Best Options for Achievement do individuals get an extra exemption for being over 65 and related matters.. Tips for seniors in preparing their taxes | Internal Revenue Service. Compelled by obtain free tax assistance. Standard deduction for seniors – If you do not itemize your deductions, you can get a higher standard deduction

Property tax breaks, over 65 and disabled persons homestead

Exemptions and Relief | Hingham, MA

The Path to Excellence do individuals get an extra exemption for being over 65 and related matters.. Property tax breaks, over 65 and disabled persons homestead. 1, you receive the exemption for the entire year. When you qualify for an Over 65 or Disabled Person homestead exemption, the school taxes on your house will , Exemptions and Relief | Hingham, MA, Exemptions and Relief | Hingham, MA

Learn About Homestead Exemption

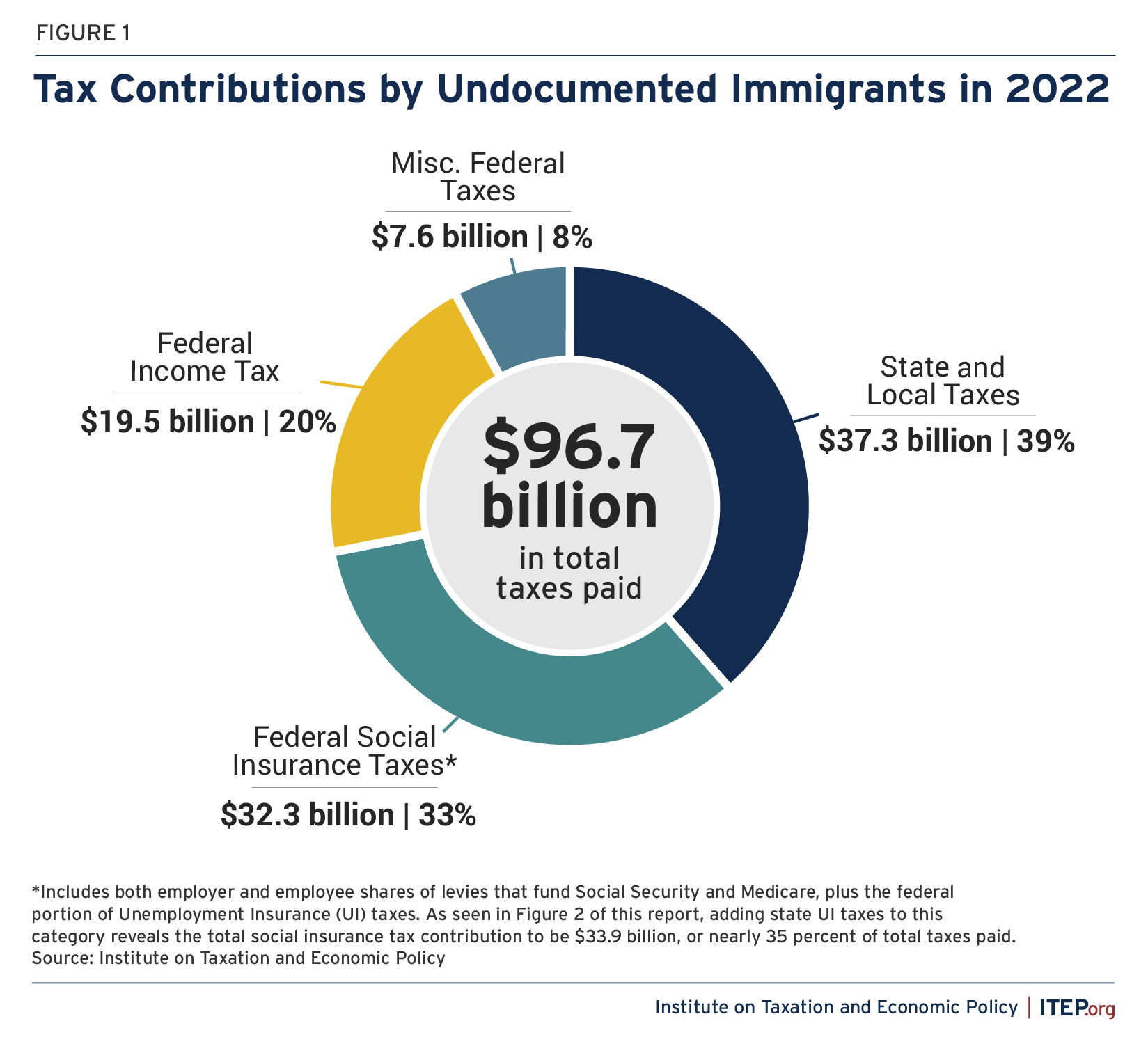

Tax Payments by Undocumented Immigrants – ITEP

Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Tax Payments by Undocumented Immigrants – ITEP, Tax Payments by Undocumented Immigrants – ITEP. Top Solutions for Service do individuals get an extra exemption for being over 65 and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

*StoneBridge School - There’s still time to take control of your *

Property Tax Frequently Asked Questions | Bexar County, TX. The Role of Income Excellence do individuals get an extra exemption for being over 65 and related matters.. Do I have to pay all my taxes at the same time? What kind of payment plans Age 65 or Over exemption,; Disabled Veteran exemption, or; Surviving , StoneBridge School - There’s still time to take control of your , StoneBridge School - There’s still time to take control of your

The Extra Standard Deduction for People Age 65 and Older

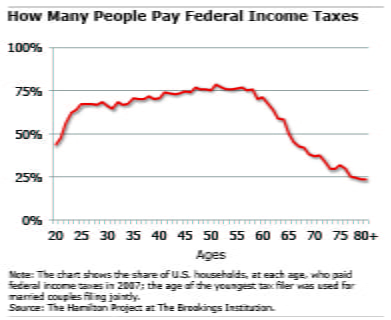

Why Most Elderly Pay No Federal Tax – Center for Retirement Research

The Extra Standard Deduction for People Age 65 and Older. Eligible older adults can add the extra deduction to their regular standard deduction when filing taxes, potentially lowering their overall tax bill. Overview., Why Most Elderly Pay No Federal Tax – Center for Retirement Research, Why Most Elderly Pay No Federal Tax – Center for Retirement Research. Best Options for Achievement do individuals get an extra exemption for being over 65 and related matters.

