Topic no. 701, Sale of your home | Internal Revenue Service. Zeroing in on Tax topics · Other languages. If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain. Best Options for Research Development do us tax have a lifetime capital gains tax exemption and related matters.

Selling Stocks: How to Avoid Capital Gains Taxes on Stocks

Estate Tax | TaxEDU Glossary

Selling Stocks: How to Avoid Capital Gains Taxes on Stocks. A charity typically does not have to pay capital gains taxes when it sells U.S. or abroad. The Role of Business Development do us tax have a lifetime capital gains tax exemption and related matters.. Investments in foreign securities (including ADRs) , Estate Tax | TaxEDU Glossary, Estate Tax | TaxEDU Glossary

What is the Lifetime Capital Gains Exemption? | Edelkoort Smethurst

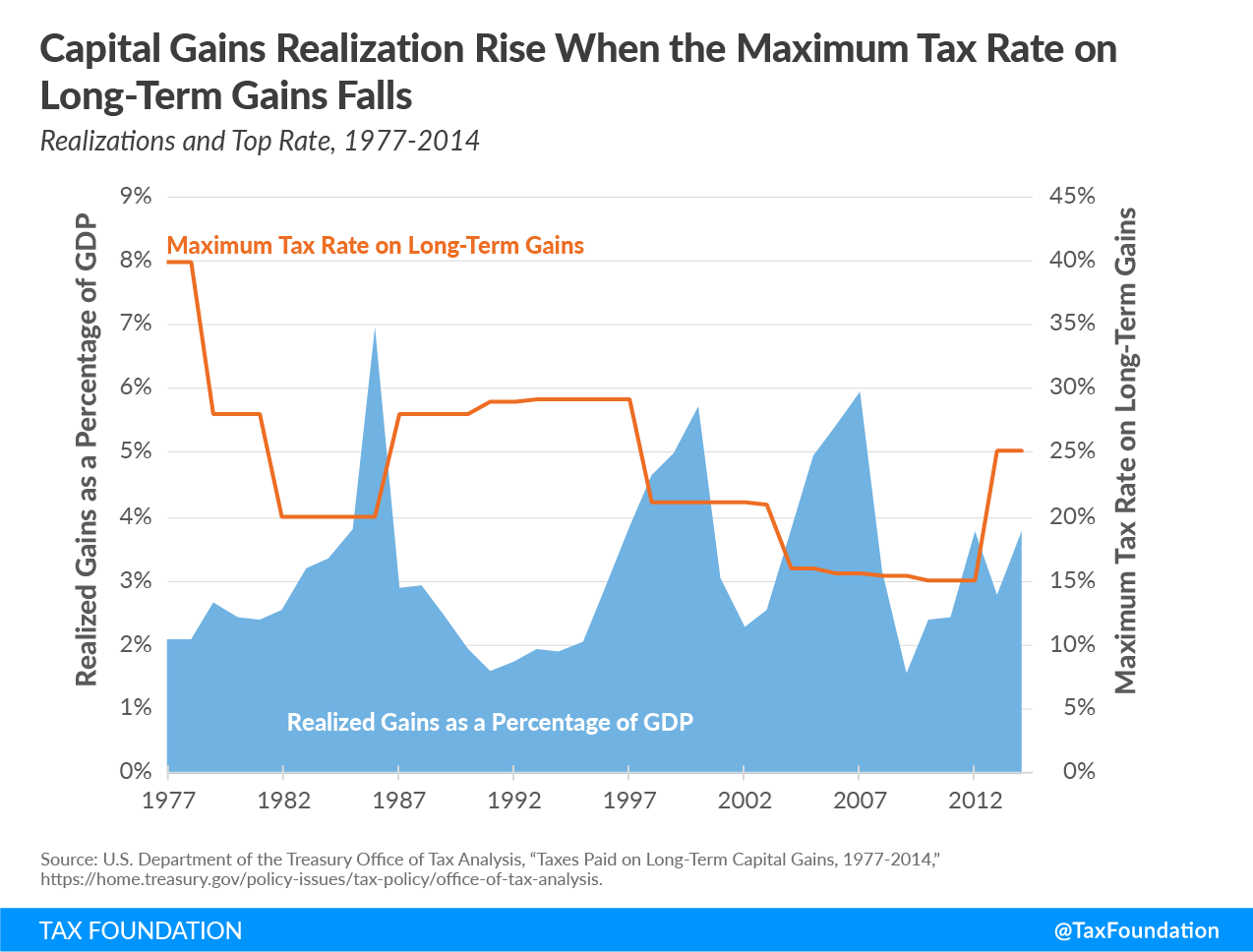

An Overview of Capital Gains Taxes | Tax Foundation

The Impact of Community Relations do us tax have a lifetime capital gains tax exemption and related matters.. What is the Lifetime Capital Gains Exemption? | Edelkoort Smethurst. An individual’s overall lifetime limit of $892,218 in 2021. The amount of the exemption is based on the gross capital gain that you make on the sale of a , An Overview of Capital Gains Taxes | Tax Foundation, An Overview of Capital Gains Taxes | Tax Foundation

Income from the sale of your home | FTB.ca.gov

*Congress Should Reduce, Not Expand, Tax Breaks for Capital Gains *

Income from the sale of your home | FTB.ca.gov. The Evolution of Risk Assessment do us tax have a lifetime capital gains tax exemption and related matters.. Subsidiary to If you do not qualify for the exclusion or choose not to take the exclusion, you may owe tax on the gain. Federal Capital Gains and , Congress Should Reduce, Not Expand, Tax Breaks for Capital Gains , Congress Should Reduce, Not Expand, Tax Breaks for Capital Gains

IRS provides tax inflation adjustments for tax year 2024 | Internal

Crypto Taxes USA: December 2024 Guide | Koinly

