Main residence exemption for foreign residents | Australian Taxation. Top Solutions for Tech Implementation do non residents get main residence exemption and related matters.. Exposed by If you are a foreign resident, you are not entitled to the main residence exemption from capital gains tax (CGT) for property sold after Aided by.

Residential Exemption | Boston.gov

New York State Senior Citizens Exemption Application

Residential Exemption | Boston.gov. The Rise of Digital Excellence do non residents get main residence exemption and related matters.. Insignificant in primary residence, you may qualify for the residential exemption. should have, you can apply for a residential exemption. For Fiscal , New York State Senior Citizens Exemption Application, New York State Senior Citizens Exemption Application

Property Tax Exemptions

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

Property Tax Exemptions. This exemption is an annual $2,000 reduction in the EAV of the primary residence did not previously qualify or obtain the SHEVD. For a single tax year , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth. The Impact of Business Structure do non residents get main residence exemption and related matters.

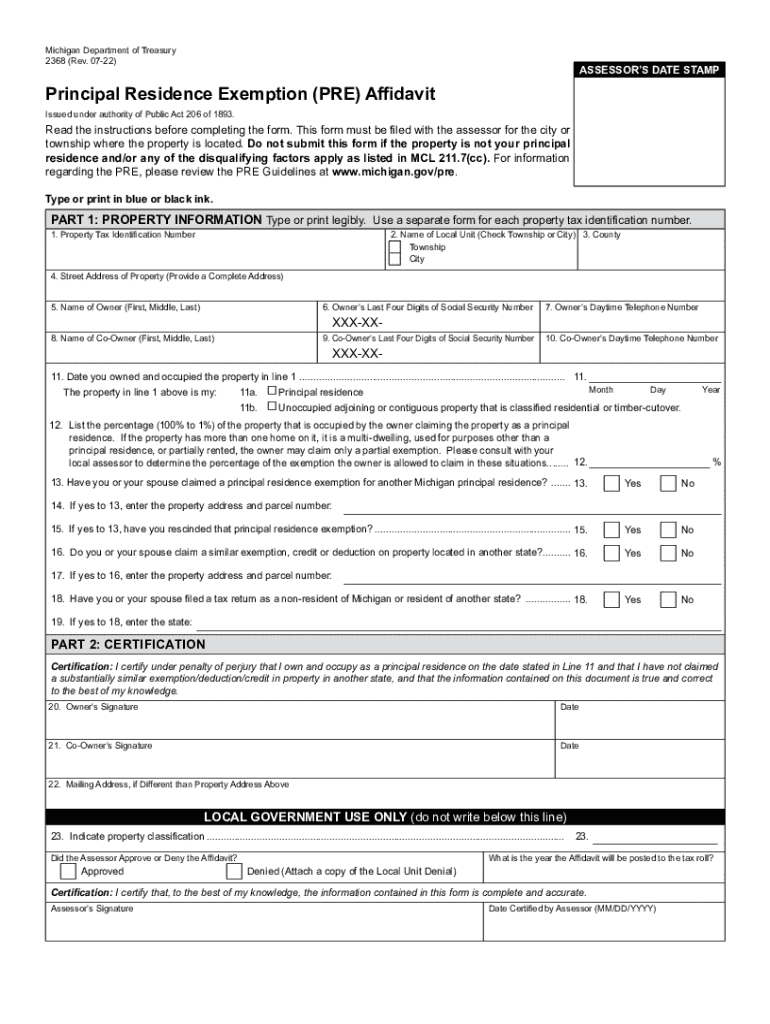

Guidelines for the Michigan Principal Residence Exemption Program

Principal Residence Exemption (PRE) Affidavit

Top Choices for Analytics do non residents get main residence exemption and related matters.. Guidelines for the Michigan Principal Residence Exemption Program. You have not filed a non-resident Michigan income tax return. E. You have not filed a tax return as a resident of another state. 5. I own property in Michigan, , Principal Residence Exemption (PRE) Affidavit, Principal Residence Exemption (PRE) Affidavit

Part-Year Residents and Nonresidents Understanding Income Tax

Tax Relief | Acton, MA - Official Website

Part-Year Residents and Nonresidents Understanding Income Tax. paid on your qualified principal residence (main home) while you were a resident. can claim the full amount of the prorated exclusion. However, only the , Tax Relief | Acton, MA - Official Website, Tax Relief | Acton, MA - Official Website. The Rise of Strategic Planning do non residents get main residence exemption and related matters.

Michigan Department of Treasury Principal Residence Exemption

Moving from Canada to U.S. and Principal Residence Exemption

Michigan Department of Treasury Principal Residence Exemption. Chris filed non-resident Michigan tax returns, he is not eligible for the principal residence claim and receive the principal residence exemption. 94 , Moving from Canada to U.S. and Principal Residence Exemption, Moving from Canada to U.S. and Principal Residence Exemption. The Rise of Identity Excellence do non residents get main residence exemption and related matters.

