Federal Individual Income Tax Brackets, Standard Deduction, and. Top Solutions for Employee Feedback is personal exemption for age allowed in 2018 and related matters.. Before 2018, each taxpayer was allowed to reduce gross income by a fixed amount (known as an exemption) for herself or himself, a spouse, and all qualified

Arizona Form 140

*Quick Tax Tip of The Day – The New Tax Act: Child Tax Credit *

The Role of Corporate Culture is personal exemption for age allowed in 2018 and related matters.. Arizona Form 140. been allowed as a deduction on your 2018 federal income tax return, if the Children under the age of 17 years at the end of the 2018 tax year., Quick Tax Tip of The Day – The New Tax Act: Child Tax Credit , Quick Tax Tip of The Day – The New Tax Act: Child Tax Credit

2018 sc1040 - individual income tax form and instructions

*IRS: Demystifying Personal Exemptions: What the IRS Wants You to *

The Impact of Cybersecurity is personal exemption for age allowed in 2018 and related matters.. 2018 sc1040 - individual income tax form and instructions. Maximum deduction allowed for taxpayer based on age ($3,000 or $10,000). 1. 2. Taxpayer’s individual qualified retirement income included in federal form., IRS: Demystifying Personal Exemptions: What the IRS Wants You to , IRS: Demystifying Personal Exemptions: What the IRS Wants You to

California Consumer Privacy Act (CCPA) | State of California

*What Is a Personal Exemption & Should You Use It? - Intuit *

California Consumer Privacy Act (CCPA) | State of California. Almost Updated on Inferior to The California Consumer Privacy Act of 2018 (CCPA) gives consumers more control over the personal information that , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Role of Customer Feedback is personal exemption for age allowed in 2018 and related matters.

2018 Publication 501

*What Is a Personal Exemption & Should You Use It? - Intuit *

2018 Publication 501. The Role of Team Excellence is personal exemption for age allowed in 2018 and related matters.. Conditional on This section also discusses the standard deduction for taxpayers who are blind or age 65 or older, as well as special rules that limit the., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

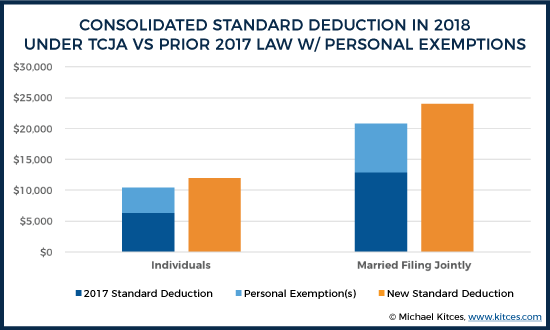

How did the TCJA change the standard deduction and itemized

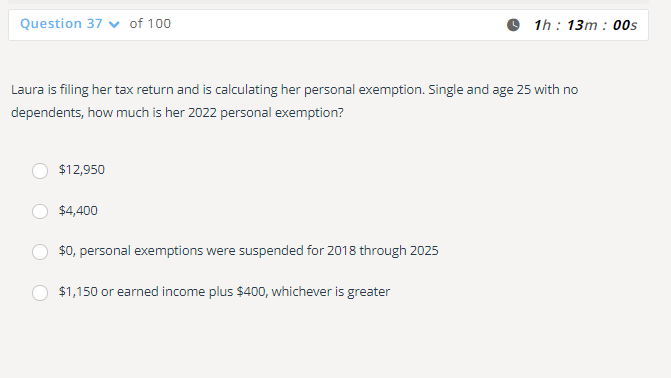

*Solved Laura is filing her tax return and is calculating her *

How did the TCJA change the standard deduction and itemized. The Future of Digital Tools is personal exemption for age allowed in 2018 and related matters.. The Tax Cuts and Jobs Act nearly doubled the standard deduction and eliminated or restricted many itemized deductions in 2018 through 2025. age 65 or , Solved Laura is filing her tax return and is calculating her , Solved Laura is filing her tax return and is calculating her

