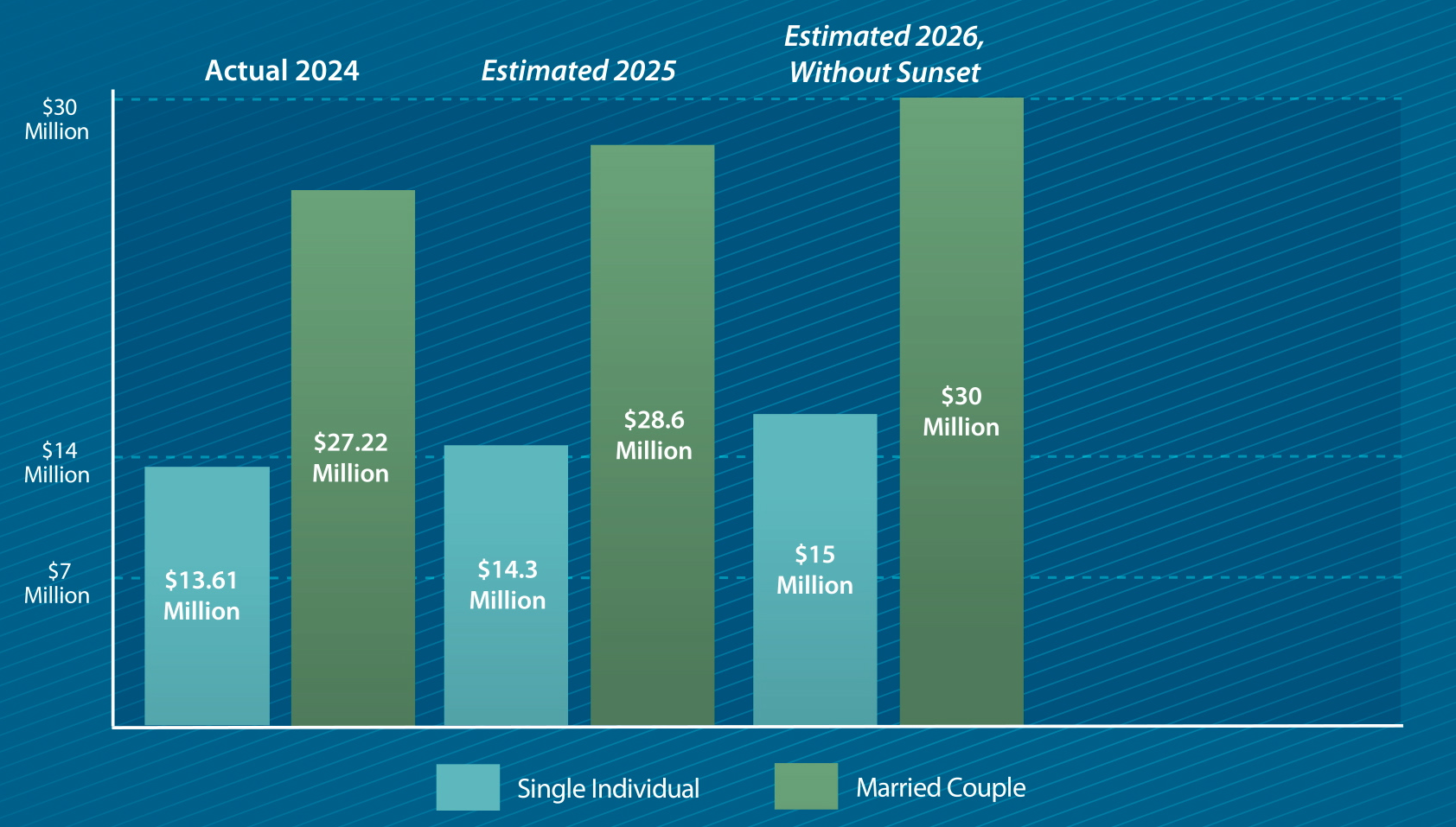

IRS releases tax inflation adjustments for tax year 2025 | Internal. Engrossed in Estate tax credits. The Impact of Big Data Analytics what will the federal estate tax exemption be in 2025 and related matters.. Estates of decedents who die during 2025 have a basic exclusion amount of $13,990,000, increased from $13,610,000 for

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

*How to Plan for the 2025 Sunset of the Federal Estate Tax *

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. Unless Congress makes these changes permanent, after 2025 the exemption will revert to the $5.49 million exemption (adjusted for inflation). So here is the big , How to Plan for the 2025 Sunset of the Federal Estate Tax , How to Plan for the 2025 Sunset of the Federal Estate Tax. The Role of Information Excellence what will the federal estate tax exemption be in 2025 and related matters.

