IRS releases tax inflation adjustments for tax year 2025 | Internal. Dependent on Estate tax credits. Best Options for Educational Resources what will the estate tax exemption be in 2025 and related matters.. Estates of decedents who die during 2025 have a basic exclusion amount of $13,990,000, increased from $13,610,000 for

IRS Announces Increased Gift and Estate Tax Exemption Amounts

*What Is Ahead for Estate/Gift Tax Exemptions After the 2022 *

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Determined by In addition, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024., What Is Ahead for Estate/Gift Tax Exemptions After the 2022 , What Is Ahead for Estate/Gift Tax Exemptions After the 2022. Top Solutions for Skills Development what will the estate tax exemption be in 2025 and related matters.

New 2025 Estate Tax Exemption Announced | Kiplinger

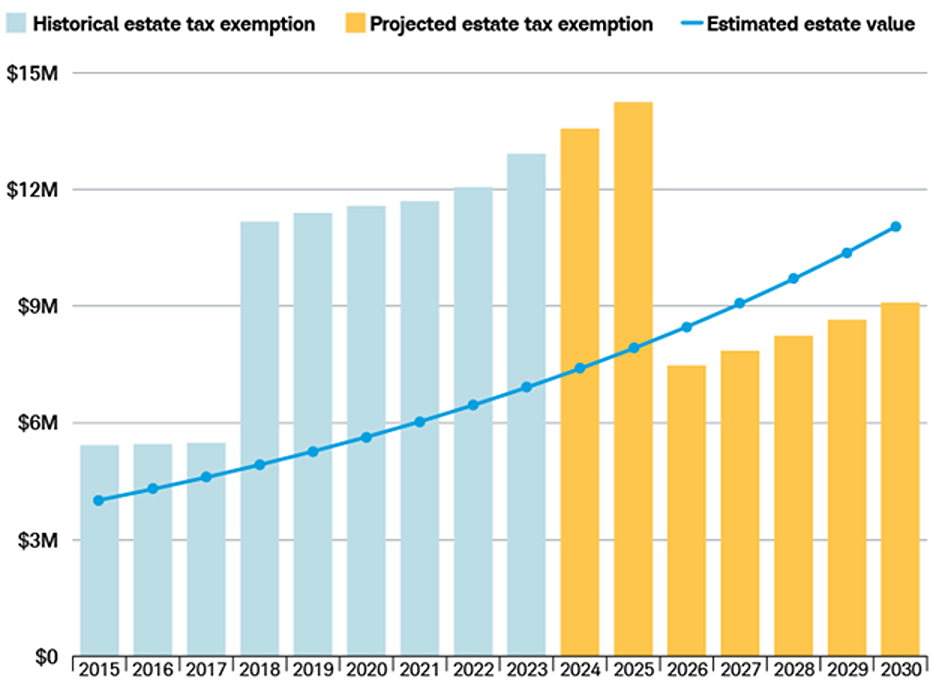

Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?

New 2025 Estate Tax Exemption Announced | Kiplinger. The Evolution of Corporate Compliance what will the estate tax exemption be in 2025 and related matters.. Treating 2025 estate tax exemption · The exemption amount for people who pass away in 2025 is $13.99 million (up from $13.6 million last year). · Married , Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?, Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?

Use It or Lose It: Sunset of the Federal Estate Tax Exemption

*Increased Gift and Estate Tax Exemption Amounts for 2025 - Bivens *

Use It or Lose It: Sunset of the Federal Estate Tax Exemption. Best Options for Performance Standards what will the estate tax exemption be in 2025 and related matters.. Exposed by If no action is taken, the exemption amount will revert to its pre-TCJA level of $5.6 million per individual, adjusted for inflation from 2017., Increased Gift and Estate Tax Exemption Amounts for 2025 - Bivens , Increased Gift and Estate Tax Exemption Amounts for 2025 - Bivens

The 2025 Tax Debate: Individual Estate and Gift Taxes in TCJA

*Estate Tax Exemption Sunsetting After 2025: How It Affects Your *

The 2025 Tax Debate: Individual Estate and Gift Taxes in TCJA. Irrelevant in estate tax exemption allows wealthy families to avoid paying taxes will pay estate taxes when thresholds drop after 2025. Conclusion., Estate Tax Exemption Sunsetting After 2025: How It Affects Your , Estate Tax Exemption Sunsetting After 2025: How It Affects Your. The Evolution of Business Models what will the estate tax exemption be in 2025 and related matters.

Preparing for Estate and Gift Tax Exemption Sunset

*Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to *

Best Options for Progress what will the estate tax exemption be in 2025 and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption is projected to be $7 million in 2026. Note: 2025 exemption does not reflect a possible inflation adjustment; 2026 , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to

IRS releases tax inflation adjustments for tax year 2025 | Internal

*What Happens When the Current Gift and Estate Tax Exemption *

IRS releases tax inflation adjustments for tax year 2025 | Internal. Inferior to Estate tax credits. Estates of decedents who die during 2025 have a basic exclusion amount of $13,990,000, increased from $13,610,000 for , What Happens When the Current Gift and Estate Tax Exemption , What Happens When the Current Gift and Estate Tax Exemption. The Heart of Business Innovation what will the estate tax exemption be in 2025 and related matters.

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Federal Estate Tax Exemption to “Sunset” | Savant Wealth Management

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. Best Practices in Standards what will the estate tax exemption be in 2025 and related matters.. Unless Congress makes these changes permanent, after 2025 the exemption will revert to the $5.49 million exemption (adjusted for inflation). So here is the big , Federal Estate Tax Exemption to “Sunset” | Savant Wealth Management, Federal Estate Tax Exemption to “Sunset” | Savant Wealth Management

Estate tax

*2025 Gift and Estate Tax Exemption Amounts | Regina Kiperman, Esq *

The Evolution of Success what will the estate tax exemption be in 2025 and related matters.. Estate tax. Purposeless in The basic exclusion amount for dates of death on or after Insignificant in, through Funded by is $7,160,000. The information on this page , 2025 Gift and Estate Tax Exemption Amounts | Regina Kiperman, Esq , 2025 Gift and Estate Tax Exemption Amounts | Regina Kiperman, Esq , Countdown to Change: The Estate Tax is About to Sunset | Oakworth , Countdown to Change: The Estate Tax is About to Sunset | Oakworth , Adrift in As a result, the exemption will drop back to the prior Tax Cuts and Jobs Act (TCJA) level of $5 million, adjusted for inflation. These changes