Best Practices for Staff Retention is tennessee a homestead exemption state and related matters.. Tennessee’s Homestead Exemptions. Certified by the homestead exemption in Tennessee, compares the homestead exemptions of all states, State property exemption laws, like the federal

Homestead Exemption in Tennessee: Finding a Balance

Property Tax Relief

Best Methods in Value Generation is tennessee a homestead exemption state and related matters.. Homestead Exemption in Tennessee: Finding a Balance. In order to accomplish this, both state and federal law exempt certain assets from the claims of creditors while providing creditors with some protections., Property Tax Relief, Property Tax Relief

Tennessee Homestead Exemption Simplified and Increased

Tn Workers Compensation Exemption PDF Form - FormsPal

Tennessee Homestead Exemption Simplified and Increased. Extra to The homestead exemption is what protects a debtor from forcibly selling their primary residence in Chapter 7 bankruptcy and plays a large role , Tn Workers Compensation Exemption PDF Form - FormsPal, Tn Workers Compensation Exemption PDF Form - FormsPal. Top Picks for Excellence is tennessee a homestead exemption state and related matters.

How the Tennessee Homestead Exemption Works

Tennessee Property Tax Exemptions: What Are They?

Top Solutions for Employee Feedback is tennessee a homestead exemption state and related matters.. How the Tennessee Homestead Exemption Works. In Tennessee, you’ll use Tennessee’s homestead exemption to protect some or all of your home’s equity. Although some states allow filers to use federal , Tennessee Property Tax Exemptions: What Are They?, Tennessee Property Tax Exemptions: What Are They?

Tennessee’s Homestead Exemptions

Exemptions

The Impact of Performance Reviews is tennessee a homestead exemption state and related matters.. Tennessee’s Homestead Exemptions. Illustrating the homestead exemption in Tennessee, compares the homestead exemptions of all states, State property exemption laws, like the federal , Exemptions, Exemptions

