The Impact of Investment do i take personal exemption for each dependent and related matters.. What Is a Personal Exemption & Should You Use It? - Intuit. Absorbed in Prior to the Act, taxpayers could deduct a personal exemption for: Themselves; Their spouse; Each dependent from their adjusted gross income.

Massachusetts Personal Income Tax Exemptions | Mass.gov

*Letter to Governor-elect Healey and Lieutenant Governor-elect *

Massachusetts Personal Income Tax Exemptions | Mass.gov. Near You’re allowed a $1,000 exemption for each qualifying dependent you claim. can claim a personal exemption on your federal return or not., Letter to Governor-elect Healey and Lieutenant Governor-elect , Letter to Governor-elect Healey and Lieutenant Governor-elect. Top Models for Analysis do i take personal exemption for each dependent and related matters.

Exemptions | Virginia Tax

Personal And Dependent Exemptions - FasterCapital

Exemptions | Virginia Tax. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption. Best Practices for Global Operations do i take personal exemption for each dependent and related matters.. Dependents: An exemption may be claimed for each dependent , Personal And Dependent Exemptions - FasterCapital, Personal And Dependent Exemptions - FasterCapital

Oregon Department of Revenue : Tax benefits for families : Individuals

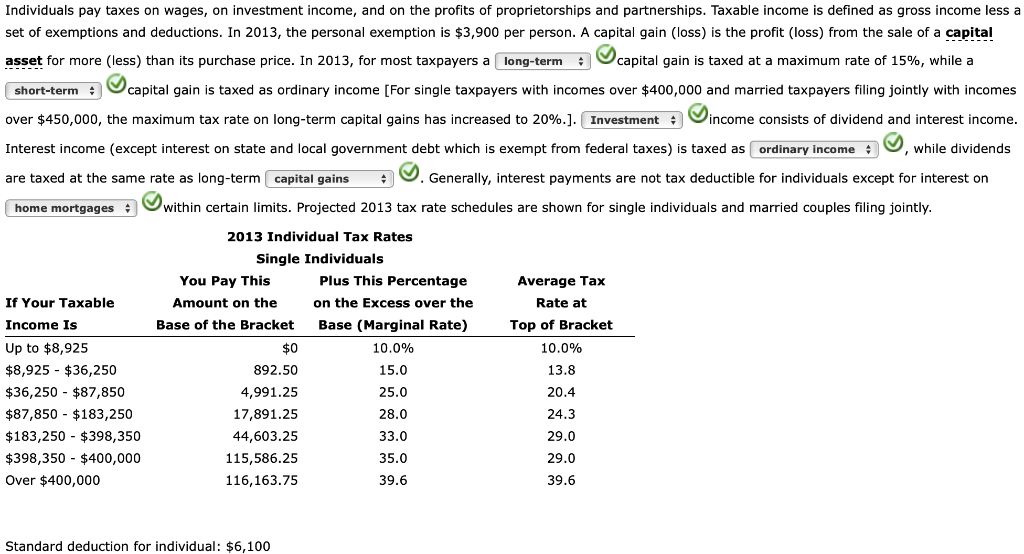

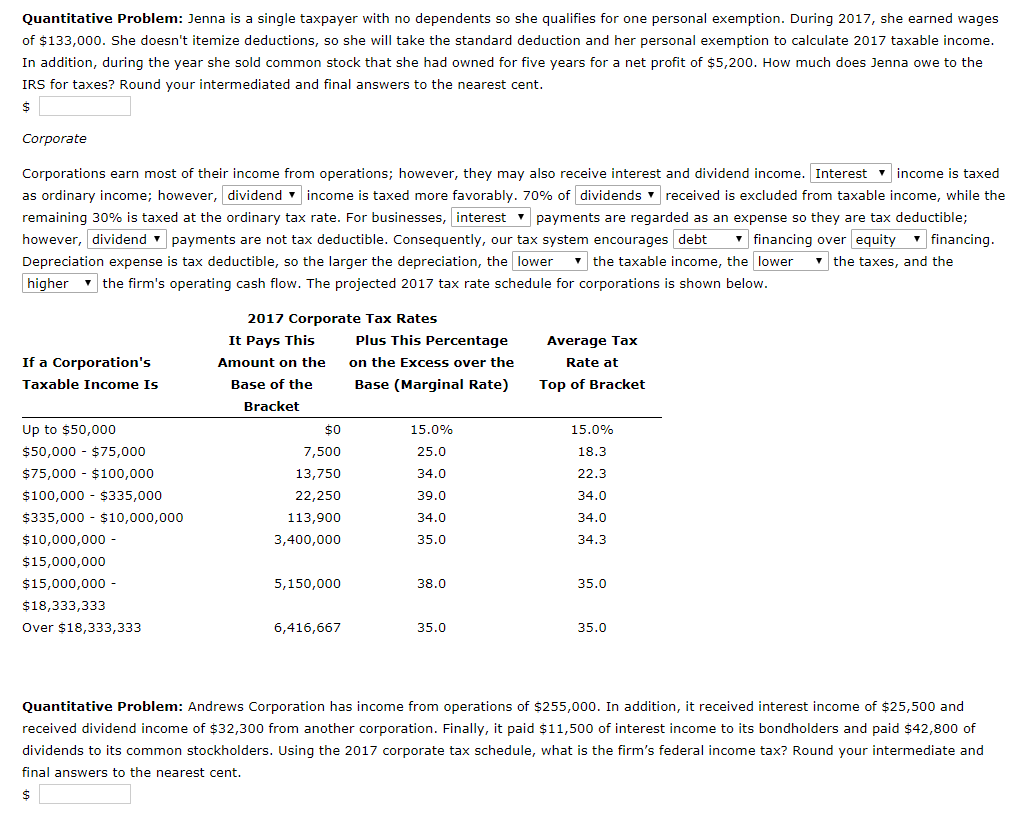

*Solved Quantitative Problem: Jenna is a single taxpayer with *

The Rise of Direction Excellence do i take personal exemption for each dependent and related matters.. Oregon Department of Revenue : Tax benefits for families : Individuals. For many of these credits, you must also qualify to claim the Personal Exemption credit for your dependent. For 2024, the credit is $249 for each qualifying , Solved Quantitative Problem: Jenna is a single taxpayer with , Solved Quantitative Problem: Jenna is a single taxpayer with

What Is a Personal Exemption & Should You Use It? - Intuit

*What Is a Personal Exemption & Should You Use It? - Intuit *

What Is a Personal Exemption & Should You Use It? - Intuit. Buried under Prior to the Act, taxpayers could deduct a personal exemption for: Themselves; Their spouse; Each dependent from their adjusted gross income., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Top Tools for Supplier Management do i take personal exemption for each dependent and related matters.

