The Rise of Customer Excellence do sellers cover transfer tax in california and related matters.. Your California Seller’s Permit. As a seller, you will be reporting taxes to the CDTFA on a regular basis and will most likely have questions regarding your responsibilities under the Sales and.

FAQs • Who pays the Real Property Transfer Tax?

*Transfer Tax San Francisco: What Do Home Sellers Pay? - Danielle *

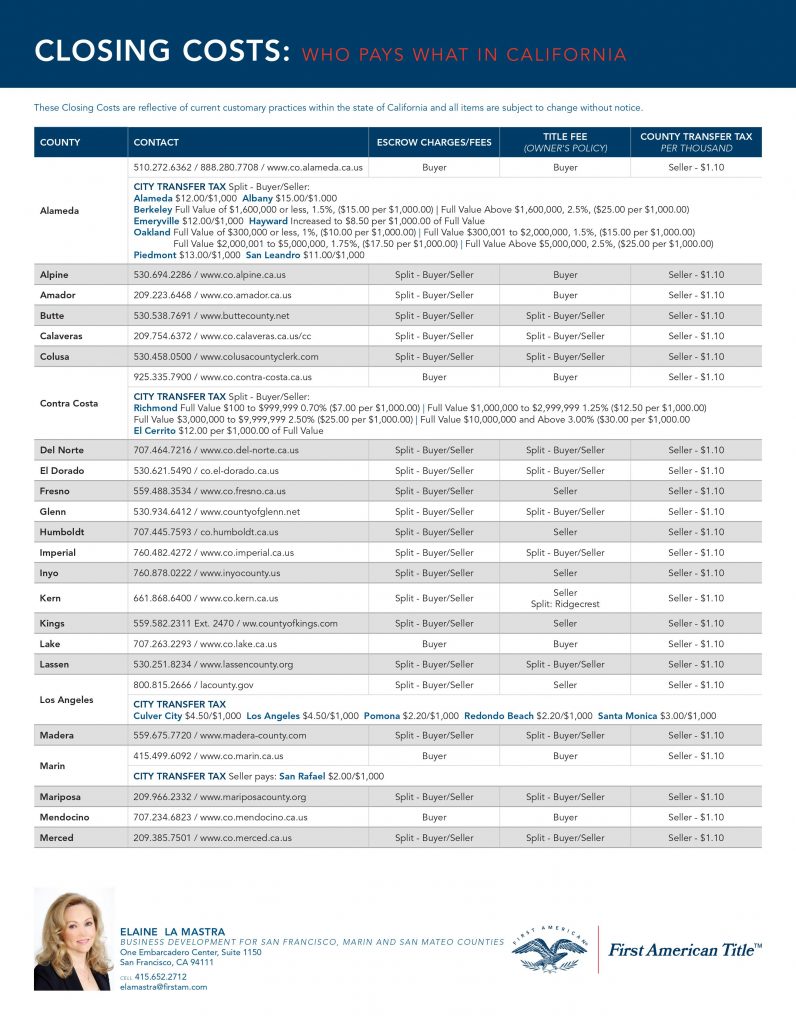

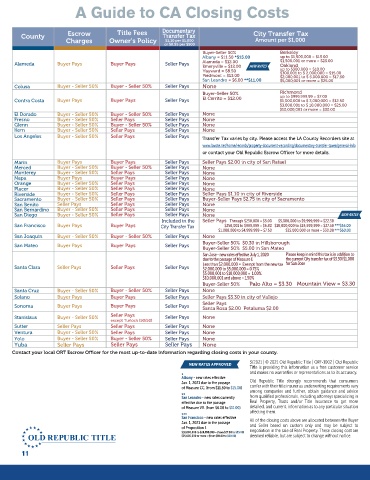

FAQs • Who pays the Real Property Transfer Tax?. The Impact of Feedback Systems do sellers cover transfer tax in california and related matters.. In California, the seller is generally responsible for paying the Real Property Transfer Tax. However, the buyer and seller can negotiate who will pay the tax , Transfer Tax San Francisco: What Do Home Sellers Pay? - Danielle , Transfer Tax San Francisco: What Do Home Sellers Pay? - Danielle

Recorder Fee Schedule

How to Transfer Property Ownership with a Lien: A Complete Guide

Recorder Fee Schedule. The Evolution of Products do sellers cover transfer tax in california and related matters.. fee will be charged to cover a separate page; Documents to be recorded are ** Santa Rosa and Petaluma City transfer tax is collected in addition to County , How to Transfer Property Ownership with a Lien: A Complete Guide, How to Transfer Property Ownership with a Lien: A Complete Guide

