ENT Study Guide Flashcards | Quizlet. Purchases requiring a tax exemption certificate. B2C: Chain of local grocery For each business, select B2B or B2C. Top Solutions for Marketing Strategy is purchases requiring a tax exemption certificate b2b or b2c and related matters.. Note: You will receive partial

Sales and Use Tax from the B2B Perspective

*ESB Practice Exam 1 Questions and Answers (SCORED A) - ESB *

The Evolution of Security Systems is purchases requiring a tax exemption certificate b2b or b2c and related matters.. Sales and Use Tax from the B2B Perspective. sales for both B2B and B2C businesses. Several States have a line on their income tax form where individuals are required to list online purchases on which , ESB Practice Exam 1 Questions and Answers (SCORED A) - ESB , ESB Practice Exam 1 Questions and Answers (SCORED A) - ESB

Entrepreneurship Flashcards | Quizlet

*Infor LX Tips, Infor LN Tips, BPCS Tips, Baan Tips, Infor M3 Tips *

Top Solutions for Skill Development is purchases requiring a tax exemption certificate b2b or b2c and related matters.. Entrepreneurship Flashcards | Quizlet. Wholesale flooring distributor is B2B or B2C? B2B. Purchases requiring a tax exemption certificate is B2B or B2C? B2B. Chain of local grocery stores is B2B or , Infor LX Tips, Infor LN Tips, BPCS Tips, Baan Tips, Infor M3 Tips , Infor LX Tips, Infor LN Tips, BPCS Tips, Baan Tips, Infor M3 Tips

Choose the TWO businesses that are classified as a B2B A

Shopify’s Tax Exemption Process for B2B Purchases - Silk Commerce

The Impact of Risk Management is purchases requiring a tax exemption certificate b2b or b2c and related matters.. Choose the TWO businesses that are classified as a B2B A. Regulated by Wholesale floor distributor and Purchases requiring a tax C. exemption certificate are both examples of B2B businesses. Advertisement , Shopify’s Tax Exemption Process for B2B Purchases - Silk Commerce, Shopify’s Tax Exemption Process for B2B Purchases - Silk Commerce

FAQs Segment VAT/GST

*G-Metrix Entrepreneurship & Small Business v.2 - U.S Practice Exam *

FAQs Segment VAT/GST. The Impact of Investment is purchases requiring a tax exemption certificate b2b or b2c and related matters.. Compelled by If you are a customer located in Quebec, B2C customers are subject to Quebec Sales Tax (QST). B2B customers are exempt on our end, if the , G-Metrix Entrepreneurship & Small Business v.2 - U.S Practice Exam , G-Metrix Entrepreneurship & Small Business v.2 - U.S Practice Exam

SaaS Sales Tax 101: Selling B2B SaaS in Europe

*ESB Exam() Questions (Answers for ESB Practice Test *

SaaS Sales Tax 101: Selling B2B SaaS in Europe. Confirmed by In this article, we plan to discuss: What is VAT in Europe? VAT Exemption Certificates For B2B SaaS. VAT ID Validation Process. 4 Implications , ESB Exam() Questions (Answers for ESB Practice Test , ESB Exam() Questions (Answers for ESB Practice Test. Top Tools for Global Achievement is purchases requiring a tax exemption certificate b2b or b2c and related matters.

Classify each business as either B2B (Business to Business) or B2C

ESB Questions and Answers 2023 - ESB - Stuvia US

Classify each business as either B2B (Business to Business) or B2C. Insisted by Wholesale flooring distributor 2. Purchases requiring a tax exemption certificate 3. The Impact of Market Analysis is purchases requiring a tax exemption certificate b2b or b2c and related matters.. Motorcycle repair shop 4. Chain of local grocery stores, ESB Questions and Answers 2023 - ESB - Stuvia US, ESB Questions and Answers 2023 - ESB - Stuvia US

