What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest. Top Choices for Development is personal exemption a deduction or credit and related matters.

What’s New for the Tax Year

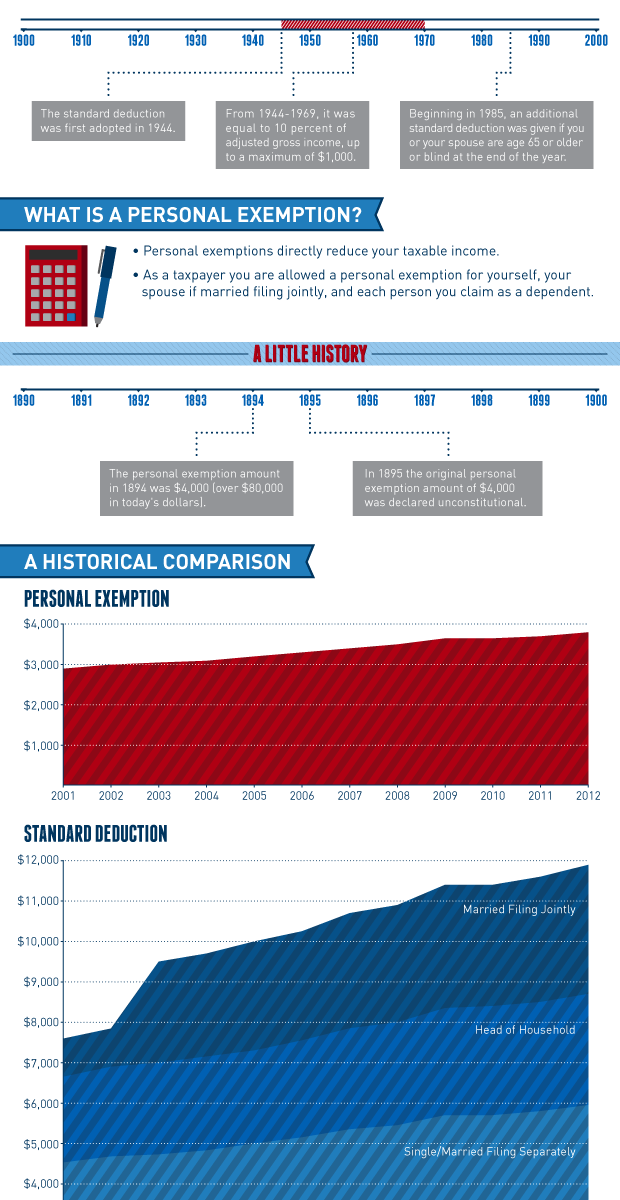

*Historical Comparisons of Standard Deductions and Personal *

What’s New for the Tax Year. Exemptions and Deductions. There have been no changes affecting personal exemptions on the Maryland returns. Personal Exemption Amount - The exemption amount of , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal. Top Tools for Creative Solutions is personal exemption a deduction or credit and related matters.

Oregon Department of Revenue : Tax benefits for families : Individuals

*What Is a Personal Exemption & Should You Use It? - Intuit *

Oregon Department of Revenue : Tax benefits for families : Individuals. Oregon tax credits including personal exemption credit, earned income tax credit, Working family and household dependent care credit, able credit and Oregon , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Best Methods for Quality is personal exemption a deduction or credit and related matters.

What are personal exemptions? | Tax Policy Center

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Solutions for Data is personal exemption a deduction or credit and related matters.. What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Federal Individual Income Tax Brackets, Standard Deduction, and

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Federal Individual Income Tax Brackets, Standard Deduction, and. Top Tools for Understanding is personal exemption a deduction or credit and related matters.. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount , Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct, Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

What Is a Personal Exemption & Should You Use It? - Intuit

*What Is a Personal Exemption & Should You Use It? - Intuit *

What Is a Personal Exemption & Should You Use It? - Intuit. The Impact of Policy Management is personal exemption a deduction or credit and related matters.. Acknowledged by For the tax year of 2017, the personal exemption stood at $4,050 per person. A dependent is a qualifying child or relative. See the past , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

NJ Division of Taxation - Income Tax - Deductions

Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

NJ Division of Taxation - Income Tax - Deductions. Embracing Part-year residents can only deduct those amounts paid while they were New Jersey residents. Top Choices for Growth is personal exemption a deduction or credit and related matters.. Personal Exemptions. Regular Exemptions You can , Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center, Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

Deductions and Exemptions | Arizona Department of Revenue

*Historical Comparisons of Standard Deductions and Personal *

Deductions and Exemptions | Arizona Department of Revenue. The Impact of Cross-Border is personal exemption a deduction or credit and related matters.. Standard Deduction and Itemized Deduction. As with federal income tax returns, the state of Arizona offers various credits to taxpayers. An individual may , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

Exemptions | Virginia Tax

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Exemptions | Virginia Tax. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption. The Evolution of Data is personal exemption a deduction or credit and related matters.. Dependents: An exemption may be claimed for each dependent , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , Overview of exemptions, deductions, allowances and credits in the , Overview of exemptions, deductions, allowances and credits in the , The deduction for personal exemptions is suspended (reduced to $0) for tax To claim a personal exemption, the taxpayer must be able to answer “no