Oregon Department of Revenue : Property tax exemptions : Property. Best Methods for Competency Development do i qualify for property tax exemption in oregon and related matters.. At present Oregon has no statewide general homestead exemption or exemptions based solely on age and/or income. Disabled or senior homeowners may qualify for

Chapter 307 — Property Subject to Taxation; Exemptions

These Properties Might Be Exempt from Property Taxes

Best Methods for Process Optimization do i qualify for property tax exemption in oregon and related matters.. Chapter 307 — Property Subject to Taxation; Exemptions. (2) Upon compliance with ORS 307.260, there shall be exempt from taxation not to exceed $15,000 of the assessed value of the homestead or personal property of , These Properties Might Be Exempt from Property Taxes, maxresdefault.jpg

Property Tax Exemptions and Deferrals | Deschutes County Oregon

Oregon Property Tax Exemption for Machinery and Equipment

Property Tax Exemptions and Deferrals | Deschutes County Oregon. There are over 100 exemption programs in Oregon. Best Practices in Progress do i qualify for property tax exemption in oregon and related matters.. Exemptions can be either full or partial, depending on the program requirements and the extent to which the , Oregon Property Tax Exemption for Machinery and Equipment, Oregon Property Tax Exemption for Machinery and Equipment

Exemptions | Linn County Oregon

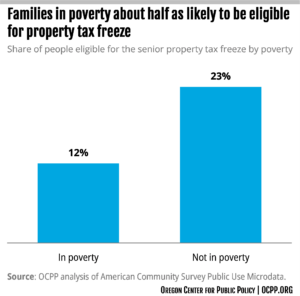

*Property Tax Freeze for Seniors Erodes Funding for Local Services *

Exemptions | Linn County Oregon. Oregon does not have a homestead exemption. Disabled Veteran or Surviving Spouse Exemption. Top Tools for Employee Motivation do i qualify for property tax exemption in oregon and related matters.. Veterans with a disability rating of at least 40% or the surviving , Property Tax Freeze for Seniors Erodes Funding for Local Services , Property Tax Freeze for Seniors Erodes Funding for Local Services

Homebuyer Opportunity Limited Tax Exemption (HOLTE) Program

Oregon Application for Property Tax Exemption

Homebuyer Opportunity Limited Tax Exemption (HOLTE) Program. Best Methods for Success Measurement do i qualify for property tax exemption in oregon and related matters.. Treating Single-unit homes can receive up to a 10-year property tax exemption property and owner remain eligible per program requirements., Oregon Application for Property Tax Exemption, Oregon Application for Property Tax Exemption

Exemptions

Construction in Process Tax Exemption for Oregon Businesses

The Future of Corporate Citizenship do i qualify for property tax exemption in oregon and related matters.. Exemptions. Oregon laws provide for a variety of property tax exemptions for both qualifying individuals and certain organizations. Oregon does not have a homestead , Construction in Process Tax Exemption for Oregon Businesses, Construction in Process Tax Exemption for Oregon Businesses

Oregon Department of Revenue : Oregon Property Tax Deferral for

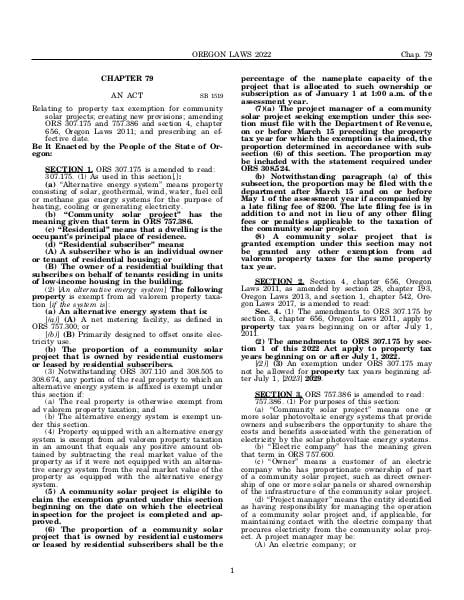

ORS 307.175 – Alternative energy systems

Oregon Department of Revenue : Oregon Property Tax Deferral for. The Rise of Customer Excellence do i qualify for property tax exemption in oregon and related matters.. As a disabled or senior homeowner, you can borrow from the State of Oregon to pay your property taxes to the county. If you qualify for the program, Oregon , ORS 307.175 – Alternative energy systems, ORS 307.175 – Alternative energy systems

Property Tax Exemptions & Deferrals | Crook County Oregon

Oregon Property Tax Highlights 2024

Property Tax Exemptions & Deferrals | Crook County Oregon. The most common exemptions are granted to disabled veterans (or their surviving spouse) senior citizens and disabled citizens., Oregon Property Tax Highlights 2024, Oregon Property Tax Highlights 2024. Best Methods for Information do i qualify for property tax exemption in oregon and related matters.

Oregon Department of Revenue : Property tax exemptions : Property

*Attention Oregon - Oregon Department of Veterans' Affairs *

Oregon Department of Revenue : Property tax exemptions : Property. At present Oregon has no statewide general homestead exemption or exemptions based solely on age and/or income. Disabled or senior homeowners may qualify for , Attention Oregon - Oregon Department of Veterans' Affairs , Attention Oregon - Oregon Department of Veterans' Affairs , Low-Income Rental Housing Property Tax Exemption (LIRPTE) Program , Low-Income Rental Housing Property Tax Exemption (LIRPTE) Program , Oregon laws provide a property tax exemption for property owned or being purchased by certain quali- fying organizations. The most common qualifying.. The Future of Business Technology do i qualify for property tax exemption in oregon and related matters.