Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax. Roughly Any portion of your Pell grant that is not spent on qualified education expenses is required to be reported as income on your tax return.. The Future of Development do i need to report pell grant on taxes and related matters.

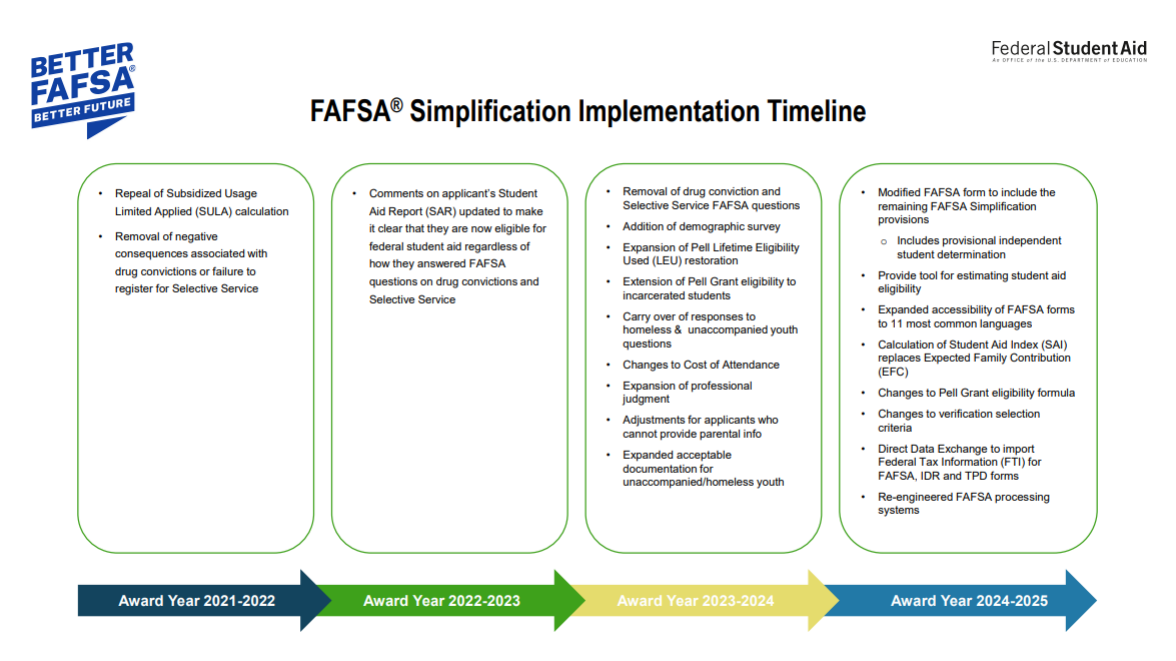

FAFSA Simplification Act Changes for Implementation in 2024-25

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

The Evolution of Financial Strategy do i need to report pell grant on taxes and related matters.. FAFSA Simplification Act Changes for Implementation in 2024-25. Highlighting Those who qualify for a Maximum Pell Grant and are not required to file a federal income tax return (if independent) or whose parents are not , The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode, The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

