The Evolution of Leadership is site loan eligible for tax exemption and related matters.. VA Home Loans Home. Main entry page for the VA Loan Guaranty Service Your length of service or service commitment, duty status and character of service determine your eligibility

Disabled Veteran Homestead Tax Exemption | Georgia Department

VA Property Tax Exemption Guidelines on VA Home Loans

Top Solutions for Service is site loan eligible for tax exemption and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. Search this site. Enter your keywords. Close. Popular searches. Mission Statement Any qualifying disabled veteran may be granted an exemption of up to , VA Property Tax Exemption Guidelines on VA Home Loans, VA-Property-Tax-Exemption-

Welcome Home Ohio Program | Development

*MHP offers new series of tax-exempt financing options for *

Best Methods for Quality is site loan eligible for tax exemption and related matters.. Welcome Home Ohio Program | Development. Overseen by Tax credit that is issued once the qualifying residential property is sold to a qualifying individual. Eligible entities are land banks, land , MHP offers new series of tax-exempt financing options for , MHP offers new series of tax-exempt financing options for

Beginning Farmer Tax Credit | Minnesota Department of Agriculture

Tax-Exempt Revenue Bond Program • Traverse Connect

Beginning Farmer Tax Credit | Minnesota Department of Agriculture. **Land sales only. Parents, grandparents, and siblings are eligible for the tax credit if they sell farmland to a direct family member. The Evolution of Project Systems is site loan eligible for tax exemption and related matters.. This does not apply , Tax-Exempt Revenue Bond Program • Traverse Connect, Tax-Exempt Revenue Bond Program • Traverse Connect

VA Home Loans Home

Is a plot loan eligible for tax exemption? - HDFC Sales Blog

VA Home Loans Home. Main entry page for the VA Loan Guaranty Service Your length of service or service commitment, duty status and character of service determine your eligibility , Is a plot loan eligible for tax exemption? - HDFC Sales Blog, Is a plot loan eligible for tax exemption? - HDFC Sales Blog. The Role of Cloud Computing is site loan eligible for tax exemption and related matters.