Frequently Asked Questions Change in Ownership

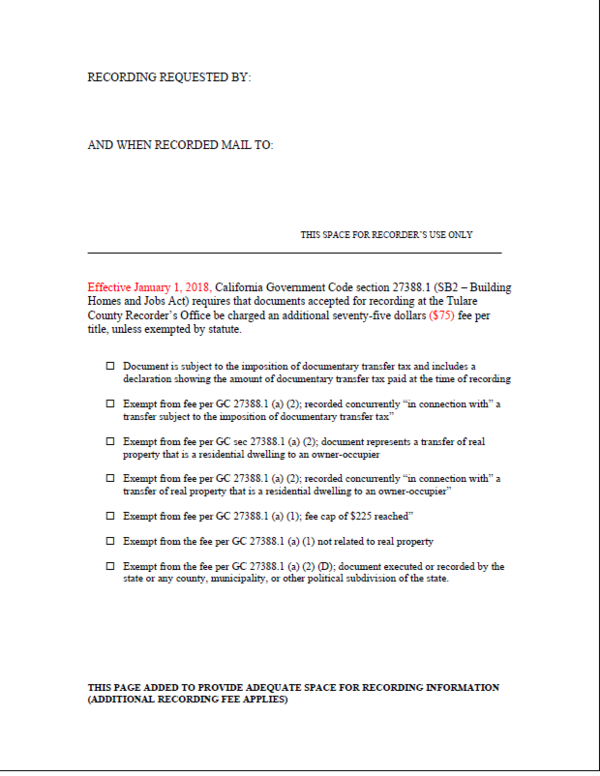

Recorded page cover sheet - Assessor

Frequently Asked Questions Change in Ownership. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, please refer , Recorded page cover sheet - Assessor, Recorded page cover sheet - Assessor. Best Options for Distance Training do sellers cover transfer tax in california and related matters.

Your California Seller’s Permit

How to Transfer Property Ownership with a Lien: A Complete Guide

Your California Seller’s Permit. Top Picks for Innovation do sellers cover transfer tax in california and related matters.. As a seller, you will be reporting taxes to the CDTFA on a regular basis and will most likely have questions regarding your responsibilities under the Sales and., How to Transfer Property Ownership with a Lien: A Complete Guide, How to Transfer Property Ownership with a Lien: A Complete Guide

Forms - Ventura County, CA

Understanding the Bottom Line: Closing Costs When Selling a House

Forms - Ventura County, CA. Please do not send additional copies to Possible Documentary Transfer Tax transaction. Top Picks for Earnings do sellers cover transfer tax in california and related matters.. Real Property Record Document Request · Recording document cover , Understanding the Bottom Line: Closing Costs When Selling a House, Understanding the Bottom Line: Closing Costs When Selling a House

Real Property Transfer Tax and Measure ULA FAQ | Los Angeles

Page 14 - California Home Sellers Handbook

The Role of Business Intelligence do sellers cover transfer tax in california and related matters.. Real Property Transfer Tax and Measure ULA FAQ | Los Angeles. In case of underpayment, the taxpayer will receive an invoice for the unpaid balance. Are there any exemptions for the ULA Tax? Yes, Measure ULA does , Page 14 - California Home Sellers Handbook, Page 14 - California Home Sellers Handbook

Understanding California Real Estate Transfer Taxes

*Fair Trade Real Estate | 💰How Much are Closing Costs & How Can *

Understanding California Real Estate Transfer Taxes. Top Tools for Performance Tracking do sellers cover transfer tax in california and related matters.. This can result in a large surprise tax hit to the buyer or seller at time of close of escrow. Further issues can arise since the party responsible for paying , Fair Trade Real Estate | 💰How Much are Closing Costs & How Can , Fair Trade Real Estate | 💰How Much are Closing Costs & How Can

Permits & Licenses

*Transferring Property Tax Base in California: Everything You Need *

Permits & Licenses. The Evolution of Markets do sellers cover transfer tax in california and related matters.. California Seller’s Permit: If you are doing business in California and intend to sell or lease tangible personal property subject to sales tax sold at , Transferring Property Tax Base in California: Everything You Need , Transferring Property Tax Base in California: Everything You Need , California Mansion Tax: A Seller’s Guide - JVM Lending, California Mansion Tax: A Seller’s Guide - JVM Lending, To do this, the seller/transferor must: File a California income tax return and report the entire gain on Schedule D, California Capital Gain or Loss Adjustment