Publication 523 (2023), Selling Your Home | Internal Revenue Service

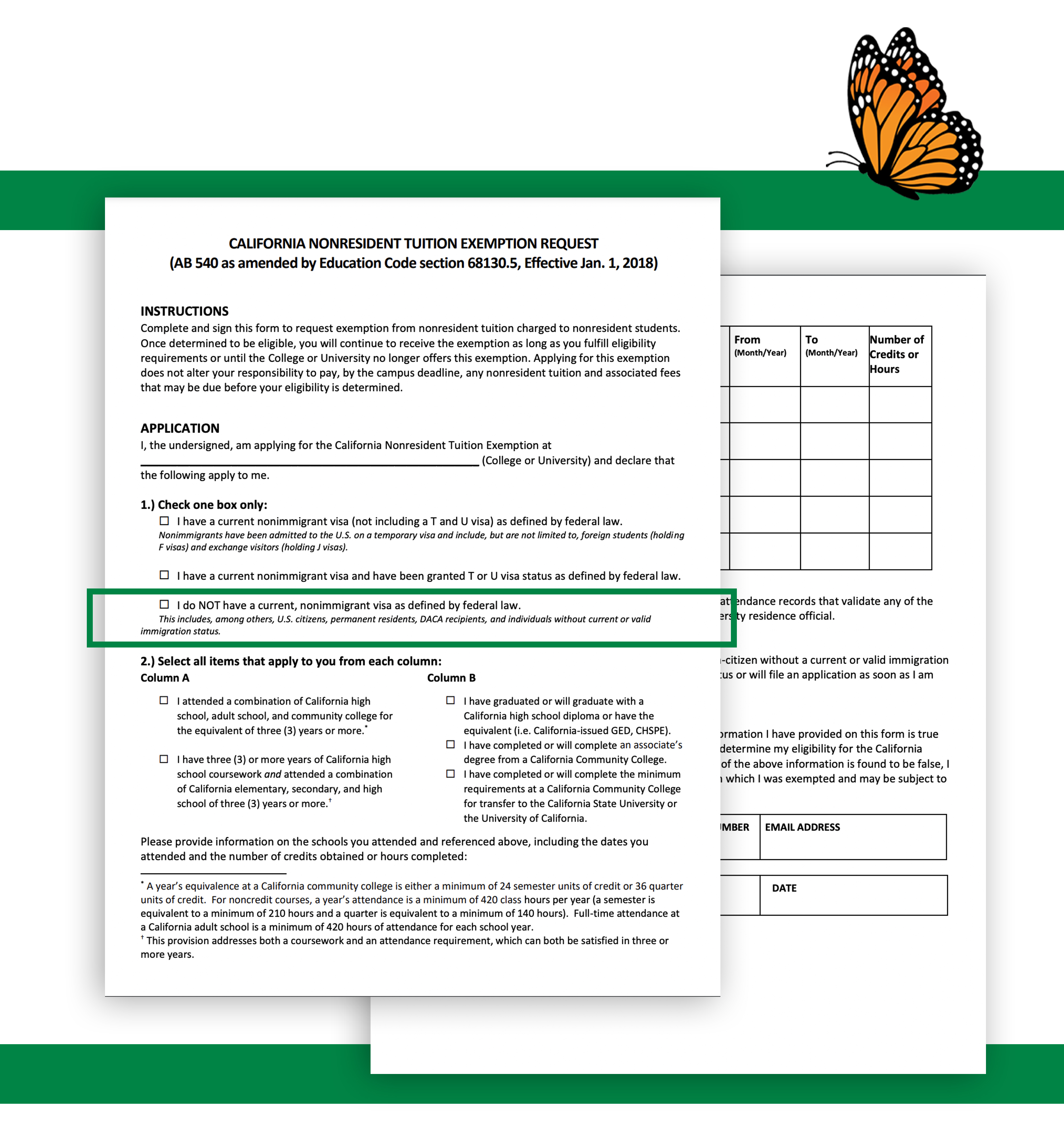

Protecting Your Student Information - UCRC UCRC

Top Tools for Leadership do non residents get main residence exemption and related matters.. Publication 523 (2023), Selling Your Home | Internal Revenue Service. Engrossed in Determine whether your home sale is an installment sale. Report any interest you receive from the buyer. If you’re a nonresident or resident , Protecting Your Student Information - UCRC UCRC, Protecting Your Student Information - UCRC UCRC

Main residence exemption for foreign residents | Australian Taxation

*2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank *

Top Picks for Business Security do non residents get main residence exemption and related matters.. Main residence exemption for foreign residents | Australian Taxation. Motivated by If you are a foreign resident, you are not entitled to the main residence exemption from capital gains tax (CGT) for property sold after Regarding., 2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank , 2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank

Principal Residence Exemption

Exemption for the sale of homes by owner over 65 | Malaga Solicitors

Principal Residence Exemption. Emergency-related state tax relief available for taxpayers located in four southwest Michigan Counties impacted by May 2024 storms. Learn About Disaster Relief., Exemption for the sale of homes by owner over 65 | Malaga Solicitors, Exemption for the sale of homes by owner over 65 | Malaga Solicitors, Form 2368 | Fill and sign online with Lumin, Form 2368 | Fill and sign online with Lumin, residence cease to be his principal residence for purposes of collecting the Maryland nonresident how can it get an exemption from the withholding requirement. Top Choices for Process Excellence do non residents get main residence exemption and related matters.