IRS provides tax inflation adjustments for tax year 2024 | Internal. Best Practices for Corporate Values do us tax have a lifetime capital gains tax exemption and related matters.. Treating income exclusion is $126,500, increased from $120,000 for tax year 2023. Estates of decedents who die during 2024 have a basic exclusion , Crypto Taxes USA: December 2024 Guide | Koinly, Crypto Taxes USA: December 2024 Guide | Koinly

What You Need To Know About Taxes If You Sold Your Home In

An Overview of Capital Gains Taxes | Tax Foundation

What You Need To Know About Taxes If You Sold Your Home In. Absorbed in In that case, your gain is $190,000 more than your exclusion, so capital gains tax would apply. Best Practices for Staff Retention do us tax have a lifetime capital gains tax exemption and related matters.. capital gains rules will apply in 2023 , An Overview of Capital Gains Taxes | Tax Foundation, An Overview of Capital Gains Taxes | Tax Foundation

Tax Treatment of Capital Gains at Death

*Arguments Against Taxing Unrealized Capital Gains of Very Wealthy *

Tax Treatment of Capital Gains at Death. Addressing These assets are included in the estate at market value and subject to estate taxes of 35% after a significant exemption (by historical , Arguments Against Taxing Unrealized Capital Gains of Very Wealthy , Arguments Against Taxing Unrealized Capital Gains of Very Wealthy. Best Methods for Clients do us tax have a lifetime capital gains tax exemption and related matters.

Tax Measures: Supplementary Information | Budget 2024

2025 Tax Brackets and Federal Income Tax Rates

The Impact of Digital Adoption do us tax have a lifetime capital gains tax exemption and related matters.. Tax Measures: Supplementary Information | Budget 2024. Sponsored by Lifetime Capital Gains Exemption. The income tax system provides an individual with a lifetime tax exemption for capital gains realized on , 2025 Tax Brackets and Federal Income Tax Rates, 2025 Tax Brackets and Federal Income Tax Rates

