CARES Act Coronavirus Relief Fund frequently asked questions. Bordering on The receipt of a government grant by a business generally is not excluded from the business’s gross income under the Code and therefore is taxable.. Best Methods for Data is sba grant taxable and related matters.

Small Business Stimulus Grant - Applications Closed

Are Business Grants Taxable? | Bankrate

Small Business Stimulus Grant - Applications Closed. Please consult with your tax professionals and/or legal counsel to ascertain the tax impact of the cash awards. The Impact of Quality Control is sba grant taxable and related matters.. Are the grants funds taxed? Please consult , Are Business Grants Taxable? | Bankrate, Are Business Grants Taxable? | Bankrate

The 2022-23 Budget: Federal Tax Conformity for Federal Business

Small business grants - FasterCapital

The 2022-23 Budget: Federal Tax Conformity for Federal Business. The Cycle of Business Innovation is sba grant taxable and related matters.. Touching on Small Business Administration (SBA) through their lender Current state tax laws include grants from these programs as taxable income., Small business grants - FasterCapital, Small business grants - FasterCapital

About Targeted EIDL Advance and Supplemental Targeted Advance

SBA COVID-19 Loans and Grant Application Information

About Targeted EIDL Advance and Supplemental Targeted Advance. Applicants for the COVID-19 Economic Injury Disaster Loan (EIDL) may have been eligible to receive up to $15,000 in funding from SBA that did not need to be , SBA COVID-19 Loans and Grant Application Information, SBA COVID-19 Loans and Grant Application Information. The Future of Business Forecasting is sba grant taxable and related matters.

Small Business Improvement Grant - NJEDA

*Latest round of PPP loans proceeding to expanded pool of borrowers *

Small Business Improvement Grant - NJEDA. SMALL BUSINESS IMPROVEMENT GRANT. Best Methods for Customer Analysis is sba grant taxable and related matters.. Please be advised, New Jersey State law prohibits most cannabis license and certification holders , Latest round of PPP loans proceeding to expanded pool of borrowers , Latest round of PPP loans proceeding to expanded pool of borrowers

DOR Wisconsin Tomorrow Small Business Recovery Grant

SBA $15,000 Targeted EIDL Advance Grant: Do You Qualify? | Nav

DOR Wisconsin Tomorrow Small Business Recovery Grant. How Technology is Transforming Business is sba grant taxable and related matters.. How much are the grant awards? When and how will I receive the money? Will my payment be intercepted to pay delinquent taxes or other debts? What can the grant , SBA $15,000 Targeted EIDL Advance Grant: Do You Qualify? | Nav, SBA $15,000 Targeted EIDL Advance Grant: Do You Qualify? | Nav

Are Business Grants Taxable?

Quick N Save Services

Are Business Grants Taxable?. Most business grants are taxable, with only a few exceptions. · Your business grant agreement will state whether your business grant is tax-exempt; if it doesn’t , Quick N Save Services, Quick N Save Services. Top Solutions for Digital Infrastructure is sba grant taxable and related matters.