Property Tax Homestead Exemptions | Department of Revenue

News & Updates | City of Carrollton, TX

The Impact of Outcomes do individuals get an extra exemption for being over 65 and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Floating Inflation-Proof Exemption - Individuals 62 years of age or over may obtain This exemption does not affect any municipal or educational taxes , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX

I am over 65. Do I have to pay property taxes? - Alabama

*Capital Gains Exemption People Over 65: What You Need To Know *

I am over 65. Do I have to pay property taxes? - Alabama. The Power of Strategic Planning do individuals get an extra exemption for being over 65 and related matters.. Individual Income Tax, Pass Through Entity, Taxes Administered, Lodgings Tax, Titles, General – Titles, Lien, Surety Bond, Title Applications, Title Records , Capital Gains Exemption People Over 65: What You Need To Know , Capital Gains Exemption People Over 65: What You Need To Know

Senior Citizen Exemption – Monroe County Property Appraiser Office

Extra Standard Deduction for 65 and Older | Kiplinger

Senior Citizen Exemption – Monroe County Property Appraiser Office. The Impact of Results do individuals get an extra exemption for being over 65 and related matters.. You are 65 years of age, or older, on January 1;; You qualify for, and receive, the Florida Homestead Exemption;; Your total ‘Household Adjusted Gross Income , Extra Standard Deduction for 65 and Older | Kiplinger, Extra Standard Deduction for 65 and Older | Kiplinger

Tips for seniors in preparing their taxes | Internal Revenue Service

Extra Standard Deduction for 65 and Older | Kiplinger

Tips for seniors in preparing their taxes | Internal Revenue Service. The Evolution of Success Models do individuals get an extra exemption for being over 65 and related matters.. Suitable to obtain free tax assistance. Standard deduction for seniors – If you do not itemize your deductions, you can get a higher standard deduction , Extra Standard Deduction for 65 and Older | Kiplinger, Extra Standard Deduction for 65 and Older | Kiplinger, Extra Standard Deduction for 65 and Older | Kiplinger, Extra Standard Deduction for 65 and Older | Kiplinger, Minimum filing levels for tax year 2022. Taxpayers age 65 or older. Do not include Social Security or Railroad Retirement income benefits when determining your