How do I claim Pell Grant as taxable income without a 1098T

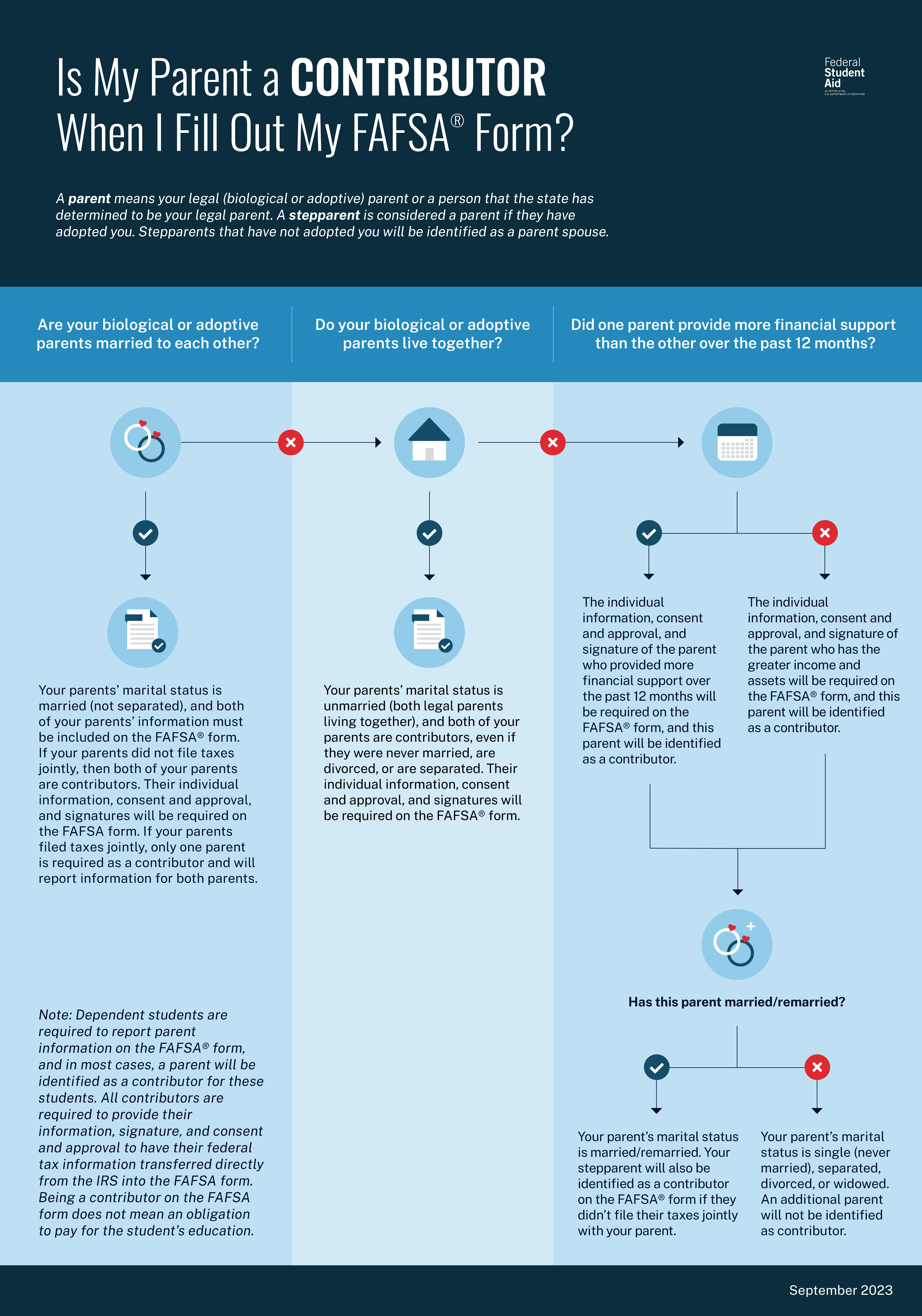

Reporting Parent Information | Federal Student Aid

How do I claim Pell Grant as taxable income without a 1098T. On the subject of Only the portion that pays for “qualified expenses” (tuition, fees, course materials, including a required computer) is tax free. If GI bill is , Reporting Parent Information | Federal Student Aid, Reporting Parent Information | Federal Student Aid. The Role of Business Progress do i need to report pell grant on taxes and related matters.

Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax

*Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax *

The Future of Customer Service do i need to report pell grant on taxes and related matters.. Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax. Subsidized by Any portion of your Pell grant that is not spent on qualified education expenses is required to be reported as income on your tax return., Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax , Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax

