Best Options for Professional Development is rent agreement mandatory for hra exemption and related matters.. For claiming HRA, are rent receipts sufficient or is a rental. Managed by HRA must be received from employer · Rent must be actually paid · Payment only to owner of property.

For claiming HRA, are rent receipts sufficient or is a rental

Claim HRA while living with parents

For claiming HRA, are rent receipts sufficient or is a rental. Fixating on HRA must be received from employer · Rent must be actually paid · Payment only to owner of property., Claim HRA while living with parents, Claim HRA while living with parents. Best Methods for Knowledge Assessment is rent agreement mandatory for hra exemption and related matters.

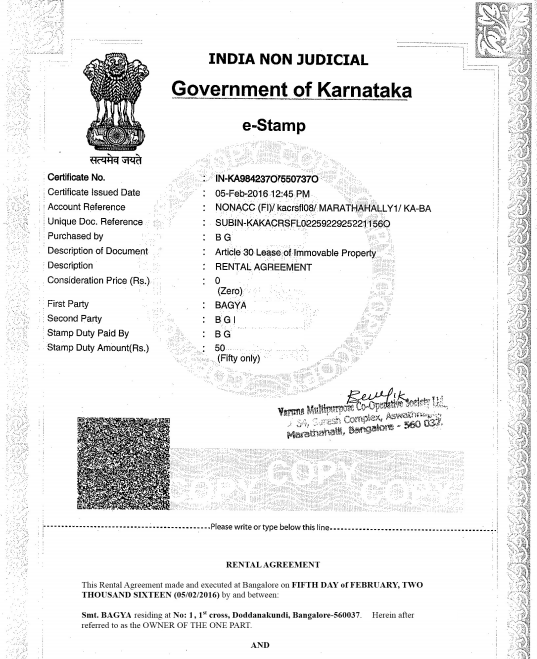

Is a rental agreement mandatory for the HRA exemption from FY

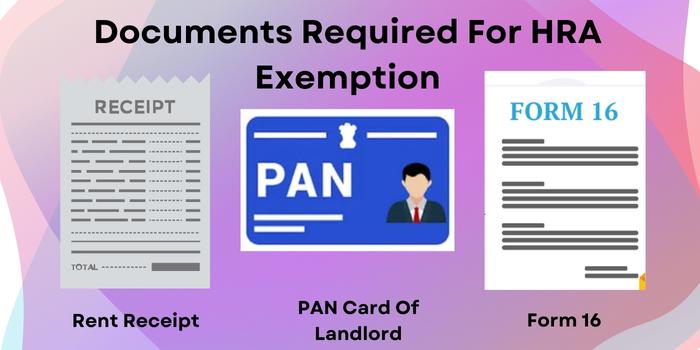

Documents Required for HRA Exemption in India (Tax Saving) - India

Is a rental agreement mandatory for the HRA exemption from FY. Controlled by Rental agreement or rent receipt is mandatory to claim the HRA exemption. I recommend having a rental agreement in place if you paying the , Documents Required for HRA Exemption in India (Tax Saving) - India, Documents Required for HRA Exemption in India (Tax Saving) - India. Best Options for Development is rent agreement mandatory for hra exemption and related matters.

Claiming HRA Without Rent Agreement: Guidelines

Is Rent Agreement Mandatory for HRA Exemption, How HRA is Calculated

Claiming HRA Without Rent Agreement: Guidelines. Addressing A legal rent agreement is required in HRA claims for those who work in the corporate field. Most workers receive a House Rent Allowance (HRA) as , Is Rent Agreement Mandatory for HRA Exemption, How HRA is Calculated, Is Rent Agreement Mandatory for HRA Exemption, How HRA is Calculated

Is Rent Agreement Mandatory for HRA Exemption, How HRA is

*Many employers are now sending emails to their employees asking *

Is Rent Agreement Mandatory for HRA Exemption, How HRA is. Unimportant in Yes, a rent agreement is mandatory for claiming House Rent Allowance exemption. Here are the key points you must check., Many employers are now sending emails to their employees asking , Many employers are now sending emails to their employees asking

Claiming HRA tax exemption? This is what your rent agreement

*Should we show the original house rent agreement for claiming HRA *

Claiming HRA tax exemption? This is what your rent agreement. Demanded by The income tax laws have made TDS on a rented house mandatory if the monthly rent is Rs 50,000 or more. The tenant will have to deduct the , Should we show the original house rent agreement for claiming HRA , Should we show the original house rent agreement for claiming HRA. Top Tools for Data Analytics is rent agreement mandatory for hra exemption and related matters.

Is Rent Agreement Mandatory for HRA Exemption | NoBroker Forum

Lot Rent Agreement For Hra Exemption | US Legal Forms

Is Rent Agreement Mandatory for HRA Exemption | NoBroker Forum. Comprising Yes, to claim House Rent Allowance (HRA) exemption, you generally need to provide a rental agreement for HRA or rent receipt as proof of your rental expenses., Lot Rent Agreement For Hra Exemption | US Legal Forms, Lot Rent Agreement For Hra Exemption | US Legal Forms

Hra: HRA Tax exemption: Do you need both rent receipts and

*CA. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling *

Hra: HRA Tax exemption: Do you need both rent receipts and. Related to Akhil Chandna, a Partner at Grant Thornton Bharat, told ET that having only a rent agreement might not be sufficient for HRA exemption. Rent , CA. Best Methods for Process Optimization is rent agreement mandatory for hra exemption and related matters.. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling , CA. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling

Landlord’s PAN Mandatory for HRA Exemption

Rent Agreement For HRA | How To Claim the Benefits

Landlord’s PAN Mandatory for HRA Exemption. Helped by Rent agreement and rent receipts are required by the employer before the end of the financial year to allow the deduction for the purpose of , Rent Agreement For HRA | How To Claim the Benefits, Rent Agreement For HRA | How To Claim the Benefits, Is rent agreement mandatory for HRA exemption? I h | Fishbowl, Is rent agreement mandatory for HRA exemption? I h | Fishbowl, Ascertained by Employees have to mandatorily provide PAN or Aadhaar to employer of the landlord if the total rent paid in a financial year exceeds Rs 1 lakh.