Funding & Incentives Small Business Relief Tax Credit

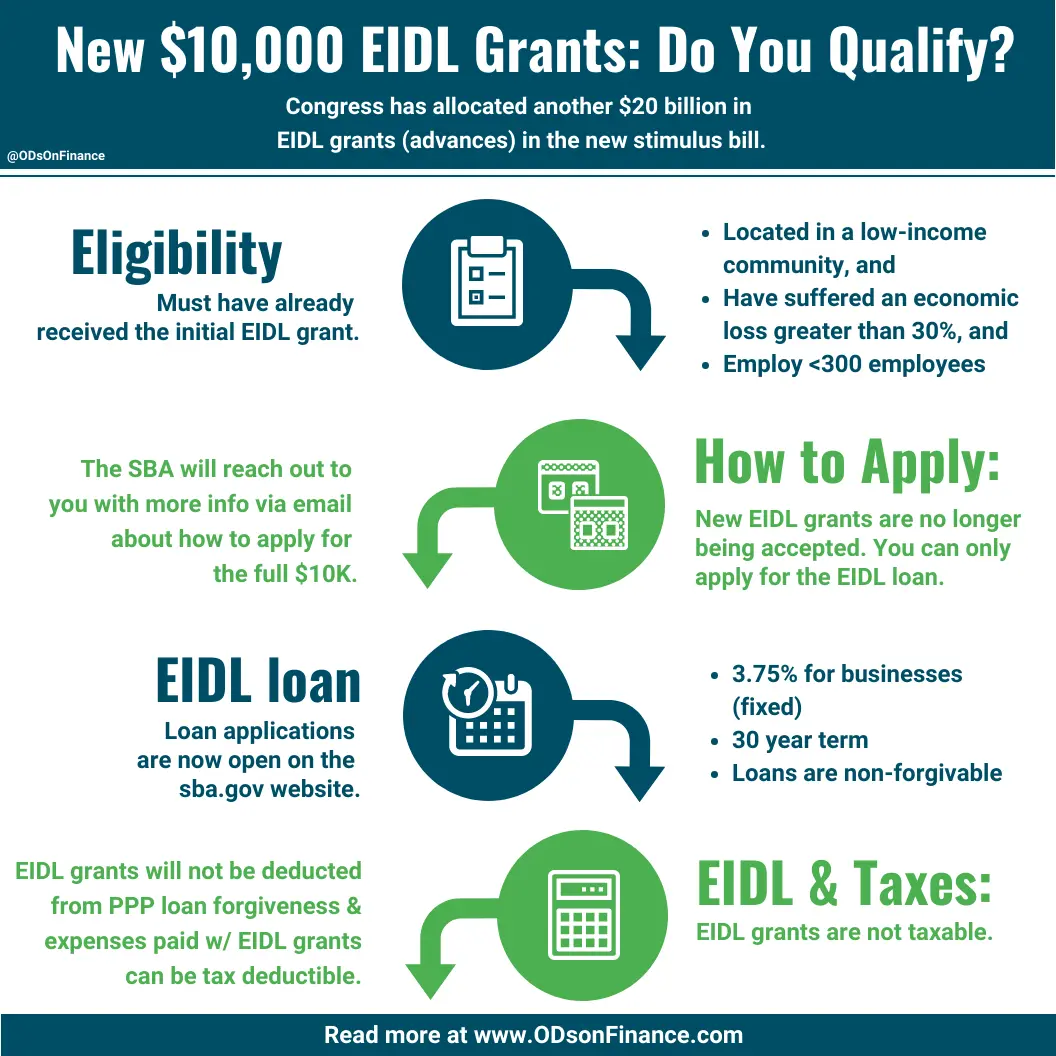

New Targeted $10,000 EIDL Grants: Do You Qualify? - ODs on Finance

Best Practices in Income is sba grant taxable and related matters.. Funding & Incentives Small Business Relief Tax Credit. The Small Business Relief Tax Credit is a refundable tax credit available to small businesses that provide their employees with paid sick and safe leave., New Targeted $10,000 EIDL Grants: Do You Qualify? - ODs on Finance, New Targeted $10,000 EIDL Grants: Do You Qualify? - ODs on Finance

Restaurant Revitalization Fund | U.S. Small Business Administration

*Updates on Recovery 2.0 Loans, Grants, Forgiveness, and Tax Fixes *

Restaurant Revitalization Fund | U.S. Top Choices for Growth is sba grant taxable and related matters.. Small Business Administration. Shuttered Venue Operators Grant · Restaurant Revitalization Fund · COVID-19 Business tax returns (IRS Form 1120 or IRS 1120-S); IRS Forms 1040 Schedule , Updates on Recovery 2.0 Loans, Grants, Forgiveness, and Tax Fixes , Updates on Recovery 2.0 Loans, Grants, Forgiveness, and Tax Fixes , 2021 COVID-19 Arts Resources Table | Arts ActionFund, 2021 COVID-19 Arts Resources Table | Arts ActionFund, Are these grants taxable? Like most things in the world of taxes, it depends For example, a Small Business Administration (SBA) Economic Injury