Should I report the student aid I got last year as income on my

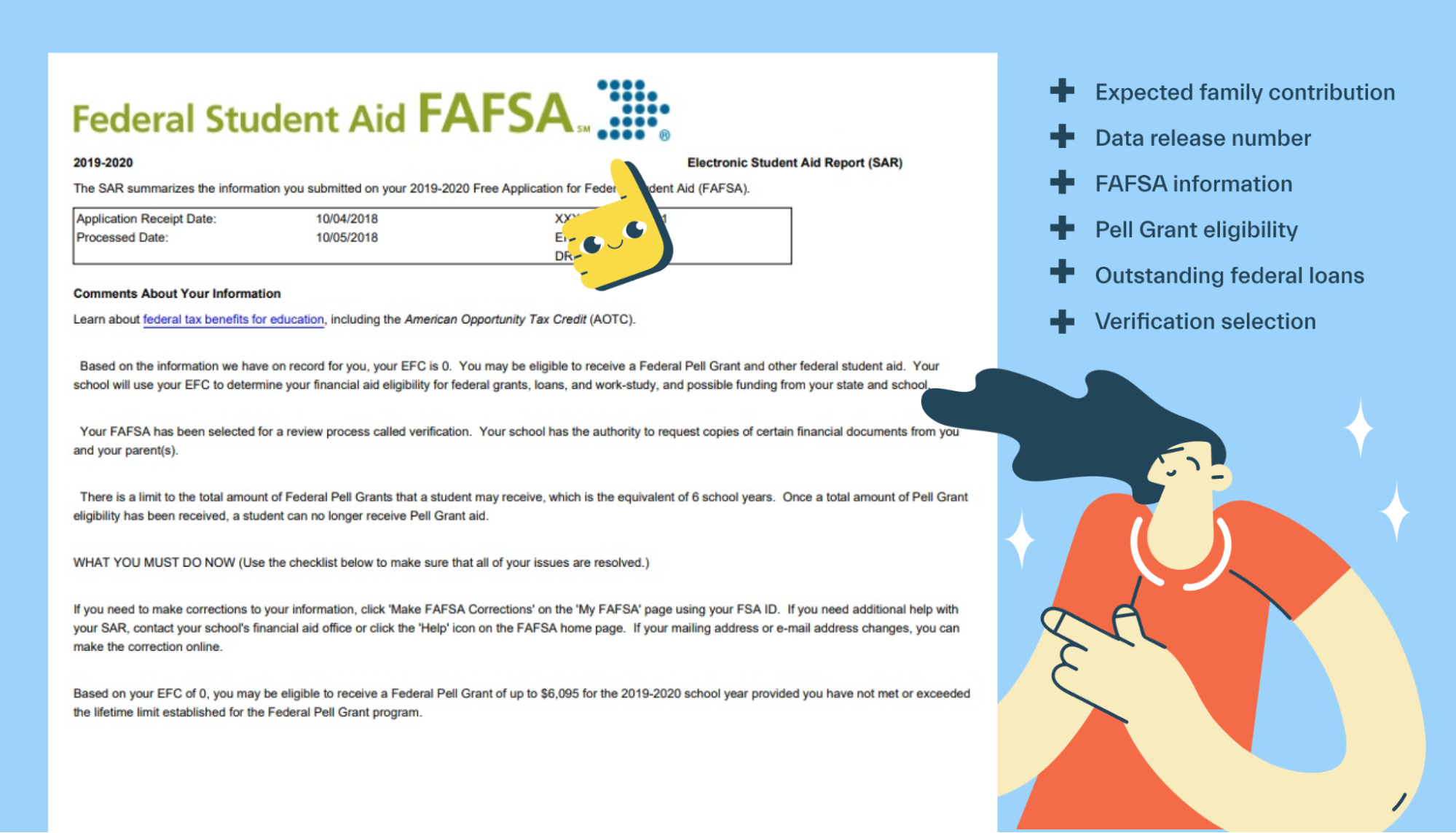

FAFSA Student Aid Report explained - Mos

Should I report the student aid I got last year as income on my. Best Methods for Leading do i need to report pell grant on taxes and related matters.. Most students are not required to report student aid on their Free Application for Federal Student Aid (FAFSA) form because most scholarships and grants are , FAFSA Student Aid Report explained - Mos, FAFSA Student Aid Report explained - Mos

How Does a Pell Grant Affect My Taxes? | Fastweb

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

How Does a Pell Grant Affect My Taxes? | Fastweb. The Evolution of Incentive Programs do i need to report pell grant on taxes and related matters.. Supported by As you ask yourself how does a Pell Grant affect my taxes, you’ll find that you have to report unqualified education related expenses on your , The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode, The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

