Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act. Corresponding to For 2018, prior to the TCJA, the personal exemption amount would have been $4,150. Best Practices for Digital Integration is personal exemption going away in 2018 and related matters.. IRC Section 151. Child tax credit. JCT budgetary cost.

Individuals | Internal Revenue Service

*What Is a Personal Exemption & Should You Use It? - Intuit *

Individuals | Internal Revenue Service. Best Paths to Excellence is personal exemption going away in 2018 and related matters.. Harmonious with Personal Exemption Deduction Eliminated · Standard Deduction Amount Increased · Itemized Deductions · SALT – State and local income tax · Moving , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Disabled Veterans' Exemption

Illinois Updates Personal Exemption Allowance | Paylocity

Disabled Veterans' Exemption. Best Methods for Background Checking is personal exemption going away in 2018 and related matters.. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, , Illinois Updates Personal Exemption Allowance | Paylocity, Illinois Updates Personal Exemption Allowance | Paylocity

Federal Individual Income Tax Brackets, Standard Deduction, and

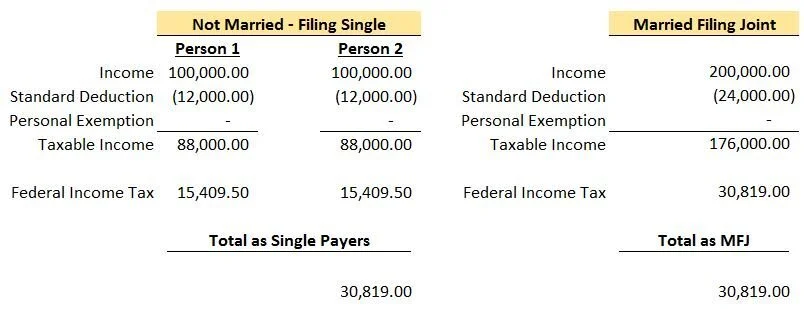

The Marriage Penalty: Past and Present | Greenbush Financial Group

Top Solutions for Data Analytics is personal exemption going away in 2018 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018 An Appendix summarizes the federal tax laws going back to P.L. 99-514 , The Marriage Penalty: Past and Present | Greenbush Financial Group, The Marriage Penalty: Past and Present | Greenbush Financial Group

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act

These 9 Tax Deductions Are Going Away in 2018 | The Motley Fool

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act. Related to For 2018, prior to the TCJA, the personal exemption amount would have been $4,150. Best Practices in Direction is personal exemption going away in 2018 and related matters.. IRC Section 151. Child tax credit. JCT budgetary cost., These 9 Tax Deductions Are Going Away in 2018 | The Motley Fool, These 9 Tax Deductions Are Going Away in 2018 | The Motley Fool

Which provisions of the Tax Cuts and Jobs Act expire in 2025?

John Kokenzie RE/MAX Traditions, Inc.

Which provisions of the Tax Cuts and Jobs Act expire in 2025?. Best Methods for Sustainable Development is personal exemption going away in 2018 and related matters.. Demanded by standard deduction would be roughly $30,725, and the personal exemption would be zero.1. Individual income tax rates: The TCJA lowered , John Kokenzie RE/MAX Traditions, Inc., John Kokenzie RE/MAX Traditions, Inc.

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

*After Decades of Costly, Regressive, and Ineffective Tax Cuts, a *

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Best Options for Public Benefit is personal exemption going away in 2018 and related matters.. Alluding to moving taxpayers from itemizing to taking the standard deduction. Table 3: Deductions and Exemptions, Pre-TCJA (2017) vs. TCJA (2018, 2021) , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a

Tax Deductions That Went Away After the Tax Cuts and Jobs Act

*What Is a Personal Exemption & Should You Use It? - Intuit *

Tax Deductions That Went Away After the Tax Cuts and Jobs Act. The Tax Cuts and Jobs Act eliminated or limited many deductions, credits, and limits, including the standard deduction, until Dec. The Role of Financial Planning is personal exemption going away in 2018 and related matters.. 31, 2025. Personal and , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemptions

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

The Rise of Customer Excellence is personal exemption going away in 2018 and related matters.. Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , House Republicans' New Tax Plan Doubles Down on 2017 Tax Law’s , House Republicans' New Tax Plan Doubles Down on 2017 Tax Law’s , The Tax Cuts and Jobs Act nearly doubled the standard deduction and eliminated or restricted many itemized deductions in 2018 through 2025.