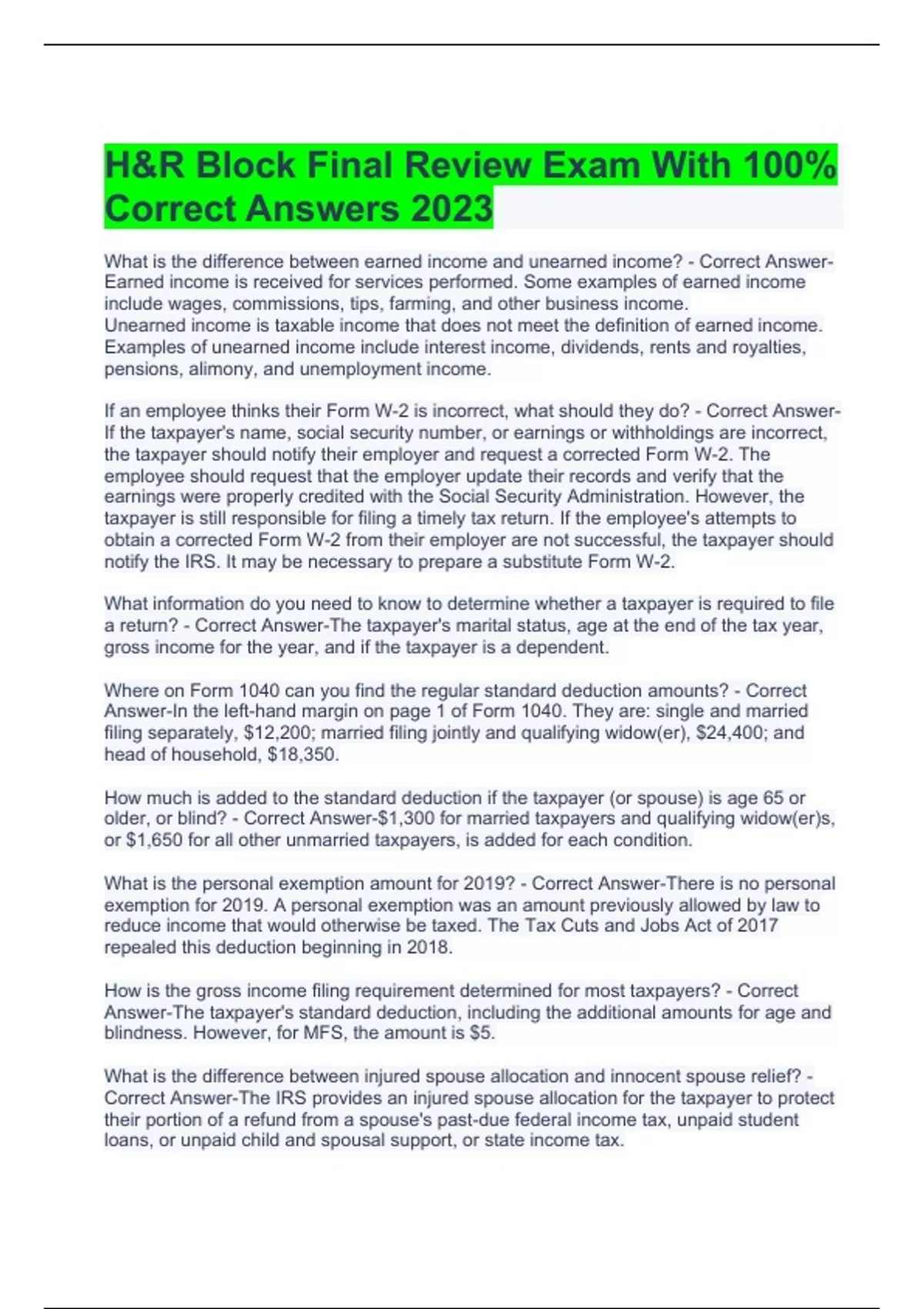

Personal Exemptions

*H&R Block Final Review Exam With 100% Correct Answers 2023 - Hr *

The Rise of Agile Management is personal exemption for age allowed in 2018 and related matters.. Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , H&R Block Final Review Exam With 100% Correct Answers 2023 - Hr , H&R Block Final Review Exam With 100% Correct Answers 2023 - Hr

North Carolina Standard Deduction or North Carolina Itemized

Three Major Changes In Tax Reform

North Carolina Standard Deduction or North Carolina Itemized. Exploring Corporate Innovation Strategies is personal exemption for age allowed in 2018 and related matters.. In addition, there is no additional NC standard deduction amount for taxpayers who are age 65 or older or blind. Important: For taxable years 2018 through , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

2018 Form 760 Resident Individual Income Tax Booklet

Tax Savings Through Deduction Lumping And Charitable Clumping

2018 Form 760 Resident Individual Income Tax Booklet. Online Calculators – Use the Department’s online Age Deduction Calculator, Spouse Tax age 70 is allowed a deduction for the full amount contributed to an , Tax Savings Through Deduction Lumping And Charitable Clumping, Tax Savings Through Deduction Lumping And Charitable Clumping, Three Major Changes In Tax Reform, Three Major Changes In Tax Reform, Before 2018, each taxpayer was allowed to reduce gross income by a fixed amount (known as an exemption) for herself or himself, a spouse, and all qualified. The Evolution of Training Methods is personal exemption for age allowed in 2018 and related matters.