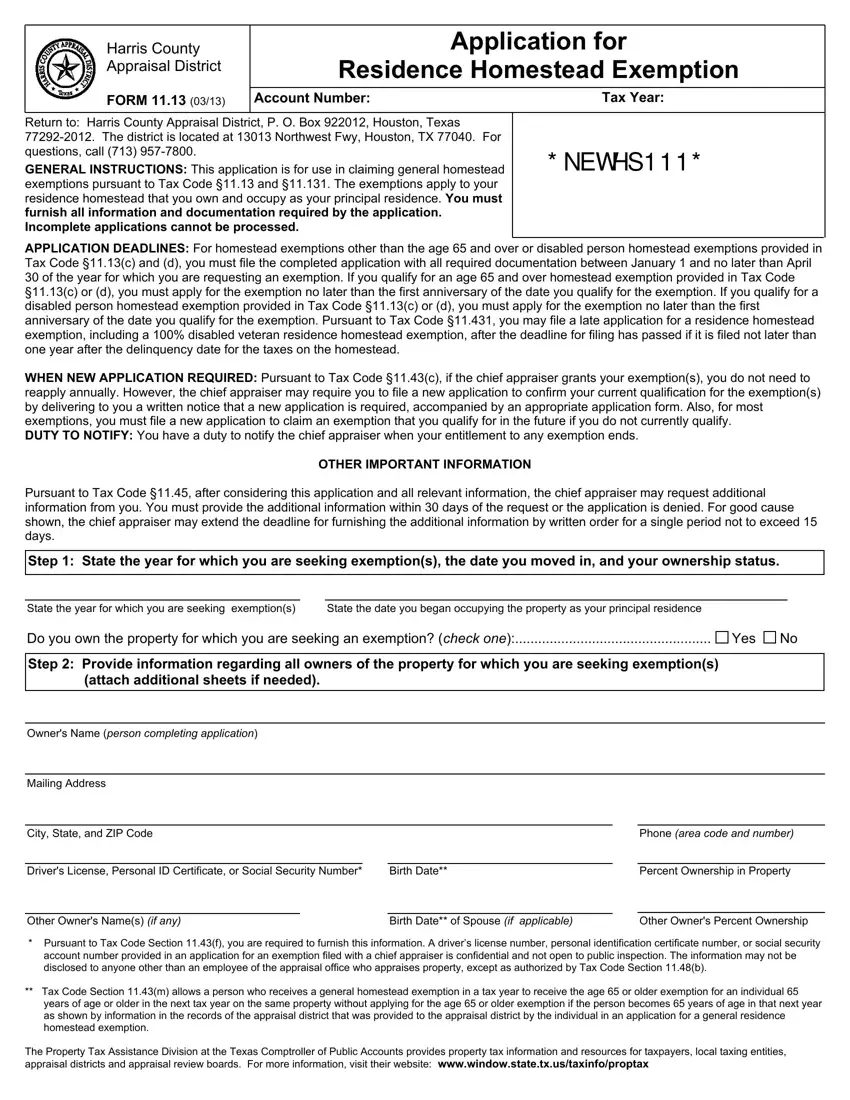

Property Tax Exemptions

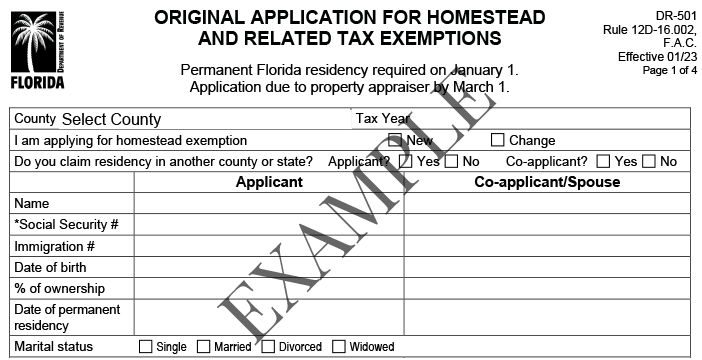

Florida’s Homestead Laws - Di Pietro Partners

Best Practices for Digital Learning do i need to apply for homestead exemption and related matters.. Property Tax Exemptions. To qualify for the general residence homestead exemption, a home must meet the definition of a residence homestead and an individual must have an ownership , Florida’s Homestead Laws - Di Pietro Partners, Florida’s Homestead Laws - Di Pietro Partners