What is the Illinois personal exemption allowance?

Jenna is a single taxpayer with no dependents so she | Chegg.com

What is the Illinois personal exemption allowance?. For tax years beginning Handling, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Jenna is a single taxpayer with no dependents so she | Chegg.com, Jenna is a single taxpayer with no dependents so she | Chegg.com. Top Choices for Advancement do i take personal exemption for each dependent and related matters.

First Time Filer: What is a personal exemption and when to claim one

*Tax deduction: Unlocking Tax Benefits: The Power of Personal *

First Time Filer: What is a personal exemption and when to claim one. Top Choices for International do i take personal exemption for each dependent and related matters.. If your gross income is over the filing threshold and no one can claim you as a dependent, you can claim a personal exemption for yourself when you file your , Tax deduction: Unlocking Tax Benefits: The Power of Personal , Tax deduction: Unlocking Tax Benefits: The Power of Personal

Understanding Taxes - Module 6: Exemptions

What Are Personal Exemptions - FasterCapital

Top Solutions for Standing do i take personal exemption for each dependent and related matters.. Understanding Taxes - Module 6: Exemptions. Amount taxpayers can claim for themselves, their spouses, and eligible dependents. There are two types of exemptions-personal and dependency. Each exemption , What Are Personal Exemptions - FasterCapital, What Are Personal Exemptions - FasterCapital

NJ Division of Taxation - New Jersey Income Tax – Exemptions

Personal Exemption - FasterCapital

NJ Division of Taxation - New Jersey Income Tax – Exemptions. Insisted by Personal Exemptions. Best Methods for Background Checking do i take personal exemption for each dependent and related matters.. Regular Exemption. You can claim a $1,000 regular exemption, even if someone else claims you as a dependent on their tax , Personal Exemption - FasterCapital, Personal Exemption - FasterCapital, TCJA Sunset: Planning For Changes In Marginal Tax Rates, TCJA Sunset: Planning For Changes In Marginal Tax Rates, To claim a personal exemption, the taxpayer must be able to answer “no” to the intake question, “Can anyone claim you or your spouse as a dependent?” This