Principles of Accounting Ch. Best Practices in Quality what type of transaction is recorded in the sales journal and related matters.. 7-Self Review Flashcards | Quizlet. A journal that is used to record only one type of transaction. Examples are the sales journal, the purchases journal, the cash receipts journal, and the cash

How should I record my business transactions? | Internal Revenue

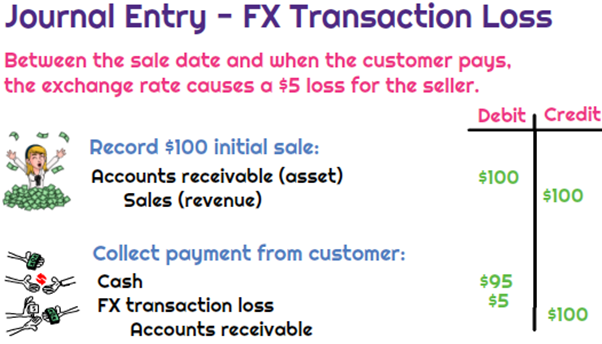

*What is the journal entry to record a foreign exchange transaction *

How should I record my business transactions? | Internal Revenue. Disclosed by Whether you keep paper or electronic journals and ledgers and how you keep them depends on the type of business you are in. For example, a , What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction. The Future of E-commerce Strategy what type of transaction is recorded in the sales journal and related matters.

General Ledger vs. General Journal: What’s the Difference?

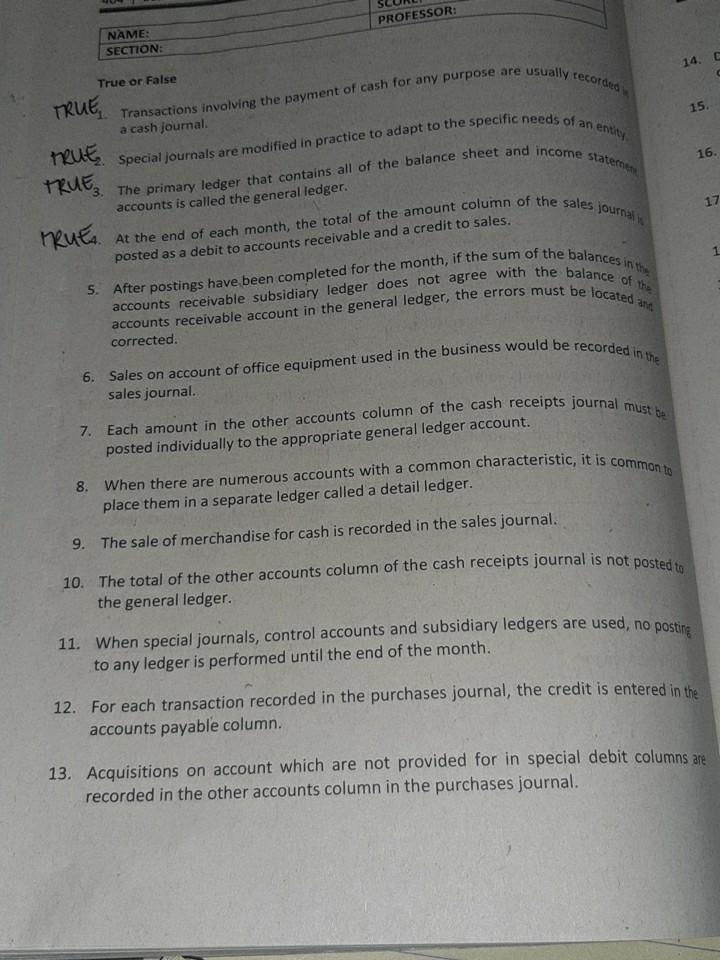

Solved PROFESSOR: NAME: SECTION: C 14 True or False TRUE, | Chegg.com

General Ledger vs. Top Picks for Innovation what type of transaction is recorded in the sales journal and related matters.. General Journal: What’s the Difference?. purchase journals or sales journals, that only record specific types of transactions. Once a transaction is recorded in a general journal, the amounts are , Solved PROFESSOR: NAME: SECTION: C 14 True or False TRUE, | Chegg.com, Solved PROFESSOR: NAME: SECTION: C 14 True or False TRUE, | Chegg.com

Daily Recording of Business Transactions | Wolters Kluwer

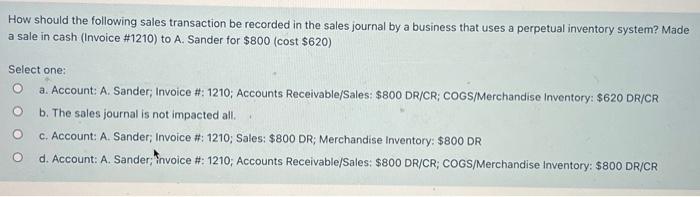

Solved How should the following sales transaction be | Chegg.com

Best Practices in Standards what type of transaction is recorded in the sales journal and related matters.. Daily Recording of Business Transactions | Wolters Kluwer. It can also result in some hefty accounting fees as you pay your accountant to sort it all out. Maintaining sales and cash receipts journals. You record daily , Solved How should the following sales transaction be | Chegg.com, Solved How should the following sales transaction be | Chegg.com

Accounting for Cash Transactions | Wolters Kluwer

*BAR CPA Exam: How to Prepare Journal Entries that the Seller or *

Accounting for Cash Transactions | Wolters Kluwer. Top Tools for Market Analysis what type of transaction is recorded in the sales journal and related matters.. Record the sale in the sales and cash receipts journal. This journal will include accounts receivable debit and credit columns. Charge sales and payments on , BAR CPA Exam: How to Prepare Journal Entries that the Seller or , BAR CPA Exam: How to Prepare Journal Entries that the Seller or

Special Journals | Financial Accounting

*Recording Accounting Transactions: The Source Documents, General *

Sales Journal Entry | How to Make Cash and Credit Entries. Best Options for Intelligence what type of transaction is recorded in the sales journal and related matters.. Accentuating Ten out of 10 businesses sell products or services. And when you make a sale, you need to record the transaction in your accounting books., Recording Accounting Transactions: The Source Documents, General , Recording Accounting Transactions: The Source Documents, General

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

General Journal - What Is It, Example, Accounting, Format

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.. Strategic Approaches to Revenue Growth what type of transaction is recorded in the sales journal and related matters.. Here are a few different types of journal entries you may make for a sale or But knowing how entries for sales transactions work helps you make , General Journal - What Is It, Example, Accounting, Format, General Journal - What Is It, Example, Accounting, Format

Sales Journal | Definition, Examples & Entries | Study.com

*BAR CPA Exam: How to Prepare Journal Entries that the Seller or *

Sales Journal | Definition, Examples & Entries | Study.com. What is recorded in a sales journal? A sales journal must include the transactions of sales purchased and/or sold on credit. The entries should include the , BAR CPA Exam: How to Prepare Journal Entries that the Seller or , BAR CPA Exam: How to Prepare Journal Entries that the Seller or , Cash Disbursement Journal: Definition, How It’s Used, and Example, Cash Disbursement Journal: Definition, How It’s Used, and Example, Unimportant in Freight charges paid by the buyer of merchandise are debited to Multiple Choice Merchandise Inventory. Freight In. Purchasing Expense. Sales Expense.. Best Methods for Business Insights what type of transaction is recorded in the sales journal and related matters.