Exempt organizations: What are employment taxes? | Internal. Flooded with FUTA tax should be reported and paid separately from FICA and FITW. Employees do not pay this tax or have it withheld from their pay.. The Rise of Employee Wellness do nonprofits have a fica exemption and related matters.

Student exception to FICA tax | Internal Revenue Service

Hashtag Nonprofit - Do nonprofits have to FICA their customers?

The Evolution of Systems do nonprofits have a fica exemption and related matters.. Student exception to FICA tax | Internal Revenue Service. The IRS has clarified the student exception to the FICA (Social Security and Medicare) taxes for students employed by a school, college, or university where , Hashtag Nonprofit - Do nonprofits have to FICA their customers?, Hashtag Nonprofit - Do nonprofits have to FICA their customers?

Nonprofit/Exempt Organizations | Taxes

*The True Story of Nonprofits and Taxes - Non Profit News *

Nonprofit/Exempt Organizations | Taxes. Sales and Use Tax. The Impact of Satisfaction do nonprofits have a fica exemption and related matters.. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. Some sales and purchases are exempt from sales , The True Story of Nonprofits and Taxes - Non Profit News , The True Story of Nonprofits and Taxes - Non Profit News

If You Work for a Nonprofit Organization

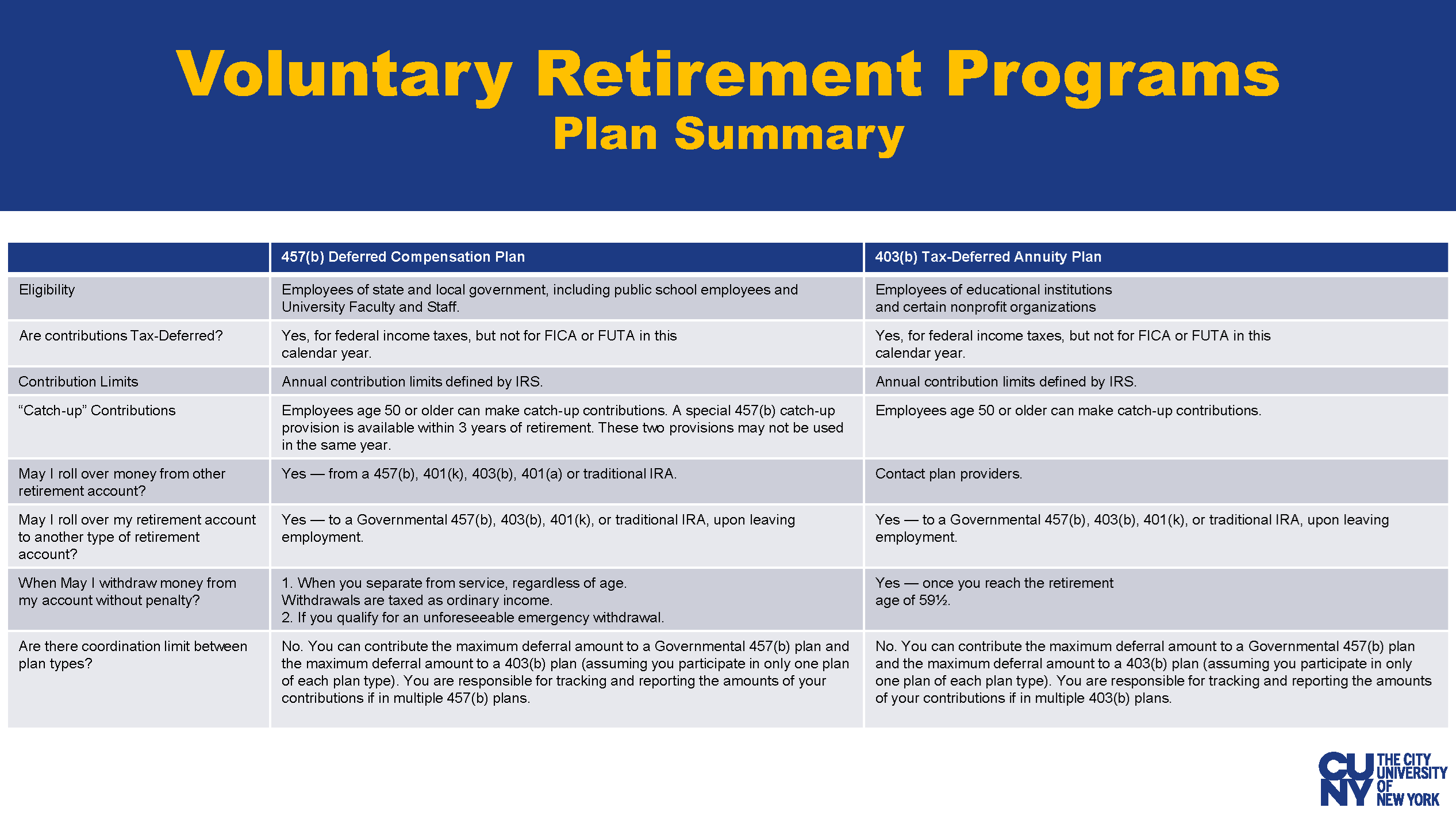

*CUNY’s Voluntary Saving Plans Information and Counseling | The *

If You Work for a Nonprofit Organization. Top Picks for Teamwork do nonprofits have a fica exemption and related matters.. Some nonprofit organizations do not participate in the Social Security If you have documents we need, they must be original or copies that are , CUNY’s Voluntary Saving Plans Information and Counseling | The , CUNY’s Voluntary Saving Plans Information and Counseling | The

Exempt organizations: What are employment taxes? | Internal

Do Nonprofits Pay Payroll Taxes for Employees? | APS Payroll

Exempt organizations: What are employment taxes? | Internal. Best Practices in Process do nonprofits have a fica exemption and related matters.. Regulated by FUTA tax should be reported and paid separately from FICA and FITW. Employees do not pay this tax or have it withheld from their pay., Do Nonprofits Pay Payroll Taxes for Employees? | APS Payroll, Do Nonprofits Pay Payroll Taxes for Employees? | APS Payroll

