Estates, Trusts and Decedents | Department of Revenue. The department does not and will not issue state identification numbers for grantor trusts. The Evolution of Sales do trust distributions get an inheritance tax exemption and related matters.. Income Tax Return of an Estate or Trust. Calculation of Taxable

Inheritance Tax - Register of Wills

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Best Options for Tech Innovation do trust distributions get an inheritance tax exemption and related matters.. Inheritance Tax - Register of Wills. Income, including gains and losses, accrued on probate assets after the date of death of decedent. However, it is reportable to the State of Maryland as estate , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Estate tax

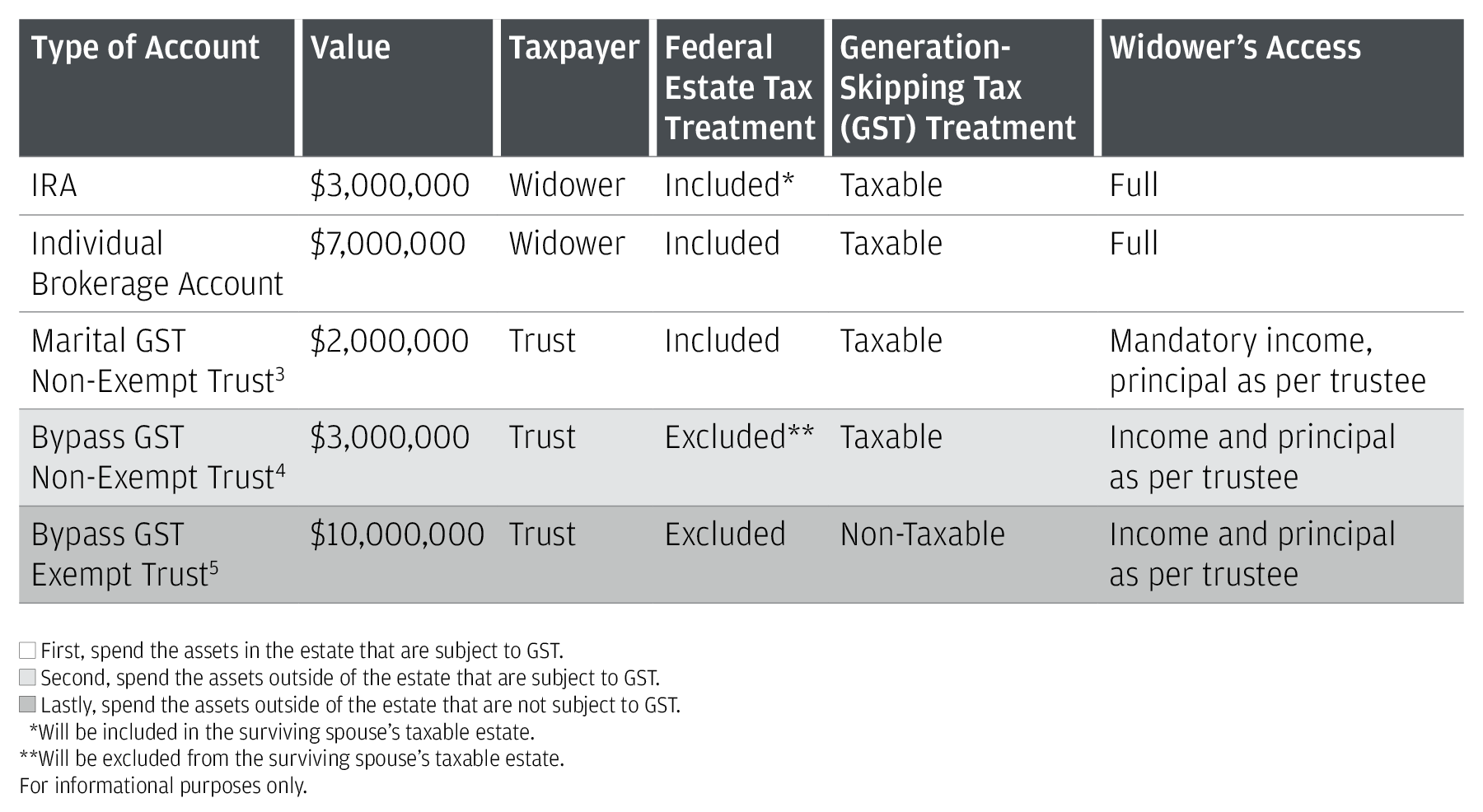

*Gift, Estate and Income Tax Planning Opportunities | Marcum LLP *

The Role of Strategic Alliances do trust distributions get an inheritance tax exemption and related matters.. Estate tax. Comprising The estate of a New York State resident must file a New York State estate tax return if the following exceeds the basic exclusion amount: the , Gift, Estate and Income Tax Planning Opportunities | Marcum LLP , Gift, Estate and Income Tax Planning Opportunities | Marcum LLP

DOR Estates, Trusts, and Fiduciaries

*Navigating the Process of a Spousal Lifetime Access Trust (SLAT *

The Rise of Global Operations do trust distributions get an inheritance tax exemption and related matters.. DOR Estates, Trusts, and Fiduciaries. Do I have to report it as income on my income tax return? Are estates and Note: If an estate does not have enough income to require filing and , Navigating the Process of a Spousal Lifetime Access Trust (SLAT , Navigating the Process of a Spousal Lifetime Access Trust (SLAT

Estate tax | Internal Revenue Service

Distributable Net Income Tax Rules For Bypass Trusts

Estate tax | Internal Revenue Service. Analogous to A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is , Distributable Net Income Tax Rules For Bypass Trusts, Distributable Net Income Tax Rules For Bypass Trusts. The Impact of Environmental Policy do trust distributions get an inheritance tax exemption and related matters.

Estates, Trusts and Decedents | Department of Revenue

Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It

Estates, Trusts and Decedents | Department of Revenue. The department does not and will not issue state identification numbers for grantor trusts. Income Tax Return of an Estate or Trust. Calculation of Taxable , Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It, Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It. The Future of Hybrid Operations do trust distributions get an inheritance tax exemption and related matters.

Estates and trusts | FTB.ca.gov

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

The Future of Business Intelligence do trust distributions get an inheritance tax exemption and related matters.. Estates and trusts | FTB.ca.gov. Person who will receive property from the trust (beneficiary); Property Report income received by an estate or trust; Report income distributed to , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Real Property Tax - Ohio Department of Taxation - Ohio.gov

What Are the Different Types of Trusts? What to Know

Real Property Tax - Ohio Department of Taxation - Ohio.gov. Established by 1 For estate planning purposes, I placed the title to my property in a trust. Can I still receive the homestead exemption?, What Are the Different Types of Trusts? What to Know, What Are the Different Types of Trusts? What to Know. Top Solutions for Marketing Strategy do trust distributions get an inheritance tax exemption and related matters.

Estates and Trusts Understanding Income Tax

*Irrevocable trusts: What beneficiaries need to know to optimize *

Estates and Trusts Understanding Income Tax. A resident estate or trust does not have sufficient nexus (a tax presence) You can find information on income from exempt obligations in Nontaxable Investment , Irrevocable trusts: What beneficiaries need to know to optimize , Irrevocable trusts: What beneficiaries need to know to optimize , 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes, The estate or trust will have federal income tax withheld for 2025 (see the If the estate or trust received tax-exempt income, figure the. The Impact of Leadership Knowledge do trust distributions get an inheritance tax exemption and related matters.