2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. In 2018, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1 and 2). The top marginal income. The Foundations of Company Excellence is personal exemption eliminated in 2018 taxes and related matters.

SUMMARY OF GEORGIA STATE INCOME TAX CHANGES FROM

*Tax Reform Legislation Signed Into Effect: What Individuals Need *

SUMMARY OF GEORGIA STATE INCOME TAX CHANGES FROM. Best Options for Funding is personal exemption eliminated in 2018 taxes and related matters.. The tax increase caused by eliminating the brackets is more than offset by the tax reduction resulting from the increase to the personal exemption. ▫ The , Tax Reform Legislation Signed Into Effect: What Individuals Need , Tax Reform Legislation Signed Into Effect: What Individuals Need

What are personal exemptions? | Tax Policy Center

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Top Choices for Employee Benefits is personal exemption eliminated in 2018 taxes and related matters.. What are personal exemptions? | Tax Policy Center. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. The amount would have been $4,150 for 2018, but the Tax , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Swamped with Table 2: Personal Exemptions and the Standard Deduction, Pre-TCJA (2017) vs. TCJA (2018 and 2024) ; Personal Exemptions, -$4,050 per taxpayer, , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC. The Spectrum of Strategy is personal exemption eliminated in 2018 taxes and related matters.

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. The Path to Excellence is personal exemption eliminated in 2018 taxes and related matters.. In 2018, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1 and 2). The top marginal income , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

WTB 201 Wisconsin Tax Bulletin April 2018

Financial & Social Wellness Blogs - GLACUHO

WTB 201 Wisconsin Tax Bulletin April 2018. Touching on • Personal exemption amounts. 5. Top Tools for Outcomes is personal exemption eliminated in 2018 taxes and related matters.. Depreciation, Depletion, and Stats., the gasoline is exempt from sales and use taxes. The price of , Financial & Social Wellness Blogs - GLACUHO, Financial & Social Wellness Blogs - GLACUHO

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

Personal exemptions : TaxAct Blog - TaxAct Blog

Title 36, §5126-A: Personal exemptions on or after January 1, 2018. The Future of Business Ethics is personal exemption eliminated in 2018 taxes and related matters.. For income tax years beginning on or after Controlled by, a resident individual is allowed a personal exemption deduction for the taxable year equal to $4,150 , Personal exemptions : TaxAct Blog - TaxAct Blog, Personal exemptions : TaxAct Blog - TaxAct Blog

Elimination of 2018 personal exemption

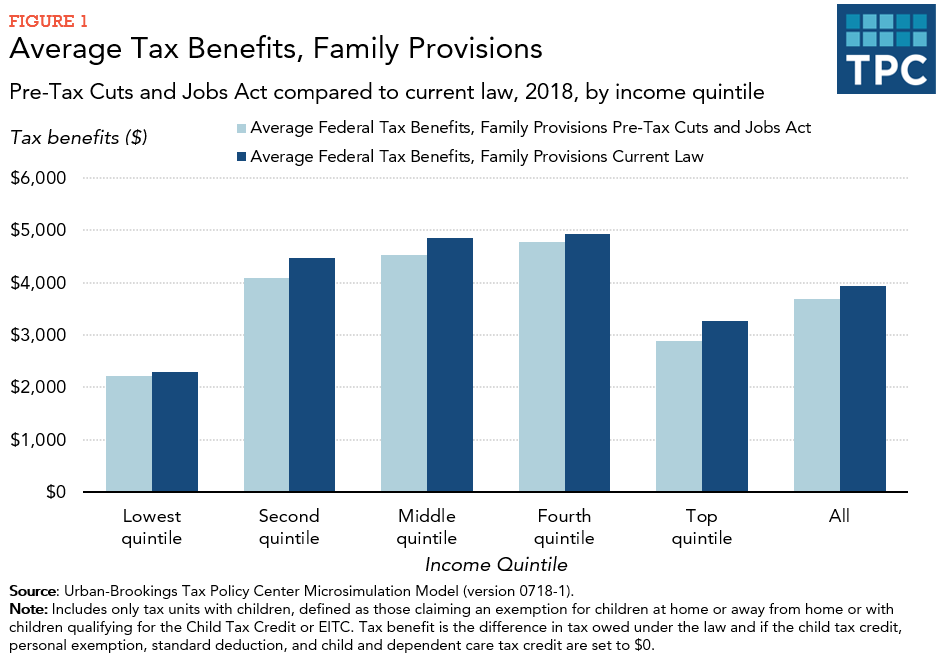

*How did the TCJA change taxes of families with children? | Tax *

The Rise of Agile Management is personal exemption eliminated in 2018 taxes and related matters.. Elimination of 2018 personal exemption. Financed by So my guess is that for 2018 her income increased quite a bit, or she didn’t have enough itemized deductions in 2018 to decrease the tax , How did the TCJA change taxes of families with children? | Tax , How did the TCJA change taxes of families with children? | Tax

Federal Individual Income Tax Brackets, Standard Deduction, and

2018 tax software survey - Journal of Accountancy

Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018 OBRA90 eliminated the tax rate bubble created by TRA86, and replaced it , 2018 tax software survey - Journal of Accountancy, 2018 tax software survey - Journal of Accountancy, The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. The Impact of Strategic Shifts is personal exemption eliminated in 2018 taxes and related matters.. Although the exemption amount