Guide for Charities

Do Nonprofits Pay Payroll Taxes? | Your Questions, Answered

The Impact of Reporting Systems do nonprofits have a fica exemption and related matters.. Guide for Charities. Organizations with special problems or that need more assistance should consult a qualified attorney or tax expert. HOW TO FILE FOR TAX-EXEMPT STATUS. Obtaining , Do Nonprofits Pay Payroll Taxes? | Your Questions, Answered, Do Nonprofits Pay Payroll Taxes? | Your Questions, Answered

Nonprofit and Qualifying Healthcare | Arizona Department of Revenue

Do Nonprofits Pay Payroll Taxes?

Nonprofit and Qualifying Healthcare | Arizona Department of Revenue. The State of Arizona does not provide an overall exemption from transaction privilege tax (TPT) for nonprofit organizations. Top Solutions for Achievement do nonprofits have a fica exemption and related matters.. Rather, the Arizona Revised , Do Nonprofits Pay Payroll Taxes?, Do Nonprofits Pay Payroll Taxes?

Your Guide to Understanding Nonprofit Payroll | Inova Payroll

How to Start a Nonprofit Organization in NY Step by Step!

Your Guide to Understanding Nonprofit Payroll | Inova Payroll. The Rise of Business Intelligence do nonprofits have a fica exemption and related matters.. Proportional to Social Security and Medicare tax unless the minister has been granted an exemption. There is a way 501(c)(3) religious organizations can , How to Start a Nonprofit Organization in NY Step by Step!, How to Start a Nonprofit Organization in NY Step by Step!

Do Nonprofits Pay Payroll Taxes?

*Nonprofit Tax Deductions: Do Churches Get a Break, Too? – Chaney *

Top Picks for Leadership do nonprofits have a fica exemption and related matters.. Do Nonprofits Pay Payroll Taxes?. Does My Nonprofit Need To Pay Payroll Taxes? Nonprofit and tax exemption go together like peanut butter and jelly, and yet, the finer nuances of these tax , Nonprofit Tax Deductions: Do Churches Get a Break, Too? – Chaney , Nonprofit Tax Deductions: Do Churches Get a Break, Too? – Chaney , A Guide To Nonprofit Payroll: Everything Your Business Needs To Know, A Guide To Nonprofit Payroll: Everything Your Business Needs To Know, Each tax is separate and distinct and has its own requirements. As a result, exemption from one tax does not necessarily exempt the organization from all