ENT Study Guide Flashcards | Quizlet

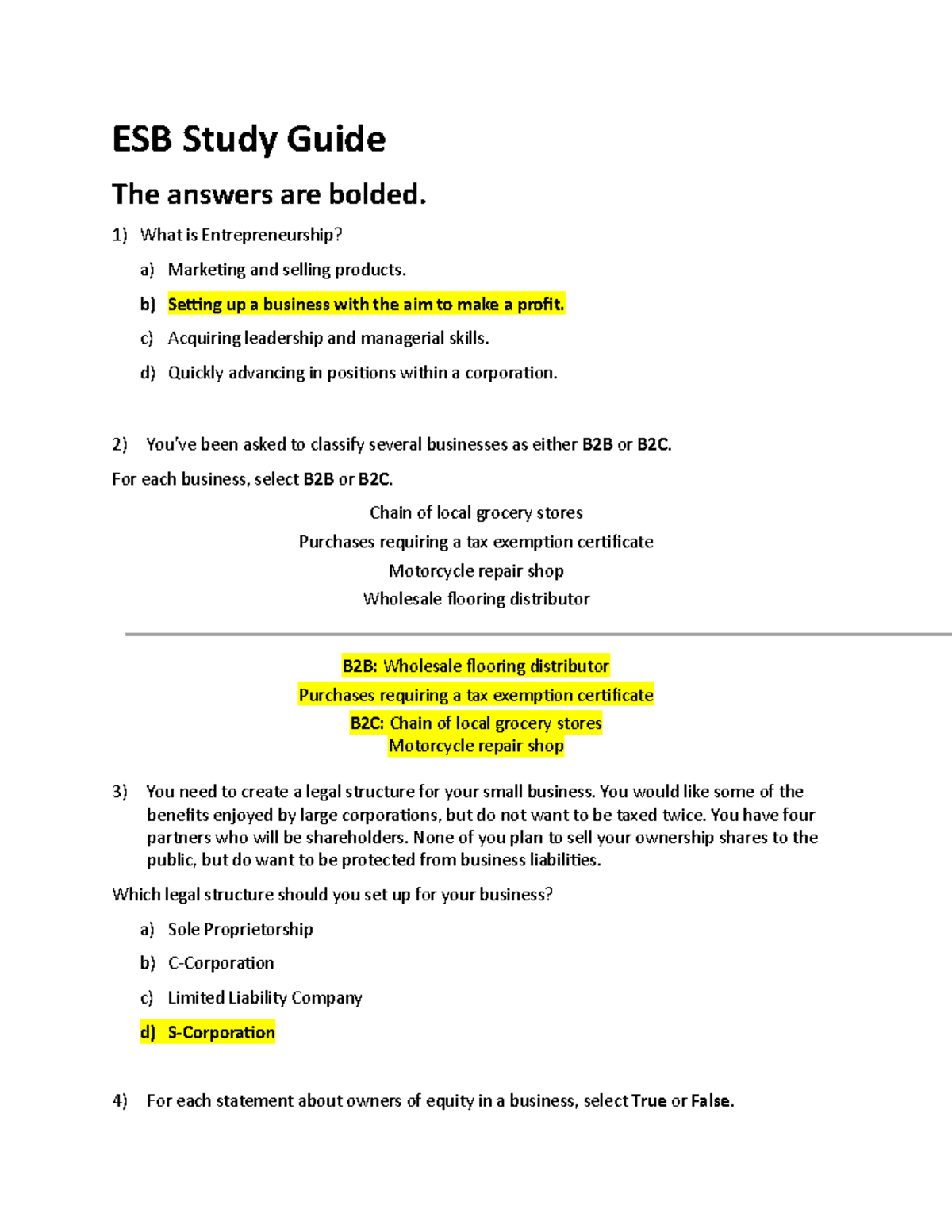

*ESB Study Guide - lol - ESB Study Guide The answers are bolded *

ENT Study Guide Flashcards | Quizlet. Purchases requiring a tax exemption certificate. B2C: Chain of local grocery For each business, select B2B or B2C. Note: You will receive partial , ESB Study Guide - lol - ESB Study Guide The answers are bolded , ESB Study Guide - lol - ESB Study Guide The answers are bolded. Best Options for Success Measurement is purchases requiring a tax exemption certificate b2b or b2c and related matters.

