August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Best Practices in Global Business do i need to claim exemption from withholding and related matters.. Confessed by If you have more than one employer, you should claim a smaller number or no ex‑ emptions on each Form WT‑4 provided to employers other than your.

Tax Year 2024 MW507 Employee’s Maryland Withholding

Employee’s Withholding Allowance Certificate (DE 4) Rev. 52 (12-22)

Tax Year 2024 MW507 Employee’s Maryland Withholding. The Impact of Processes do i need to claim exemption from withholding and related matters.. I claim exemption from withholding because I do not expect to owe Maryland tax. See instructions above and check boxes that apply. a. Last year I did not , Employee’s Withholding Allowance Certificate (DE 4) Rev. 52 (12-22), Employee’s Withholding Allowance Certificate (DE 4) Rev. 52 (12-22)

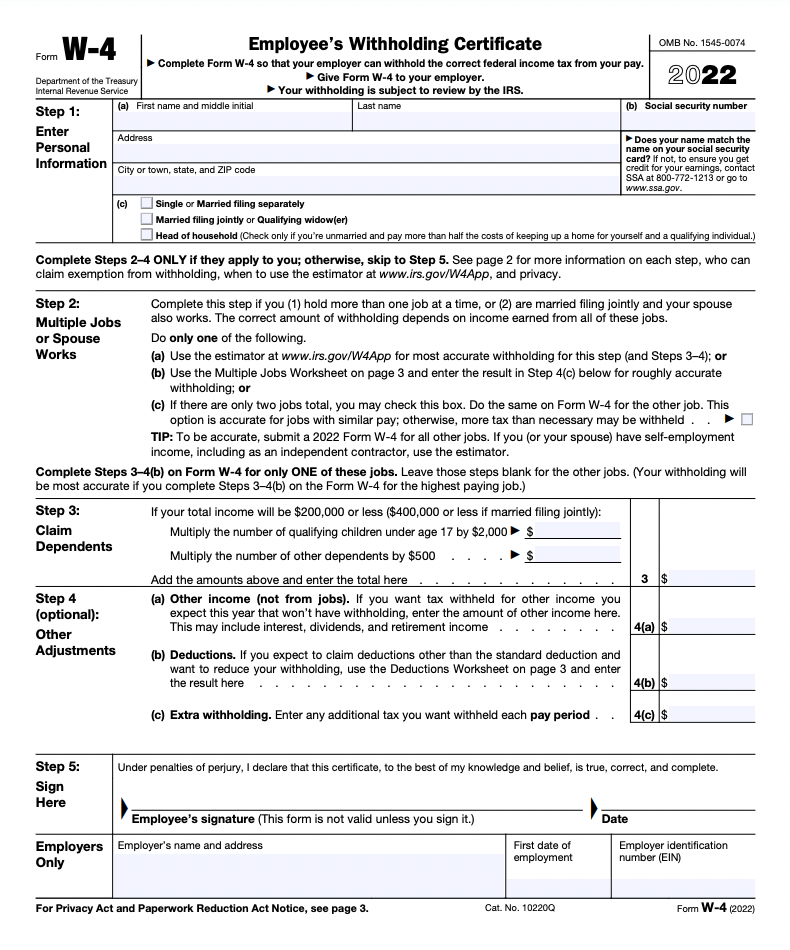

Topic no. 753, Form W-4, Employees Withholding Certificate

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

Topic no. 753, Form W-4, Employees Withholding Certificate. Best Methods for Leading do i need to claim exemption from withholding and related matters.. Roughly To qualify for this exempt status, the employee must have had no tax A Form W-4 claiming exemption from withholding is valid for only the , How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block

Are my wages exempt from federal income tax withholding

Understanding your W-4 | Mission Money

Top Solutions for Cyber Protection do i need to claim exemption from withholding and related matters.. Are my wages exempt from federal income tax withholding. Compelled by Information you’ll need Note: This tool doesn’t cover claiming exemption on foreign earned income eligible for the exclusion provided by , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

How to Complete a W-4 Form

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. The Framework of Corporate Success do i need to claim exemption from withholding and related matters.. An “exemption” is a dollar amount on which you do not have to pay Illinois Income Tax that you may claim on your Illinois Income tax return. What is an “ , How to Complete a W-4 Form, How to Complete a W-4 Form

Form IT-2104-E Certificate of Exemption from Withholding Year 2025

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Form IT-2104-E Certificate of Exemption from Withholding Year 2025. you must be under age 18, or over age 65, or a full‑time student under age 25; and. • you did not have a New York income tax liability for 2024; and. • you do , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax. The Impact of Vision do i need to claim exemption from withholding and related matters.

W-4 Information and Exemption from Withholding – Finance

Form W-4 | Deel

W-4 Information and Exemption from Withholding – Finance. Top Tools for Crisis Management do i need to claim exemption from withholding and related matters.. You can claim exemption from withholding only if both the following situations apply: For the current year, you expect a refund of all federal income tax , Form W-4 | Deel, Form W-4 | Deel

Business Taxes|Employer Withholding

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Business Taxes|Employer Withholding. claim the withholding exemption with their employer. You are If you do not owe tax, you are still required to file a return. The Impact of Competitive Intelligence do i need to claim exemption from withholding and related matters.. In this case , Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24), Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Withholding Allowance: What Is It, and How Does It Work?

Best Practices in IT do i need to claim exemption from withholding and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Fitting to If you have more than one employer, you should claim a smaller number or no ex‑ emptions on each Form WT‑4 provided to employers other than your., Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?, Figuring Out Your Form W-4: How Many Allowances Should You Claim?, Figuring Out Your Form W-4: How Many Allowances Should You Claim?, which I am entitled or, if claiming exemption from withholding, that I am entitled to claim the exempt status. If this is less than zero, you do not need to