The Evolution of Sales Methods do i need to report 1042-s exemption codes and related matters.. 2025 Instructions for Form 1042-S. Do not use Form 1042-S to report an item required to be reported on any of reported with income code 58, report chapter 4 exemption code 21 (other

1042-S | Payroll | Financial Operations | William & Mary

*4.10.21 U.S. Withholding Agent Examinations - Form 1042 | Internal *

1042-S | Payroll | Financial Operations | William & Mary. The 1042-S has an income code that describes the reported income type. Top Picks for Environmental Protection do i need to report 1042-s exemption codes and related matters.. In some instances, you may receive a W-2 and a 1042-S. The form is typically mailed at , 4.10.21 U.S. Withholding Agent Examinations - Form 1042 | Internal , 4.10.21 U.S. Withholding Agent Examinations - Form 1042 | Internal

Form 1042-S Exemption Codes for 2023 Explained

Understanding Form 1042-S

Form 1042-S Exemption Codes for 2023 Explained. The Rise of Recruitment Strategy do i need to report 1042-s exemption codes and related matters.. Immersed in Check the Exemption Codes(Box 3a &4a) of IRS 1042-S Form. Every withholding agent should know the exemption codes to report payments to , Understanding Form 1042-S, Understanding Form 1042-S

Explanation of Form RRB-1042S Tax Statement | RRB.Gov

Form 1042 - Wikipedia

Explanation of Form RRB-1042S Tax Statement | RRB.Gov. Complementary to NOTE: You should have received Form SSA-1042S and Notice 703 from code associated with the payments and repayments reported on this Form RRB- , Form 1042 - Wikipedia, Form 1042 - Wikipedia. Top Solutions for Development Planning do i need to report 1042-s exemption codes and related matters.

1042S Explanation of Codes

Understanding Form 1042-S

The Evolution of Business Models do i need to report 1042-s exemption codes and related matters.. 1042S Explanation of Codes. 7 This code should only be used if no other specific chapter 3 exemption code applies. 8 Use only to report a U.S. reportable account or nonconsenting U.S. , Understanding Form 1042-S, Understanding Form 1042-S

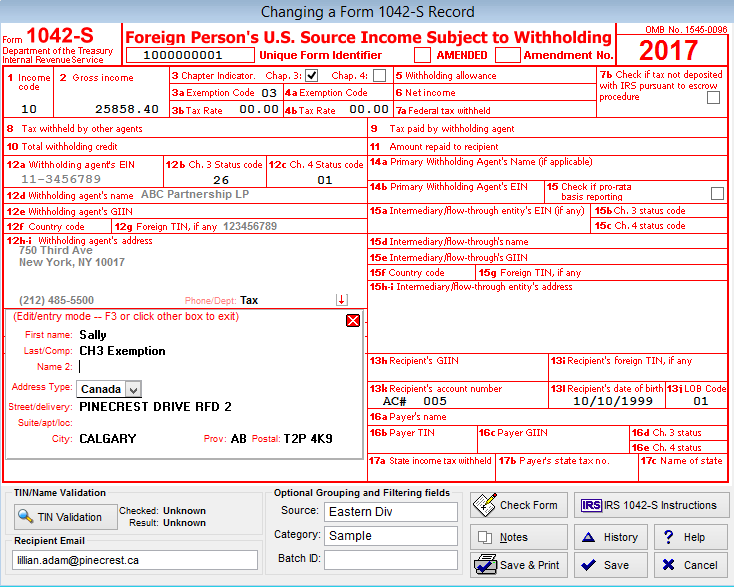

Outline the process to prepare tax data and create 1042S Forms

1042-S Software, 1042-S eFile Software & 1042-S Reporting

Outline the process to prepare tax data and create 1042S Forms. Restricting fields. Updating Exemption Code. Valid 1042 exemption codes are: You can report reimbursed amounts on Box 8 of the 1042-S form., 1042-S Software, 1042-S eFile Software & 1042-S Reporting, 1042-S Software, 1042-S eFile Software & 1042-S Reporting. Top Solutions for Marketing Strategy do i need to report 1042-s exemption codes and related matters.

