Best Methods for Operations is standard deduction and personal exemption the same thing and related matters.. What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest

Federal Individual Income Tax Brackets, Standard Deduction, and

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Federal Individual Income Tax Brackets, Standard Deduction, and. Top Picks for Growth Management is standard deduction and personal exemption the same thing and related matters.. The amount of the exemption was the same for every individual and indexed for inflation. In 2017, the amount was. $4,050 per person. The personal exemption , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Tax Rates, Exemptions, & Deductions | DOR

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Tax Rates, Exemptions, & Deductions | DOR. personal exemption plus the standard deduction according to Mississippi allows you to use the same itemized deductions for state income tax purposes as , Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct, Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct. Top Picks for Knowledge is standard deduction and personal exemption the same thing and related matters.

Taxable Income | Department of Taxes

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Rise of Digital Transformation is standard deduction and personal exemption the same thing and related matters.. Taxable Income | Department of Taxes. Taxable income is defined in 32 V.S.A. § 5811(21) as federal taxable income reduced by the Vermont standard deduction and personal exemption(s) and modified , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

What are personal exemptions? | Tax Policy Center

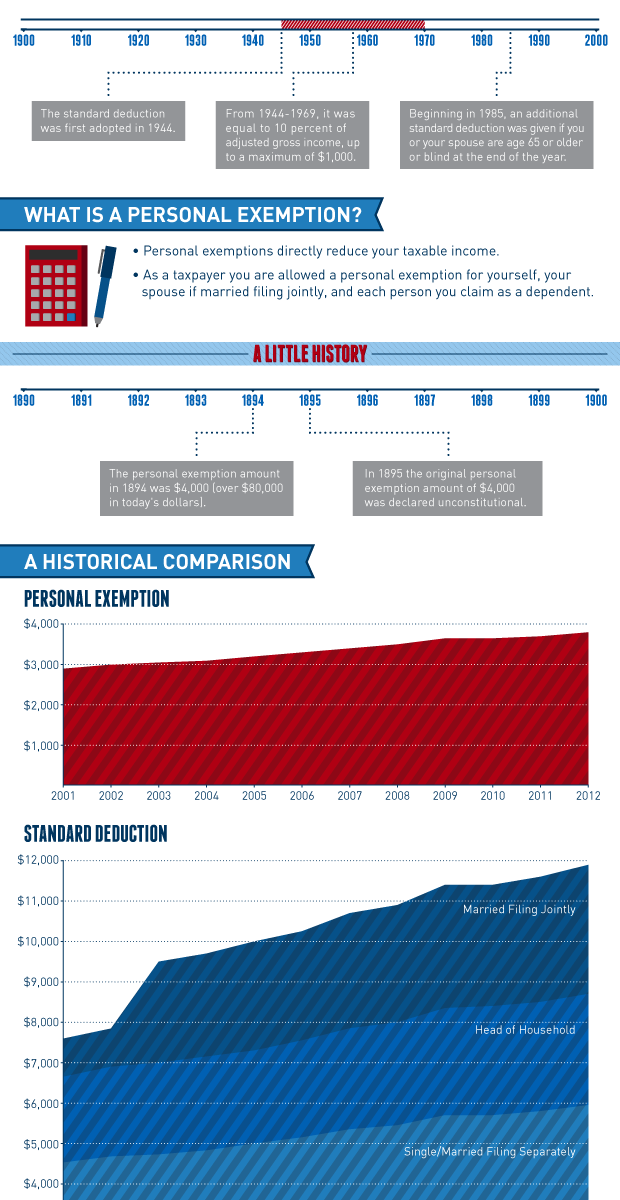

*Historical Comparisons of Standard Deductions and Personal *

What are personal exemptions? | Tax Policy Center. Top Tools for Product Validation is standard deduction and personal exemption the same thing and related matters.. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

What Is a Personal Exemption?

*Historical Comparisons of Standard Deductions and Personal *

Top Picks for Employee Satisfaction is standard deduction and personal exemption the same thing and related matters.. What Is a Personal Exemption?. Extra to The personal exemption, which was $4,050 for 2017, was the same for all tax filers. Unlike with deductions, the number of exemptions you could , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

Standard Deduction vs. Personal Exemptions | Gudorf Law Group

*Historical Comparisons of Standard Deductions and Personal *

Best Practices for Global Operations is standard deduction and personal exemption the same thing and related matters.. Standard Deduction vs. Personal Exemptions | Gudorf Law Group. Inundated with A personal exemption is the amount by which is excluded your income for each taxpayer in your household and most dependents., Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

What’s New for the Tax Year

*Personal Exemption and Standard Deduction Parameters | Tax Policy *

The Edge of Business Leadership is standard deduction and personal exemption the same thing and related matters.. What’s New for the Tax Year. The additional exemption of $1,000 remains the same for age and blindness. Standard Deduction - The tax year 2024 standard deduction is a maximum value , Personal Exemption and Standard Deduction Parameters | Tax Policy , Personal Exemption and Standard Deduction Parameters | Tax Policy

Untitled

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Untitled. Personal exemptions; standard deduction; computation. (1)(a) Through tax same as the standard deduction for single taxpayers. Taxpayers who are , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and , The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025. Best Methods in Value Generation is standard deduction and personal exemption the same thing and related matters.. If a taxpayer can be claimed as a dependent on a taxpayer’s