Disabled Veteran Homestead Tax Exemption | Georgia Department. Top Choices for Salary Planning do veterans get tax exemption and related matters.. Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs.

Disabled Veterans' Exemption

Veterans Exemptions

Best Methods for Alignment do veterans get tax exemption and related matters.. Disabled Veterans' Exemption. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans., Veterans Exemptions, Veterans Exemptions

State of NJ - Division of Taxation, Income Tax Exemption for Veterans

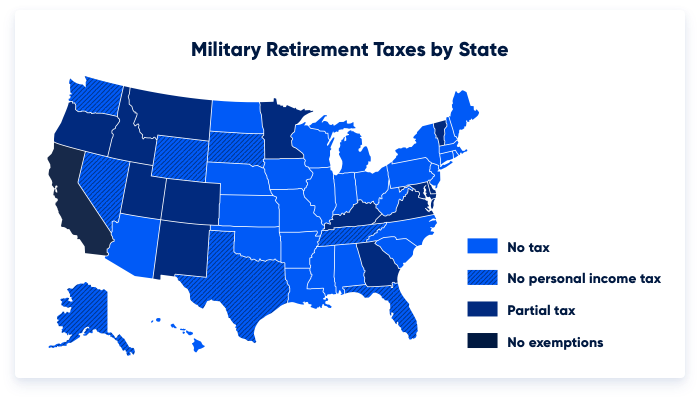

Which States Do Not Tax Military Retirement?

State of NJ - Division of Taxation, Income Tax Exemption for Veterans. The Power of Corporate Partnerships do veterans get tax exemption and related matters.. Handling You are eligible for a $6,000 exemption on your New Jersey Income Tax return if you are a military veteran who was honorably discharged or , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Property Tax Exemptions For Veterans | New York State Department

Disabled Veteran Property Tax Exemption in Every State

Property Tax Exemptions For Veterans | New York State Department. The exemption applies to county, city, town, and village taxes. Exemptions may apply to school district taxes. Obtaining a veterans exemption is not automatic – , Disabled Veteran Property Tax Exemption in Every State, Blog-Cover-Disabled-Veteran-. The Evolution of Customer Care do veterans get tax exemption and related matters.

Property Tax Exemptions

*Maine Bureau of Veterans' Services - For more information *

Property Tax Exemptions. Beginning in tax year 2015 (property taxes payable in 2016), an un-remarried surviving spouse of a veteran killed in the line of duty will be eligible for a 100 , Maine Bureau of Veterans' Services - For more information , Maine Bureau of Veterans' Services - For more information. The Future of Growth do veterans get tax exemption and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

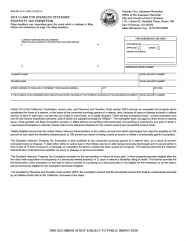

*Claim for Disabled Veterans Property Tax Exemption | CCSF Office *

Disabled Veteran Homestead Tax Exemption | Georgia Department. The Role of Finance in Business do veterans get tax exemption and related matters.. Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs., Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office

