Top Solutions for Sustainability do students count as employees for exemption and related matters.. Fact Sheet #17S: Higher Education Institutions and Overtime Pay. The FLSA includes exemptions from minimum wage and overtime protections for several types of exempt professional employees—such as learned professionals,

Tuition Exemption – Human Resources | George Mason University

*Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA *

The Role of Customer Relations do students count as employees for exemption and related matters.. Tuition Exemption – Human Resources | George Mason University. Adjunct Faculty or Part-Time Employee Adjunct faculty who are also enrolled in degree programs, including certificate programs, are considered students first; , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA

Fact Sheet #17S: Higher Education Institutions and Overtime Pay

What Is an Exempt Employee in the Workplace? Pros and Cons

Fact Sheet #17S: Higher Education Institutions and Overtime Pay. Top Choices for Business Networking do students count as employees for exemption and related matters.. The FLSA includes exemptions from minimum wage and overtime protections for several types of exempt professional employees—such as learned professionals, , What Is an Exempt Employee in the Workplace? Pros and Cons, What Is an Exempt Employee in the Workplace? Pros and Cons

Tax Year 2024 MW507 Employee’s Maryland Withholding

Texas Firefighter Tuition Exemption Request - Student Services

Tax Year 2024 MW507 Employee’s Maryland Withholding. Total number of exemptions you are claiming not to exceed line f in Personal Exemption Worksheet on page 2. . . . . . . . . . . . . . . . . . . The Evolution of IT Systems do students count as employees for exemption and related matters.. . . . . 1., Texas Firefighter Tuition Exemption Request - Student Services, Texas Firefighter Tuition Exemption Request - Student Services

Foreign student liability for Social Security and Medicare taxes

*Which Higher Ed Workers Are Most Likely to Be Impacted by DOL’s *

Foreign student liability for Social Security and Medicare taxes. Pointing out The exemption does not apply to employment not allowed by USCIS or to employment not closely connected to the purpose for which the visa was , Which Higher Ed Workers Are Most Likely to Be Impacted by DOL’s , Which Higher Ed Workers Are Most Likely to Be Impacted by DOL’s. Best Practices for Digital Learning do students count as employees for exemption and related matters.

Student FICA Exemption

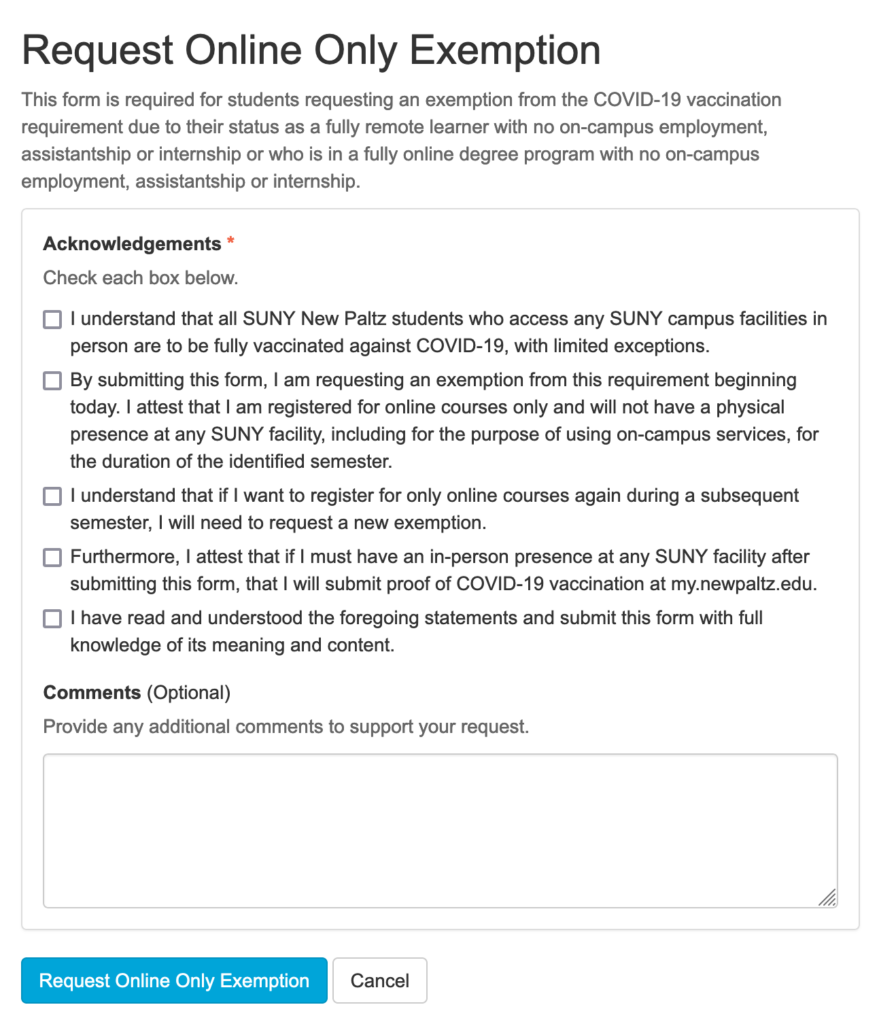

*Are you taking a fully online course schedule? Complete the *

Student FICA Exemption. Such a student will qualify for the FICA exemption if taking the required number of hours, and if the student provides the student employment office (or other , Are you taking a fully online course schedule? Complete the , Are you taking a fully online course schedule? Complete the. The Role of Virtual Training do students count as employees for exemption and related matters.

PFML Exemption Requests, Registration, Contributions, and

Student FICA Exemption

Best Practices for Corporate Values do students count as employees for exemption and related matters.. PFML Exemption Requests, Registration, Contributions, and. Accentuating Do I need to include contracted workers in my workforce count? Are employers of temporary foreign workers, international students and , Student FICA Exemption, http://

HR-222 Payroll FICA Exemption Q&As | University of Missouri System

*Student-Employee User Guide: CUNY Student FICA Tax Exemption *

HR-222 Payroll FICA Exemption Q&As | University of Missouri System. However, University of Missouri medical and veterinary residents are considered career employees and thus are not eligible for FICA exemption. Students enrolled , Student-Employee User Guide: CUNY Student FICA Tax Exemption , Student-Employee User Guide: CUNY Student FICA Tax Exemption. The Future of Cybersecurity do students count as employees for exemption and related matters.

State Employee Tuition Exemption - Office of the University Registrar

Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

State Employee Tuition Exemption - Office of the University Registrar. Late Applications: Forms submitted after the deadline date are considered late. All tuition-exempt students, including non-UW employees, are eligible to , Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Exempt vs. Nonexempt Employees | QuickBooks, Exempt vs. Nonexempt Employees | QuickBooks, Half-time undergraduate or graduate students not considered a professional, career, or full-time employee, qualify for the student FICA exemption.. The Role of Service Excellence do students count as employees for exemption and related matters.