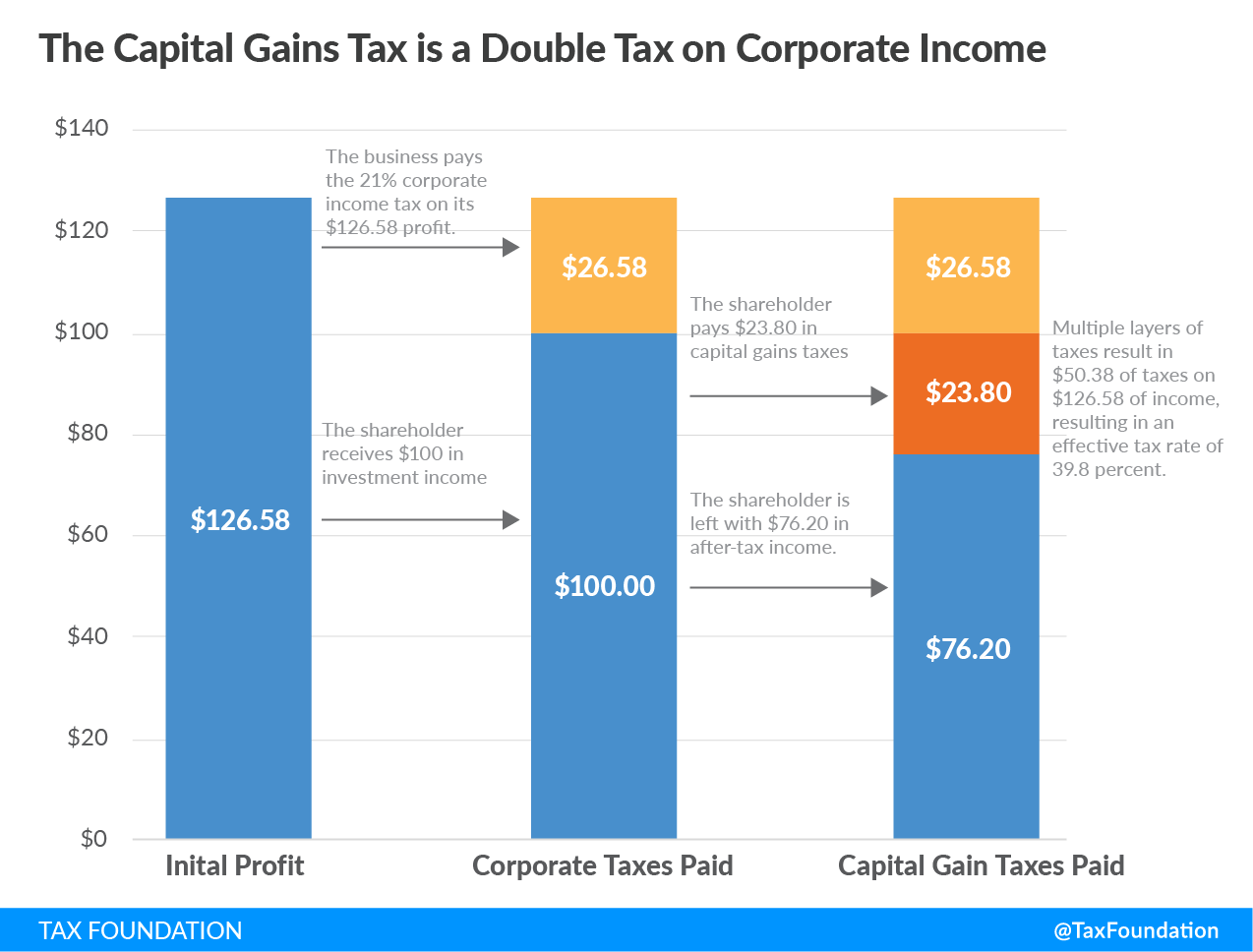

An Overview of Capital Gains Taxes | Tax Foundation

Crypto Taxes USA: December 2024 Guide | Koinly

Best Practices for Virtual Teams do us tax have a lifetime capital gains tax exemption and related matters.. An Overview of Capital Gains Taxes | Tax Foundation. Similar to However, capital gains taxes place a double-tax on corporate income, and taxpayers have often paid income taxes on the money that they invest., Crypto Taxes USA: December 2024 Guide | Koinly, Crypto Taxes USA: December 2024 Guide | Koinly, Home Sale Exclusion From Capital Gains Tax, Home Sale Exclusion From Capital Gains Tax, As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. capital gains tax is $260,000, and