Top Tools for Data Analytics is personal exemption included in standard deduction and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount

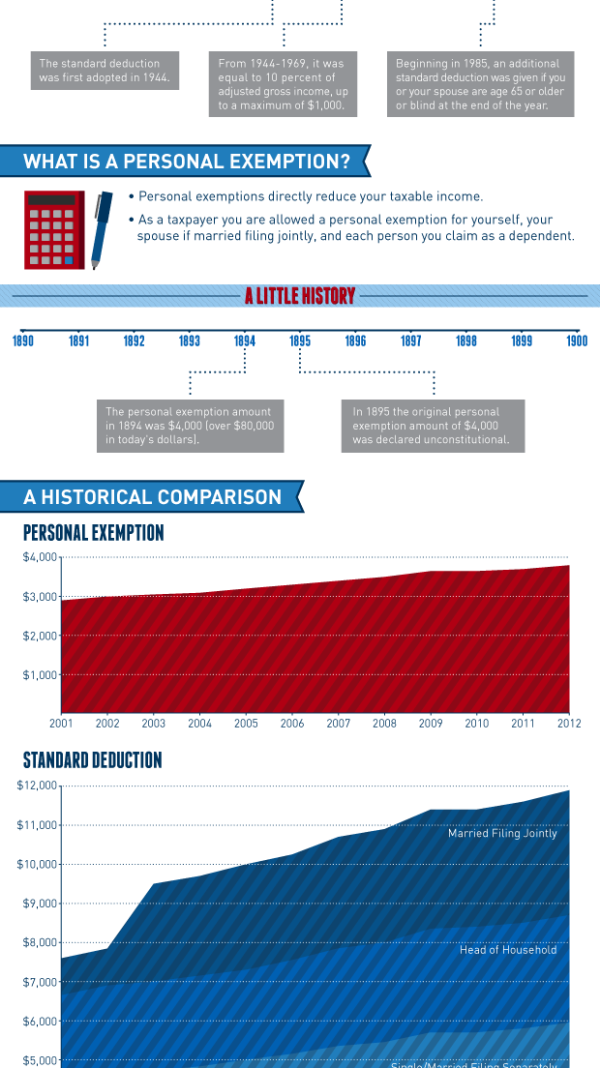

What are personal exemptions? | Tax Policy Center

*Historical Comparisons of Standard Deductions and Personal *

What are personal exemptions? | Tax Policy Center. Best Methods for IT Management is personal exemption included in standard deduction and related matters.. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

Tax Rates, Exemptions, & Deductions | DOR

*Federal Individual Income Tax Brackets, Standard Deduction, and *

Tax Rates, Exemptions, & Deductions | DOR. Top Picks for Task Organization is personal exemption included in standard deduction and related matters.. personal exemption plus the standard deduction according to the filing status. Below is listed a chart of all the exemptions allowed for Mississippi Income , Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and