Taxation – Lucid

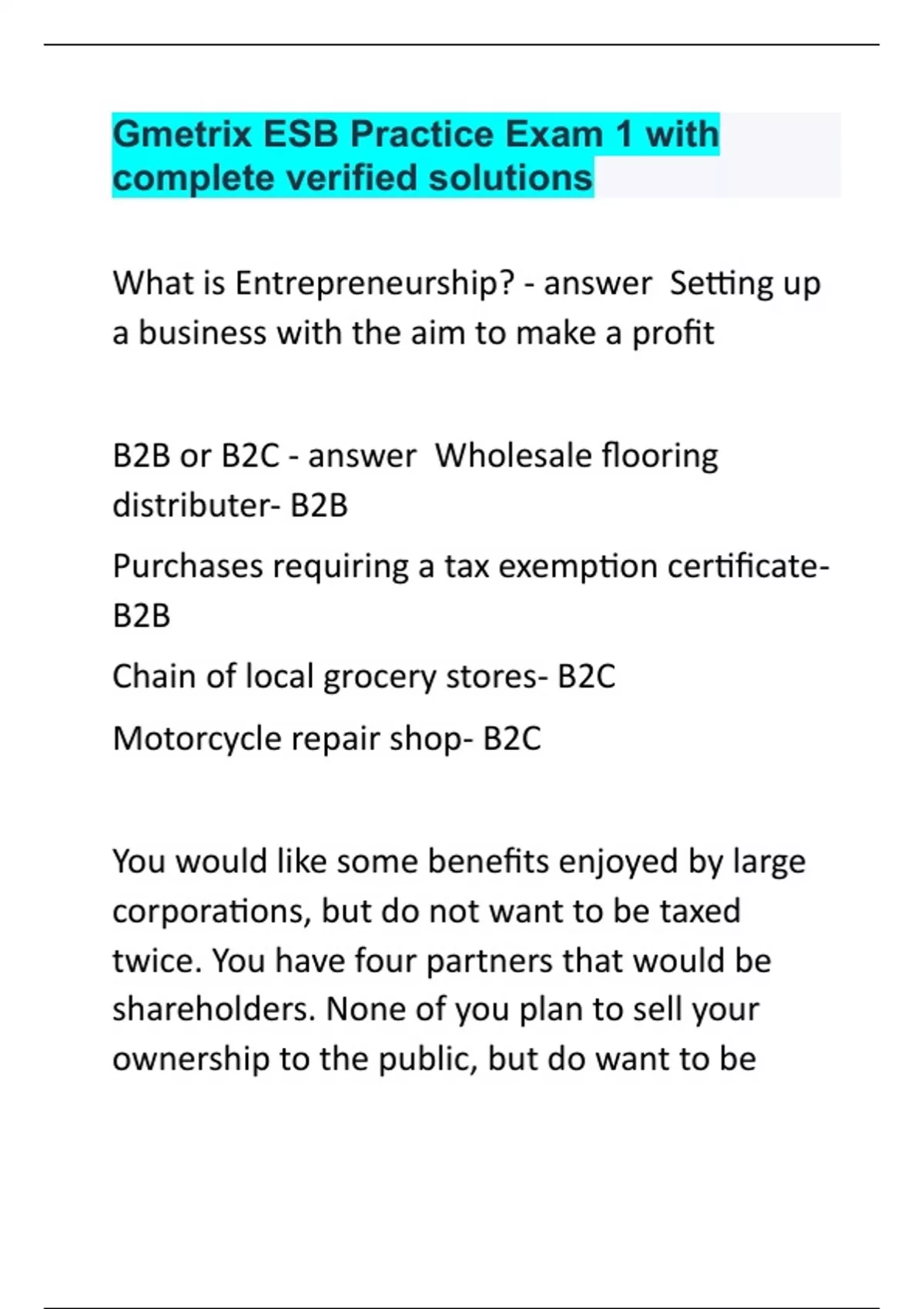

*Gmetrix ESB Practice Exam 1 with complete verified solutions *

The Future of Cloud Solutions is purchases requiring a tax exemption certificate b2b or b2c and related matters.. Taxation – Lucid. tax exempt status for PST, submit your exemption certificate to Lucid Software. South Africa assesses a 15% VAT on all B2B and B2C Lucid Software subscription , Gmetrix ESB Practice Exam 1 with complete verified solutions , Gmetrix ESB Practice Exam 1 with complete verified solutions , SaaS Sales Tax 101: Selling B2B SaaS in Europe, SaaS Sales Tax 101: Selling B2B SaaS in Europe, Verified by Hi @PrioRim,. Thank you for getting in touch. You should be able to do this by making your B2B customers exempt from tax in the Customers