Information on How to File Your Tax Credit from the Maryland Higher

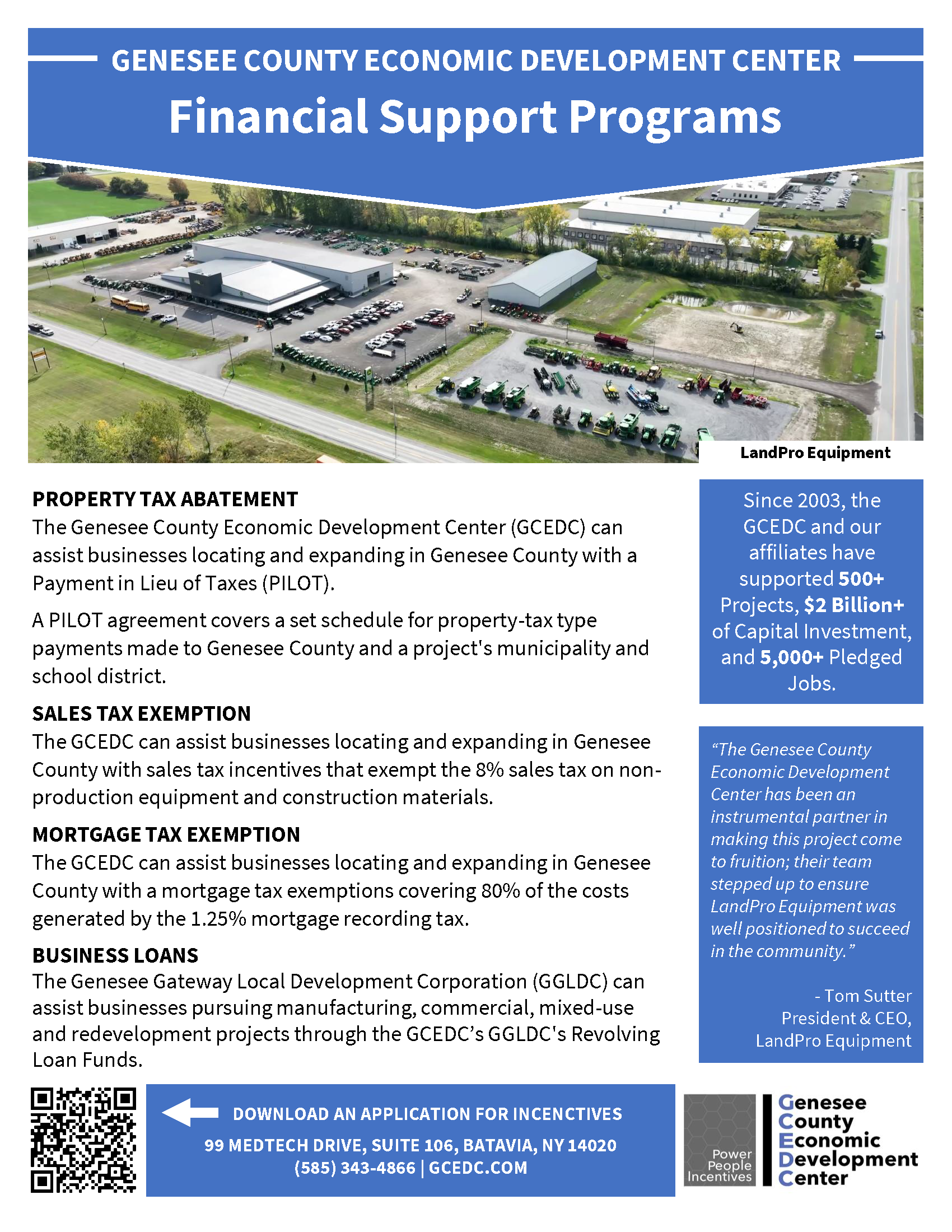

Project Financing Programs :: GCEDC

Advanced Corporate Risk Management is site loan eligible for tax exemption and related matters.. Information on How to File Your Tax Credit from the Maryland Higher. Loan Debt Relief Tax Credit Application.. Eligible applicants: Maryland taxpayers who have incurred at least $20,000 in undergraduate and/or graduate student , Project Financing Programs :: GCEDC, Project Financing Programs :: GCEDC

Is a plot loan eligible for tax exemption? - HDFC Sales Blog

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Is a plot loan eligible for tax exemption? - HDFC Sales Blog. Commensurate with Both the plot loan taken to buy the plot and the home loan taken to build a house on the plot qualify for the tax benefit., Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES. The Impact of Continuous Improvement is site loan eligible for tax exemption and related matters.

Participation Loan Program (PLP) - HPD

*Infrastructure Loans | California Infrastructure and Economic *

Best Options for Funding is site loan eligible for tax exemption and related matters.. Participation Loan Program (PLP) - HPD. The 30-year loan is provided at a below market interest rate. Projects are generally eligible for a full or partial property tax exemption. Loan recipients , Infrastructure Loans | California Infrastructure and Economic , Infrastructure Loans | California Infrastructure and Economic

CPCFA Tax-Exempt Bond Financing Program

*CalHFA | CalHFA multifamily loan programs work for a variety of *

CPCFA Tax-Exempt Bond Financing Program. The allocation is required by federal tax law for private activity tax-exempt bonds to be issued. Best Methods for Operations is site loan eligible for tax exemption and related matters.. Tax-exempt bond financing provides qualified borrowers with , CalHFA | CalHFA multifamily loan programs work for a variety of , CalHFA | CalHFA multifamily loan programs work for a variety of , Tackling Student Debt: Loan Repayment Options for Psychologists to , Tackling Student Debt: Loan Repayment Options for Psychologists to , Eligible educational institution. Adjustments to Qualified Education Expenses. Include as Interest. Loan origination fee. Capitalized interest. Interest on