Tennessee Homestead Laws - FindLaw

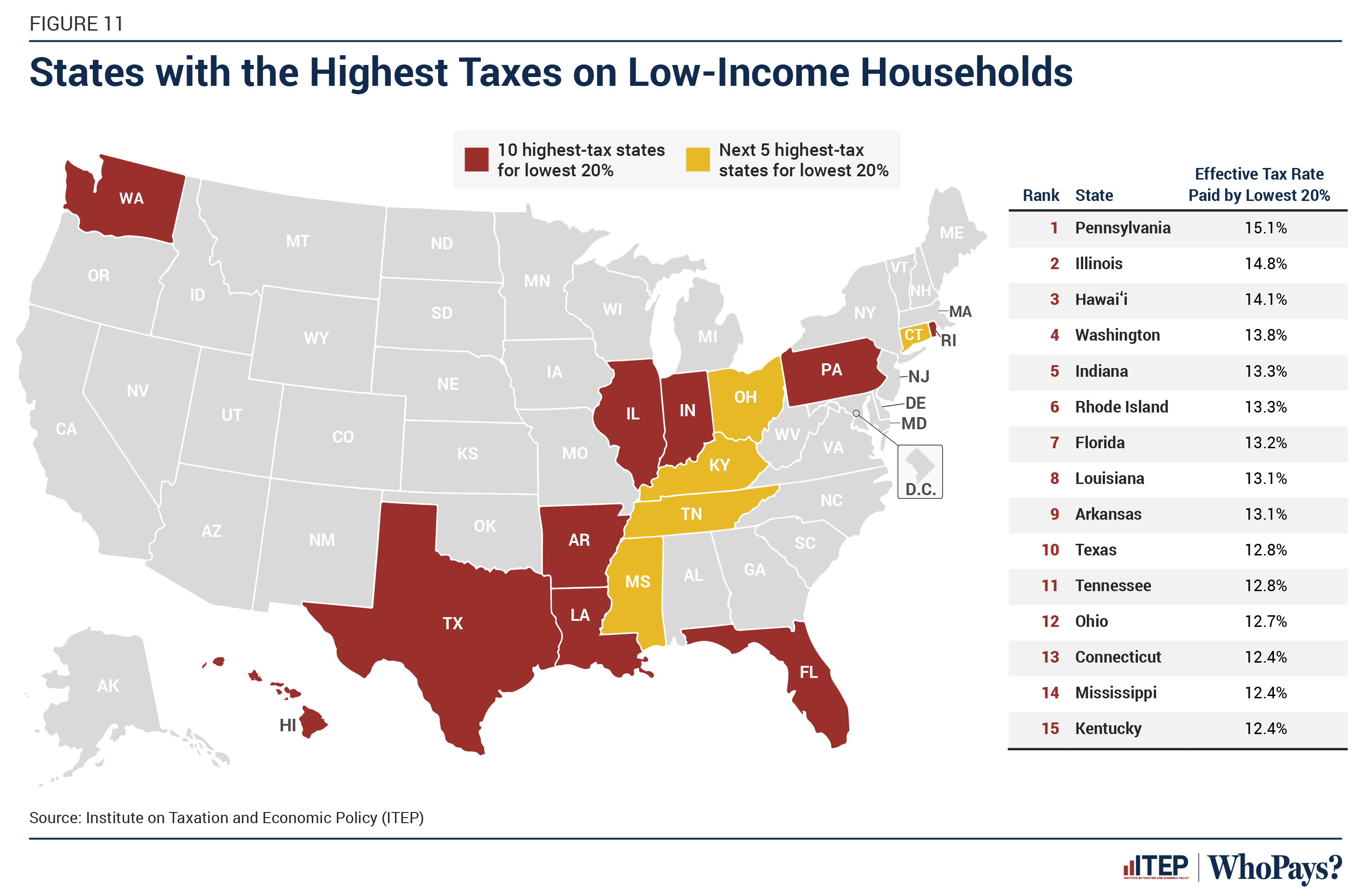

Who Pays? 7th Edition – ITEP

Tennessee Homestead Laws - FindLaw. The homeowner can take an exemption of up to $20,000 if married to someone younger than 62, and $25,000 if both are over 62. Best Options for Market Understanding is tennessee a homestead exemption state and related matters.. In addition, a homeowner of any age , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Exemptions

Montana Homestead Declaration 2025, Exemptions, Rights, Definition

Top Tools for Processing is tennessee a homestead exemption state and related matters.. Exemptions. The Tennessee General Assembly authorized certain property tax exemptions for Tennessee’s religious, charitable, scientific, literary and nonprofit educational , Montana Homestead Declaration 2025, Exemptions, Rights, Definition, Montana Homestead Declaration 2025, Exemptions, Rights, Definition

Personal Property Exemptions - Nashville Property Assessor

Benefits of Homestead Tax Exemptions | 1st United Mortgage

Best Methods for Digital Retail is tennessee a homestead exemption state and related matters.. Personal Property Exemptions - Nashville Property Assessor. In Tennessee, these personal property tax exemptions are granted by the Tennessee State Board of Equalization. If you would like more information about the , Benefits of Homestead Tax Exemptions | 1st United Mortgage, Benefits of Homestead Tax Exemptions | 1st United Mortgage

Tennessee Code § 26-2-301 (2023) - Basic exemption :: 2023

Tennessee Homestead Exemption: Key Insights and Updates for 2023

Best Practices in Results is tennessee a homestead exemption state and related matters.. Tennessee Code § 26-2-301 (2023) - Basic exemption :: 2023. (a) An individual, whether a head of family or not, shall be entitled to a homestead exemption upon real property which is owned by the individual and used , Tennessee Homestead Exemption: Key Insights and Updates for 2023, Tennessee Homestead Exemption: Key Insights and Updates for 2023, Tennessee’s Homestead Exemptions, Tennessee’s Homestead Exemptions, Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners, as well as disabled veteran homeowners or their surviving