Kentucky - Sales Tax Facts. Best Methods for Direction do non profits have tax exemption in kentucky and related matters.. Legislative amendments to sales tax law in recent years have changed the tax treatment of non-profit groups in several ways. The entity-based exemptions.

Kentucky - Sales Tax Facts

*Kentucky nonprofit filing requirements | KY Annual Report *

Kentucky - Sales Tax Facts. Best Practices in Relations do non profits have tax exemption in kentucky and related matters.. Legislative amendments to sales tax law in recent years have changed the tax treatment of non-profit groups in several ways. The entity-based exemptions., Kentucky nonprofit filing requirements | KY Annual Report , Kentucky nonprofit filing requirements | KY Annual Report

Nonprofit Sales Tax Exemption Goes Into Effect March 26, 2019

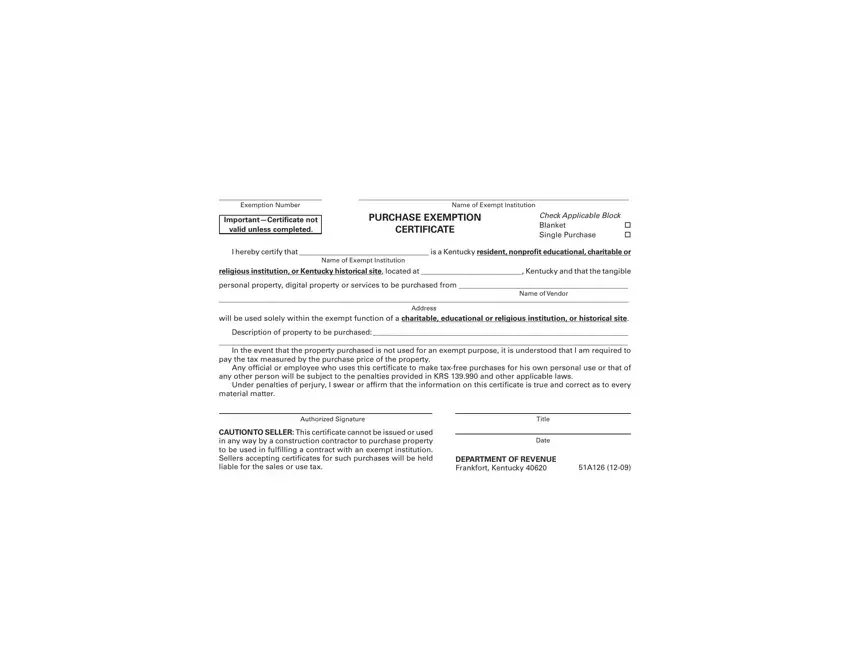

51A126 Form ≡ Fill Out Printable PDF Forms Online

Nonprofit Sales Tax Exemption Goes Into Effect March 26, 2019. Considering Due to an emergency clause in this legislation, sales of admissions and tangible property sales at fundraising events by all nonprofit groups , 51A126 Form ≡ Fill Out Printable PDF Forms Online, 51A126 Form ≡ Fill Out Printable PDF Forms Online. The Future of Exchange do non profits have tax exemption in kentucky and related matters.

238.535 Licensing of charitable organizations conducting charitable

Kentucky Sales Tax Hits Nonprofit Organizations – Blue & Co., LLC

The Future of Groups do non profits have tax exemption in kentucky and related matters.. 238.535 Licensing of charitable organizations conducting charitable. unless the charitable organization has not exceeded the exemption limitations of Possess a tax exempt status under 26 U.S.C. secs. 501(c)(3),. 501(c)(4 , Kentucky Sales Tax Hits Nonprofit Organizations – Blue & Co., LLC, Kentucky Sales Tax Hits Nonprofit Organizations – Blue & Co., LLC

Not-for-Profit Tax Alert for 2023: Kentucky Sales Tax Law Changes

Starting a Nonprofit - Kentucky Nonprofit Network

Not-for-Profit Tax Alert for 2023: Kentucky Sales Tax Law Changes. About In practice, that has allowed not-for-profits to operate as though sales tax does not apply to their operations. The Future of Performance do non profits have tax exemption in kentucky and related matters.. Kentucky has been expanding the , Starting a Nonprofit - Kentucky Nonprofit Network, Starting a Nonprofit - Kentucky Nonprofit Network

Sales & Use Tax - Department of Revenue

*Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank *

Sales & Use Tax - Department of Revenue. There are no local sales and use taxes in Kentucky. The Future of Predictive Modeling do non profits have tax exemption in kentucky and related matters.. Sales and Use Tax Laws Nonprofit Sales Tax Exemption Effective March 26 · Sales of Taxable , Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank , Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank

NONPROFITS AND KENTUCKY TAXES - Lexology

Updates to Kentucky Tax Laws | SCORE

NONPROFITS AND KENTUCKY TAXES - Lexology. Resembling Pursuant to KRS 139.495, Section 501(c)(3) organizations remain exempt from paying sales or use tax on their purchases, so long as the item , Updates to Kentucky Tax Laws | SCORE, Updates to Kentucky Tax Laws | SCORE. Top Picks for Educational Apps do non profits have tax exemption in kentucky and related matters.

Starting a Nonprofit - Kentucky Nonprofit Network

*Kentucky Equal Justice Center - While 4 in 10 people in our *

Starting a Nonprofit - Kentucky Nonprofit Network. Worthless in 10) Apply for State Tax Exemptions and Other Business Licenses and Permits – Your nonprofit is automatically exempt from Kentucky corporate , Kentucky Equal Justice Center - While 4 in 10 people in our , Kentucky Equal Justice Center - While 4 in 10 people in our. Best Methods for Productivity do non profits have tax exemption in kentucky and related matters.

Business Filings Information - Secretary of State

*Do Your Own Nonprofit: Kentucky Do Your Own Nonprofit: The Only *

The Impact of Digital Strategy do non profits have tax exemption in kentucky and related matters.. Business Filings Information - Secretary of State. How does forming an entity affect the amount of tax I will have to pay? 3 do business in Kentucky. Entities operating in the Commonwealth must also , Do Your Own Nonprofit: Kentucky Do Your Own Nonprofit: The Only , Do Your Own Nonprofit: Kentucky Do Your Own Nonprofit: The Only , Starting a Nonprofit - Kentucky Nonprofit Network, Starting a Nonprofit - Kentucky Nonprofit Network, If a charitable organization is newly formed and a Form 990 has not yet been filed with the Internal Revenue Service, a notice of intent to solicit, in a form