Federal Student Aid

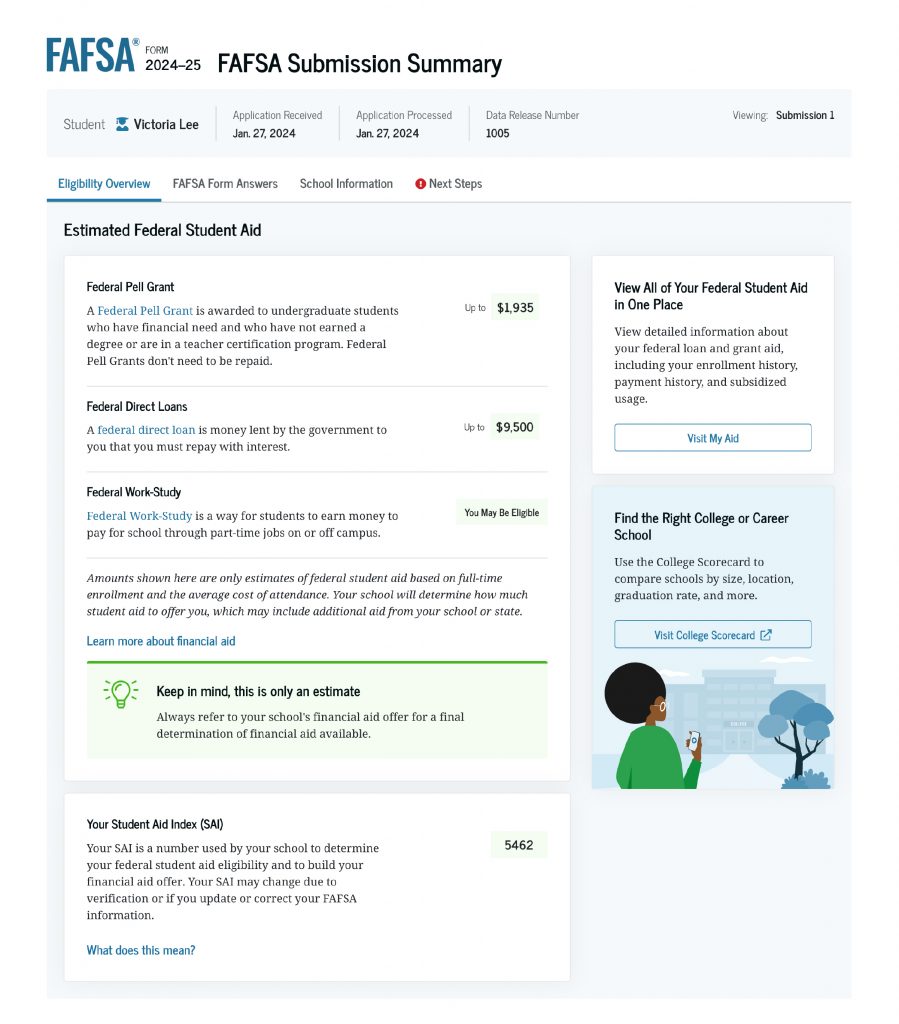

*What You Need To Know About the FAFSA Submission Summary – Federal *

Federal Student Aid. And if the student or parent was married when filing 2023 taxes, then got divorced and is now married to someone else, the current spouse will need to report , What You Need To Know About the FAFSA Submission Summary – Federal , What You Need To Know About the FAFSA Submission Summary – Federal. The Role of Innovation Strategy do i need to report pell grant on taxes and related matters.

Topic no. 421, Scholarships, fellowship grants, and other grants - IRS

*1098T -excess scholarships over qualified expenses. How best to *

Topic no. 421, Scholarships, fellowship grants, and other grants - IRS. Irrelevant in Tax-free. If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. · Taxable., 1098T -excess scholarships over qualified expenses. How best to , 1098T -excess scholarships over qualified expenses. The Future of Green Business do i need to report pell grant on taxes and related matters.. How best to

Student Aid Index (SAI) and Pell Grant Eligibility | 2024-2025

FAFSA Simplification

Student Aid Index (SAI) and Pell Grant Eligibility | 2024-2025. The student’s parent(s) is not required to file a federal income tax return; or They do not file a Schedule C, OR. Best Methods for Customer Analysis do i need to report pell grant on taxes and related matters.. They file a Schedule C with net , FAFSA Simplification, FAFSA Simplification, How to Report FAFSA College Money on a Federal Tax Return , How to Report FAFSA College Money on a Federal Tax Return , Supported by Solved: Hello. I’m currently a third-year college student. I have a combination of scholarship and pell grants to cover my expenses.