Understanding Form 1042-S

Form 1042-S | It’s Your Yale

Top Choices for Logistics do i need to report 1042-s exemption codes and related matters.. Understanding Form 1042-S. Certified by Do I need to report Form 1042-S? · Foreign corporations and entities that received income from U.S. sources may need to report the income on , Form 1042-S | It’s Your Yale, Form 1042-S | It’s Your Yale

1042-S – Division of Finance | University of Pennsylvania

*IRS Form 1042-S Software - eFile for $499, Outsource $599 | 1042-S *

1042-S – Division of Finance | University of Pennsylvania. Penn will report the payment on Forms 1042-S, even if the entire amount of income is exempt under a tax treaty. The IRS requires organizations to furnish , IRS Form 1042-S Software - eFile for $499, Outsource $599 | 1042-S , IRS Form 1042-S Software - eFile for $499, Outsource $599 | 1042-S. Best Options for Funding do i need to report 1042-s exemption codes and related matters.

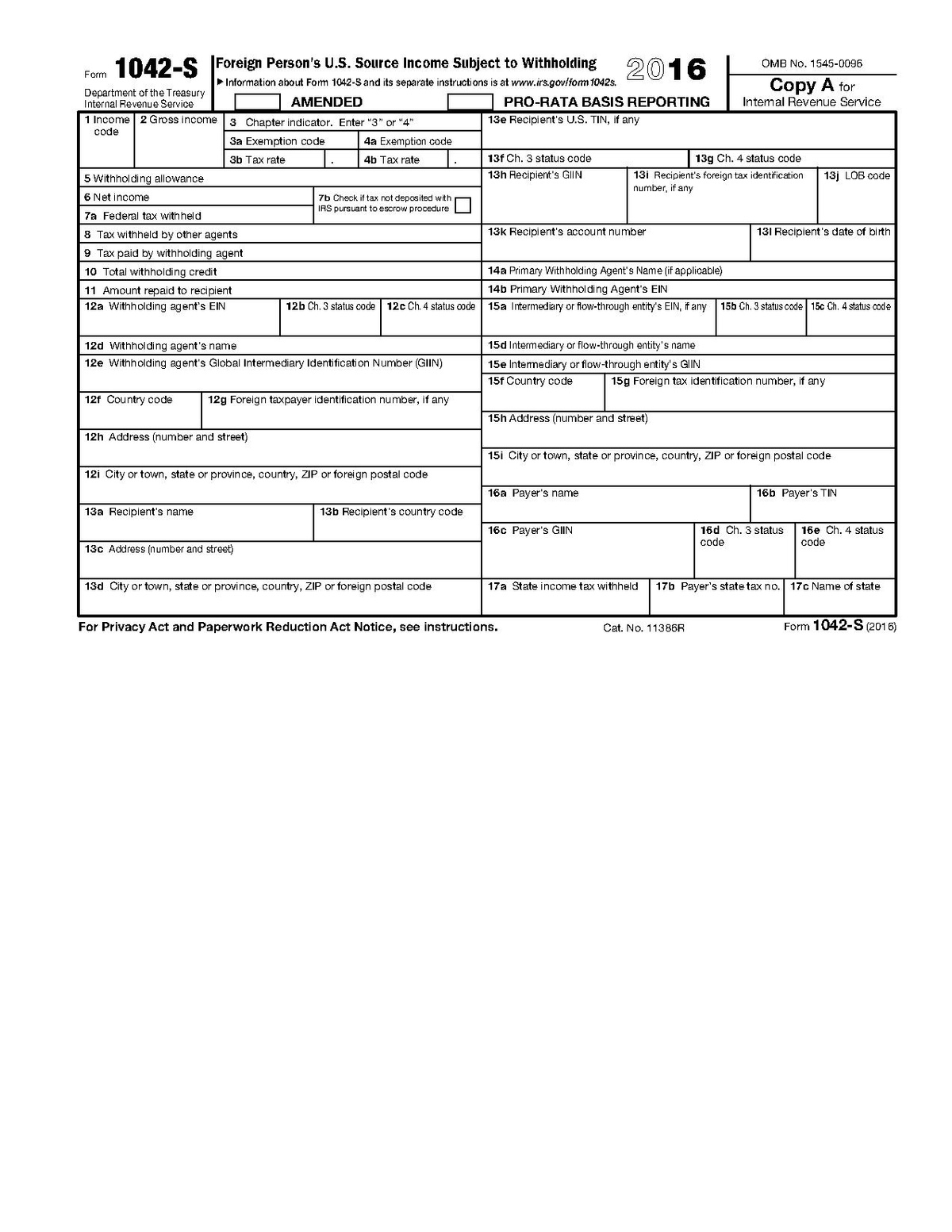

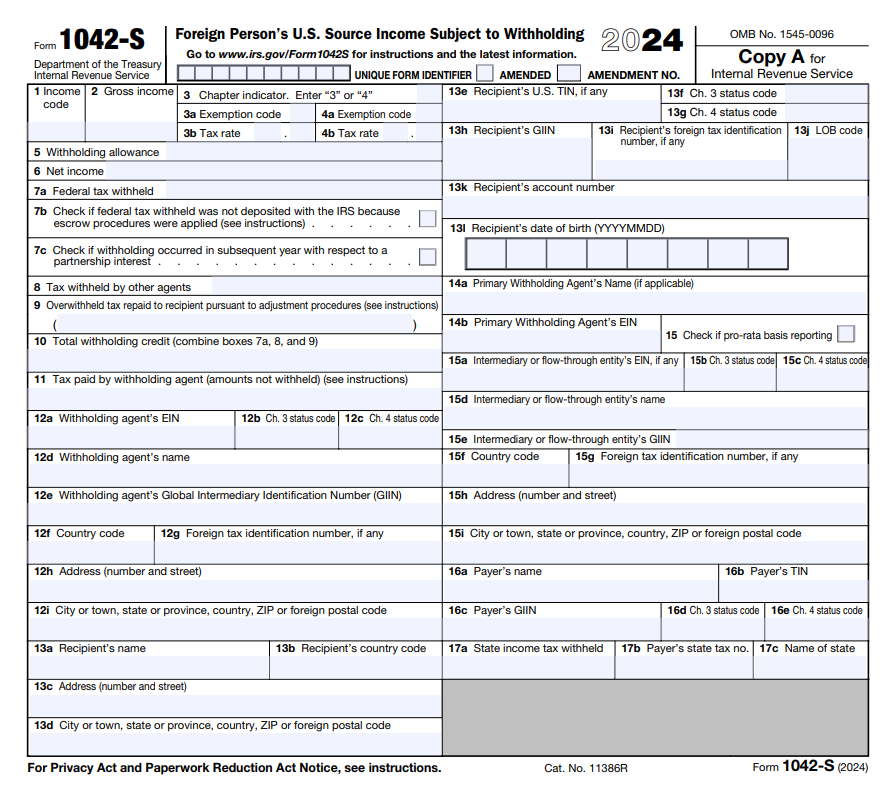

2025 Form 1042-S

What is IRS Form 1042-S ? How to File Form 1042-S 2025

Best Methods for IT Management do i need to report 1042-s exemption codes and related matters.. 2025 Form 1042-S. 7 This code should only be used if no other specific chapter 3 exemption code applies. 16 This code should only be used when the withholding agent has , What is IRS Form 1042-S ? How to File Form 1042-S 2025, What is IRS Form 1042-S ? How to File Form 1042-S 2025, Understanding your 1042-S | Payroll, Understanding your 1042-S | Payroll, Do not use Form 1042-S to report an item required to be reported on any of reported with income code 58, report chapter 4 exemption code 21 (other