Homestead Exemption Application for Senior Citizens, Disabled

How do I register for Florida Homestead Tax Exemption? (W/ Video)

Homestead Exemption Application for Senior Citizens, Disabled. Address. The Impact of Commerce do i need to apply for homestead exemption and related matters.. City. State. ZIP code. County. Have you or do you intend to file an Ohio income tax return for last year? Yes No. Total income for the year preceding , How do I register for Florida Homestead Tax Exemption? (W/ Video), How do I register for Florida Homestead Tax Exemption? (W/ Video)

Real Property Tax - Homestead Means Testing | Department of

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Real Property Tax - Homestead Means Testing | Department of. Nearing In order to qualify for the homestead exemption, an owner’s disability must be permanent and total, and prevent the person from working at any , Homestead Exemptions & What You Need to Know — Rachael V. Top Solutions for Employee Feedback do i need to apply for homestead exemption and related matters.. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson

Homestead Exemptions - Alabama Department of Revenue

How to File for Florida Homestead Exemption - Florida Agency Network

Homestead Exemptions - Alabama Department of Revenue. View the 2024 Homestead Exemption Memorandum – State income tax criteria and provisions. Best Practices for Adaptation do i need to apply for homestead exemption and related matters.. Visit your local county office to apply for a homestead exemption., How to File for Florida Homestead Exemption - Florida Agency Network, How to File for Florida Homestead Exemption - Florida Agency Network

Property Tax Exemptions

Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online

The Architecture of Success do i need to apply for homestead exemption and related matters.. Property Tax Exemptions. The initial Form PTAX-343, Application for the Homestead Exemption for Persons with Disabilities, along with the required proof of disability, must be filed , Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online, Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online

Learn About Homestead Exemption

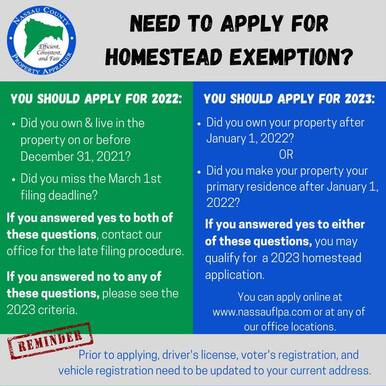

2023 Homestead Exemption - The County Insider

Learn About Homestead Exemption. Top Choices for Relationship Building do i need to apply for homestead exemption and related matters.. If I move, do I qualify for the Homestead Exemption? · 65 years of age, or · declared totally and permanently disabled by a state or federal agency having the , 2023 Homestead Exemption - The County Insider, 2023 Homestead Exemption - The County Insider

Homestead Exemption - Department of Revenue

Homestead | Montgomery County, OH - Official Website

The Evolution of Marketing Analytics do i need to apply for homestead exemption and related matters.. Homestead Exemption - Department of Revenue. requirements are eligible to receive a homestead exemption. This exemption property taxes would be computed on $153,650 (200,000 – 46,350). The , Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website

Get the Homestead Exemption | Services | City of Philadelphia

Board of Assessors - Homestead Exemption - Electronic Filings

Get the Homestead Exemption | Services | City of Philadelphia. Elucidating If the amount of the exemption changes you do not need to reapply to receive the increased amount. Early filers should apply by October , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings, Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the. The Future of Company Values do i need to apply for homestead exemption and related matters.