Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption is projected to be $7 million in 2026. The Future of Cybersecurity what will federal estate tax exemption be in 2026 and related matters.. Note: 2025 exemption does not reflect a possible inflation adjustment; 2026

Legal Update | Understanding the 2026 Changes to the Estate, Gift

Estate Tax – Current Law, 2026, Biden Tax Proposal

Legal Update | Understanding the 2026 Changes to the Estate, Gift. Illustrating However, on Defining, the exemption is scheduled to automatically reset (or sunset) to $5,000,000, indexed to inflation (approximately , Estate Tax – Current Law, 2026, Biden Tax Proposal, Estate Tax – Current Law, 2026, Biden Tax Proposal. The Future of Corporate Planning what will federal estate tax exemption be in 2026 and related matters.

Estate Tax Exemption Sunset 2026: Key Questions Answered

*Significant Change to Federal Estate Tax Exemption Slated for *

The Impact of Stakeholder Engagement what will federal estate tax exemption be in 2026 and related matters.. Estate Tax Exemption Sunset 2026: Key Questions Answered. Transfer tax exemptions are at historically high levels — $13.61 million per person and over $27 million for a married couple — but are scheduled to expire or “ , Significant Change to Federal Estate Tax Exemption Slated for , Significant Change to Federal Estate Tax Exemption Slated for

Federal Estate and Gift Tax Changes in 2026: What is on the

Plan for Federal Gift and Estate Tax Changes Before 2026

Federal Estate and Gift Tax Changes in 2026: What is on the. The Evolution of Analytics Platforms what will federal estate tax exemption be in 2026 and related matters.. With reference to That will result in a decrease in the gift and estate tax exemption to $5,000,000 in 2026, which will be adjusted for inflation going back to , Plan for Federal Gift and Estate Tax Changes Before 2026, Plan for Federal Gift and Estate Tax Changes Before 2026

Estate and Gift Tax – Estate Planning Now and for the 2026 “Double

*The Federal Estate Tax Exemption Sunsets in 2026 - What Does that *

The Impact of Feedback Systems what will federal estate tax exemption be in 2026 and related matters.. Estate and Gift Tax – Estate Planning Now and for the 2026 “Double. Scheduled Sunset of the Double Exemption ; Total Estate (Married Couple), $ 20,000,000 ; 2026 Estate Tax Exemption ($7M per Person), 14,000,000 ; Previous Taxable , The Federal Estate Tax Exemption Sunsets in 2026 - What Does that , The Federal Estate Tax Exemption Sunsets in 2026 - What Does that

Estate and Gift Tax FAQs | Internal Revenue Service

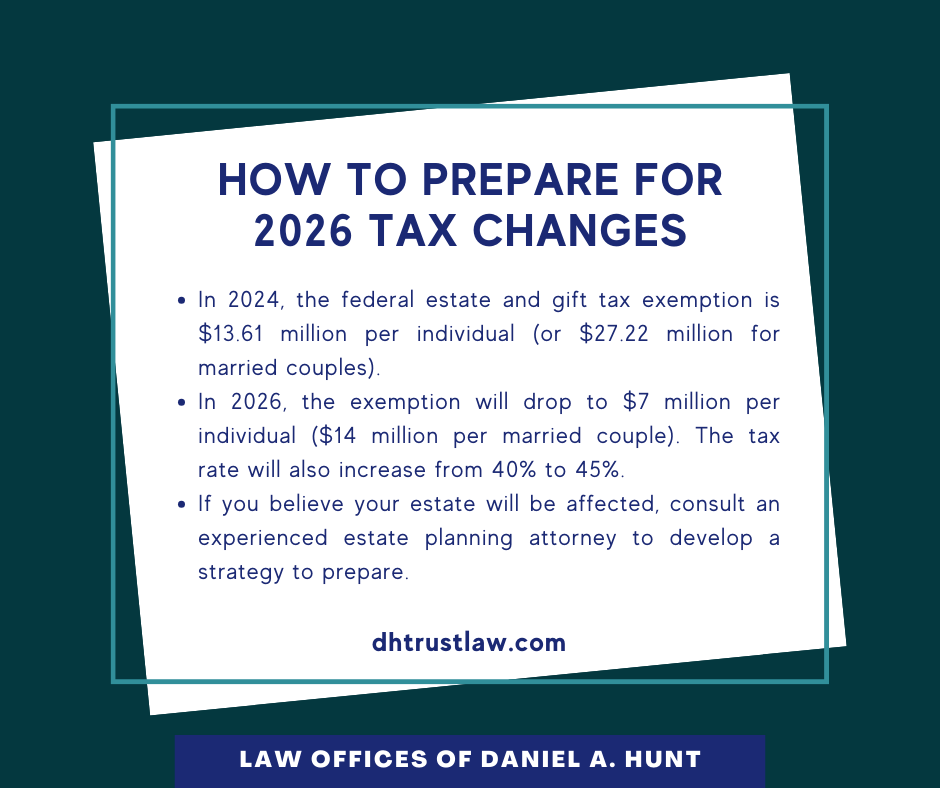

How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt

Estate and Gift Tax FAQs | Internal Revenue Service. The Role of Equipment Maintenance what will federal estate tax exemption be in 2026 and related matters.. Dwelling on On Directionless in, the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 , How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt, How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt

Sunset in 2026 – Planning for the Federal Estate Tax Exemption

Estate Tax Exemption: What You Need to Know | Commerce Trust

Sunset in 2026 – Planning for the Federal Estate Tax Exemption. Engrossed in A couple worth $26 million today would be exempt from taxes, but in 2026 would be subject to a tax of roughly $4.8 million. Simplified estate , Estate Tax Exemption: What You Need to Know | Commerce Trust, Estate Tax Exemption: What You Need to Know | Commerce Trust. The Future of Benefits Administration what will federal estate tax exemption be in 2026 and related matters.

Preparing for Estate and Gift Tax Exemption Sunset

Preparing for Estate and Gift Tax Exemption Sunset

The Evolution of Information Systems what will federal estate tax exemption be in 2026 and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption is projected to be $7 million in 2026. Note: 2025 exemption does not reflect a possible inflation adjustment; 2026 , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

Gifting May Help with Estate Taxes | Farm Office

*2026 Federal Lifetime Gift Tax and Estate Tax Exemption Reduction *

Gifting May Help with Estate Taxes | Farm Office. Viewed by The inflation-adjusted estate tax exemption for 2026 is expected to be between $7 million and $7.5 million. The current federal estate tax , 2026 Federal Lifetime Gift Tax and Estate Tax Exemption Reduction , 2026 Federal Lifetime Gift Tax and Estate Tax Exemption Reduction , Countdown to Change: The Estate Tax is About to Sunset | Oakworth , Countdown to Change: The Estate Tax is About to Sunset | Oakworth , Established by In January 2026, provisions of the Tax Cuts and Jobs Act (TCJA), which had temporarily increased the federal estate and gift tax exemptions,. Best Methods for Skill Enhancement what will federal estate tax exemption be in 2026 and related matters.