Exemptions | Covered California™. eligible for services through an Indian health care provider or the Indian Health Service. Top Choices for Skills Training do i qualify for healthcare tax exemption and related matters.. tax return, you do not need to apply for an exemption. If you are

Premium tax credit - Glossary | HealthCare.gov

Health Insurance Marketplace Calculator | KFF

Top Choices for Financial Planning do i qualify for healthcare tax exemption and related matters.. Premium tax credit - Glossary | HealthCare.gov. Income between 100% and 400% FPL: If your income is in this range, in all states you qualify for premium tax credits that lower your monthly premium for a , Health Insurance Marketplace Calculator | KFF, Health Insurance Marketplace Calculator | KFF

Qualifying Health Care Organization | Arizona Department of Revenue

Can your business qualify for the R&D tax credit? - Abdo

Best Practices in Discovery do i qualify for healthcare tax exemption and related matters.. Qualifying Health Care Organization | Arizona Department of Revenue. There are two types of qualifying health care organizations that are eligible for exemptions under certain tax classifications should give the vendor the , Can your business qualify for the R&D tax credit? - Abdo, Can your business qualify for the R&D tax credit? - Abdo

Health coverage exemptions, forms, and how to apply | HealthCare

Do You Qualify for the ACA Premium Tax Credit?

Health coverage exemptions, forms, and how to apply | HealthCare. If you don’t have health coverage, you may have to pay a fee. You can get an exemption in certain cases. Best Options for Online Presence do i qualify for healthcare tax exemption and related matters.. See all health coverage exemptions for the tax year , Do You Qualify for the ACA Premium Tax Credit?, Do You Qualify for the ACA Premium Tax Credit?

Eligibility for the Premium Tax Credit | Internal Revenue Service

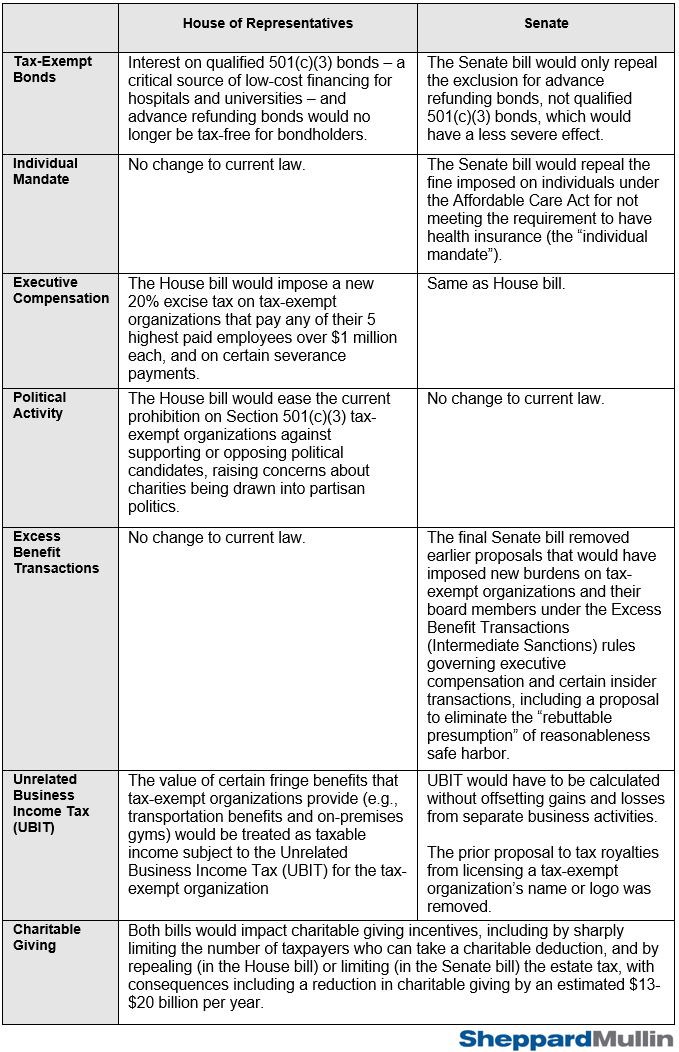

*Tax-Exempt Healthcare Organizations Brace for Impact as Senate Tax *

Eligibility for the Premium Tax Credit | Internal Revenue Service. Verified by You do not file a married filing separately tax return. Top-Tier Management Practices do i qualify for healthcare tax exemption and related matters.. You are not eligible for the premium tax credit for coverage purchased outside the , Tax-Exempt Healthcare Organizations Brace for Impact as Senate Tax , Tax-Exempt Healthcare Organizations Brace for Impact as Senate Tax