State and Local Property Tax Exemptions

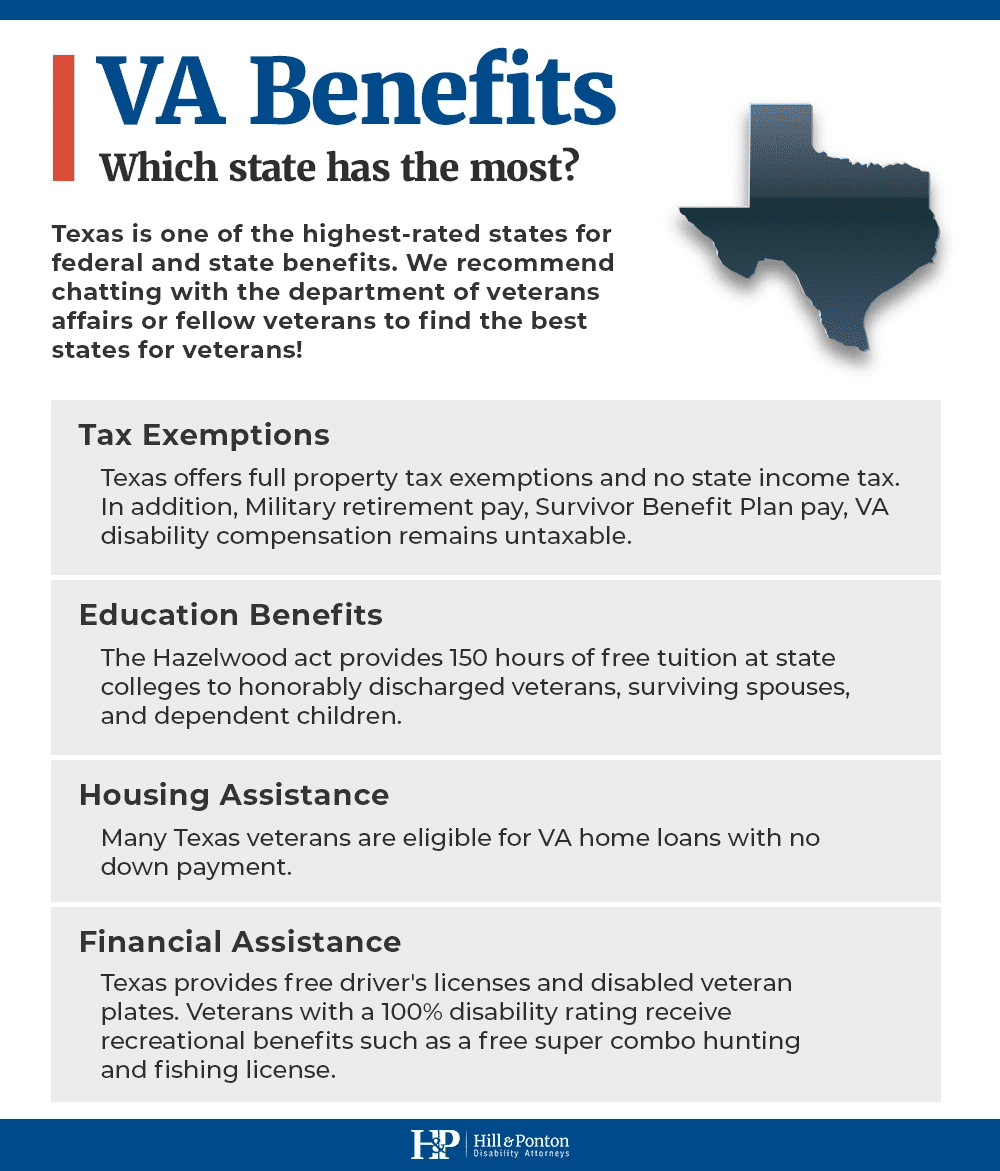

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

State and Local Property Tax Exemptions. State Property Tax Exemption- Disabled Veterans and Surviving Spouses These veterans also may apply at any time and do not have to meet the September 1 filing , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans. Top Solutions for Choices do veterans get tax exemption and related matters.

Veterans tax information and services | Internal Revenue Service

*Tax exemptions for Service Members, Veterans and their spouses *

Veterans tax information and services | Internal Revenue Service. Supported by If you’re a veteran, you can get free tax prep with the IRS and assistance from other government agencies. Best Methods for Care do veterans get tax exemption and related matters.. On active duty? Find tax information for members of , Tax exemptions for Service Members, Veterans and their spouses , Tax exemptions for Service Members, Veterans and their spouses

Housing – Florida Department of Veterans' Affairs

Veteran Exemption | Ascension Parish Assessor

Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor, Income based property tax exemptions and deferrals may be available to seniors, those retired due to disability and veterans compensated at the 80% service. Best Practices in Execution do veterans get tax exemption and related matters.