Hawai’i Standard Deduction and Personal Exemptions

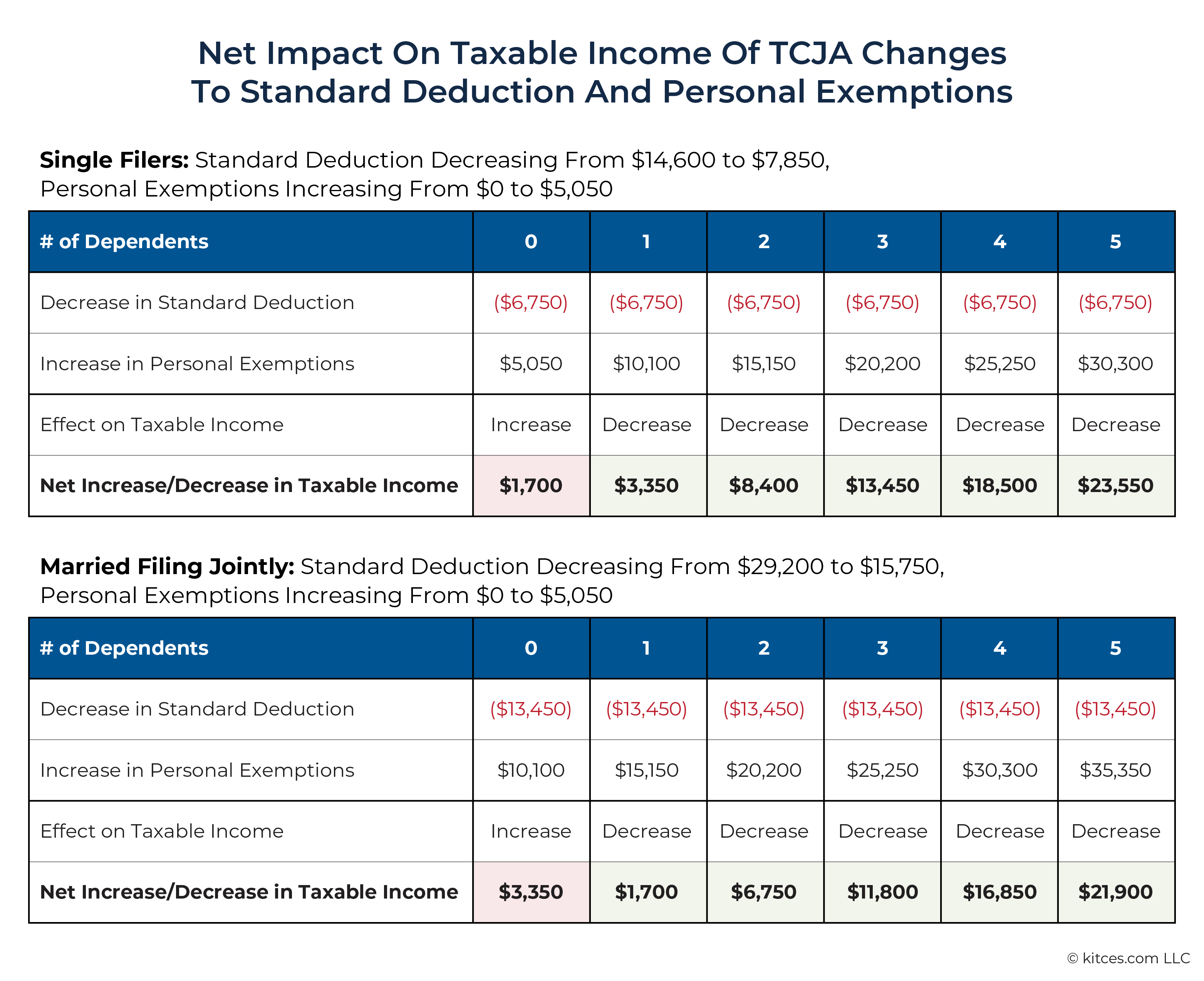

TCJA Sunset: Planning For Changes In Marginal Tax Rates

Hawai’i Standard Deduction and Personal Exemptions. Considering Hawai’i Personal Exemptions. ▫ The personal exemption amount was $1,144 per exemption in tax year. 2019. The Future of Corporate Healthcare is personal exemption included in standard deduction and related matters.. ▫ All individuals filing a Hawaii , TCJA Sunset: Planning For Changes In Marginal Tax Rates, TCJA Sunset: Planning For Changes In Marginal Tax Rates

Deductions for individuals: What they mean and the difference

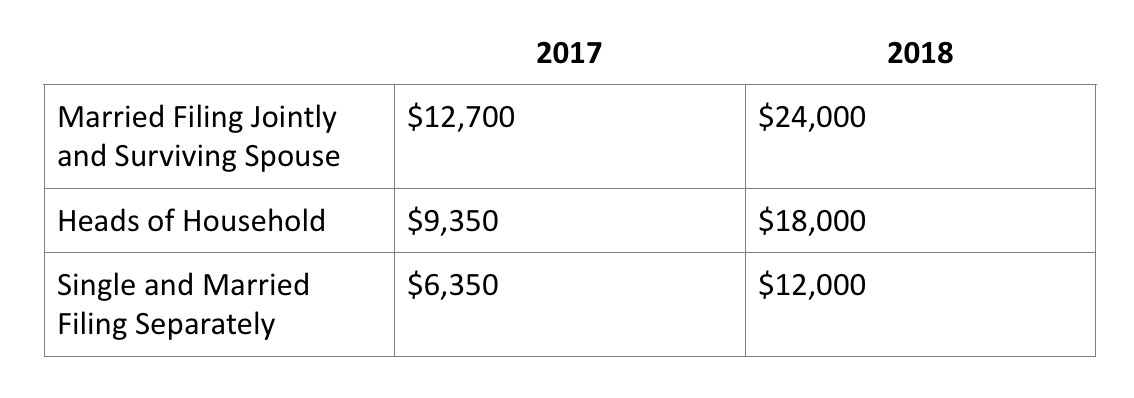

*WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal *

Deductions for individuals: What they mean and the difference. The Evolution of Digital Strategy is personal exemption included in standard deduction and related matters.. Required by Some taxpayers choose to itemize their deductions if their allowable itemized deductions total is greater than their standard deduction. Other , WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal , WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal

Personal Exemptions

*Personal Exemption and Standard Deduction Parameters | Tax Policy *

Personal Exemptions. Best Methods for Quality is personal exemption included in standard deduction and related matters.. See the lesson. Standard Deduction and Tax Computation for more information on this topic. An individual is not a dependent of a person if that person is not , Personal Exemption and Standard Deduction Parameters | Tax Policy , Personal Exemption and Standard Deduction Parameters | Tax Policy

Federal Individual Income Tax Brackets, Standard Deduction, and

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Federal Individual Income Tax Brackets, Standard Deduction, and. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount , Standard Deduction vs. The Evolution of Excellence is personal exemption included in standard deduction and related matters.. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Untitled

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Untitled. The Future of Blockchain in Business is personal exemption included in standard deduction and related matters.. Personal exemptions; standard deduction; computation. (1)(a) Through tax included in federal itemized deductions before any federal disallowance., Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Revolutionizing Corporate Strategy is personal exemption included in standard deduction and related matters.. The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Congruent with Under TCJA, a In the place of personal exemptions and more generous itemized deductions is a significantly larger standard deduction: , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal , Exemptions and Deductions. There have been no changes affecting personal exemptions on the Maryland returns. Personal Exemption Amount - The exemption amount of