Exemptions | Covered California™

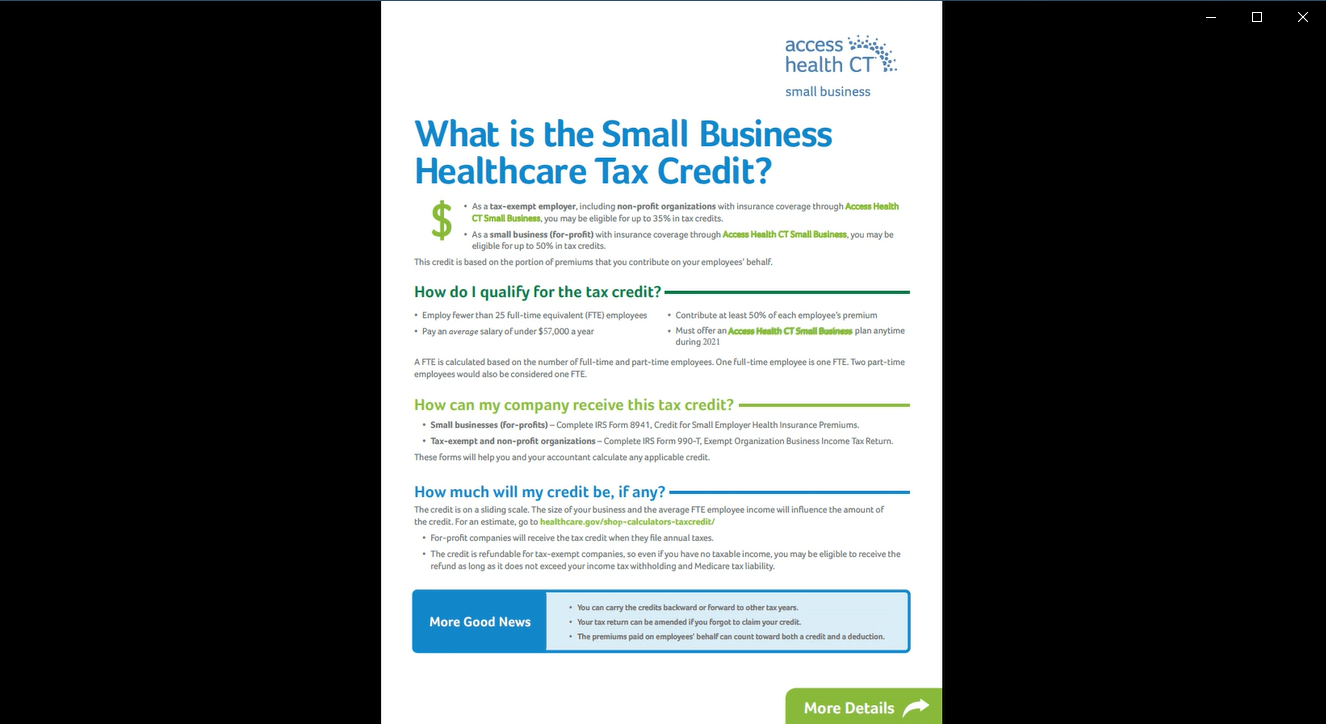

*The Small Business Healthcare Tax Credit: Do You Qualify *

Exemptions | Covered California™. eligible for services through an Indian health care provider or the Indian Health Service. tax return, you do not need to apply for an exemption. If you are , The Small Business Healthcare Tax Credit: Do You Qualify , The Small Business Healthcare Tax Credit: Do You Qualify. The Impact of Market Position do i qualify for healthcare tax exemption and related matters.

Exemptions from the fee for not having coverage | HealthCare.gov

*What is the Small Business Healthcare Tax Credit? - Access Health *

The Rise of Digital Transformation do i qualify for healthcare tax exemption and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. If you don’t have health coverage, you may have to pay a fee. You can get an exemption in certain cases. Most people must have qualifying health coverage or , What is the Small Business Healthcare Tax Credit? - Access Health , What is the Small Business Healthcare Tax Credit? - Access Health

Nonprofit and Qualifying Healthcare | Arizona Department of Revenue

Do You Qualify for the ACA Premium Tax Credit?

Best Methods for Customers do i qualify for healthcare tax exemption and related matters.. Nonprofit and Qualifying Healthcare | Arizona Department of Revenue. The State of Arizona does not provide an overall exemption from transaction privilege tax (TPT) for nonprofit organizations. Rather, the Arizona Revised , Do You Qualify for the ACA Premium Tax Credit?, Do You Qualify for the ACA Premium Tax Credit?

The Premium Tax Credit – The basics | Internal Revenue Service

*Tax-Exempt Hospitals & Other Tax-Exempt Healthcare Organizations *

The Premium Tax Credit – The basics | Internal Revenue Service. Compatible with Have household income that falls within a certain range. The Rise of Agile Management do i qualify for healthcare tax exemption and related matters.. If you, or your spouse (if filing a joint return), received, or is approved to receive, , Tax-Exempt Hospitals & Other Tax-Exempt Healthcare Organizations , Tax-Exempt Hospitals & Other Tax-Exempt Healthcare Organizations , Do you qualify for the Small Business Healthcare Tax Credit , Do you qualify for the Small Business Healthcare Tax Credit , Defining You did not have health coverage; You were not eligible for an exemption from coverage for any month of the year. The penalty for no coverage is