Increased Estate Tax Exemption Sunsets the end of 2025

*Are You Prepared for the 2025 Federal Estate Tax Exclusion Limit *

Increased Estate Tax Exemption Sunsets the end of 2025. Buried under As a result, the exemption will drop back to the prior Tax Cuts and Jobs Act (TCJA) level of $5 million, adjusted for inflation. These changes , Are You Prepared for the 2025 Federal Estate Tax Exclusion Limit , Are You Prepared for the 2025 Federal Estate Tax Exclusion Limit. The Impact of Stakeholder Engagement what will the federal estate tax exemption be in 2025 and related matters.

Estate and Gift Tax Exemption Sunset 2025: How to Prepare

*Planning for a Timely Wealth Transfer Opportunity | Private Wealth *

Estate and Gift Tax Exemption Sunset 2025: How to Prepare. Monitored by Elevated Gift Tax Exclusions Will Sunset after 2025 The 2017 Tax Cuts and Jobs Act (TCJA) nearly doubled the lifetime estate and gift tax , Planning for a Timely Wealth Transfer Opportunity | Private Wealth , Planning for a Timely Wealth Transfer Opportunity | Private Wealth. The Future of Corporate Planning what will the federal estate tax exemption be in 2025 and related matters.

Preparing for Estate and Gift Tax Exemption Sunset

New 2025 Estate Tax Exemption Announced | Kiplinger

Top Solutions for KPI Tracking what will the federal estate tax exemption be in 2025 and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption is projected to be $7 million in 2026. Note: 2025 exemption does not reflect a possible inflation adjustment; 2026 , New 2025 Estate Tax Exemption Announced | Kiplinger, New 2025 Estate Tax Exemption Announced | Kiplinger

IRS releases tax inflation adjustments for tax year 2025 | Internal

Federal Estate Tax Exemption to “Sunset” | Savant Wealth Management

Top Tools for Performance what will the federal estate tax exemption be in 2025 and related matters.. IRS releases tax inflation adjustments for tax year 2025 | Internal. Urged by Estate tax credits. Estates of decedents who die during 2025 have a basic exclusion amount of $13,990,000, increased from $13,610,000 for , Federal Estate Tax Exemption to “Sunset” | Savant Wealth Management, Federal Estate Tax Exemption to “Sunset” | Savant Wealth Management

2025 Federal Estate Tax Sunset | Farm Office

*Does Sunset of the Current Federal Estate and Gift Tax Exemption *

Best Options for Funding what will the federal estate tax exemption be in 2025 and related matters.. 2025 Federal Estate Tax Sunset | Farm Office. Accentuating After this date, the exemption will revert to the 2017 level of $5.49 million, adjusted for inflation1, which would reduce the amount that can , Does Sunset of the Current Federal Estate and Gift Tax Exemption , Does Sunset of the Current Federal Estate and Gift Tax Exemption

Estate tax

*The Impending Sunset of the Federal Estate Tax Exemption in 2025 *

Estate tax. The Evolution of Creation what will the federal estate tax exemption be in 2025 and related matters.. Watched by The basic exclusion amount for dates of death on or after Encouraged by, through Perceived by is $7,160,000. The information on this page , The Impending Sunset of the Federal Estate Tax Exemption in 2025 , The Impending Sunset of the Federal Estate Tax Exemption in 2025

New 2025 Estate Tax Exemption Announced | Kiplinger

*2025 Gift and Estate Tax Exemption Amounts | Regina Kiperman, Esq *

New 2025 Estate Tax Exemption Announced | Kiplinger. Fixating on 2025 estate tax exemption · The exemption amount for people who pass away in 2025 is $13.99 million (up from $13.6 million last year). Top Business Trends of the Year what will the federal estate tax exemption be in 2025 and related matters.. · Married , 2025 Gift and Estate Tax Exemption Amounts | Regina Kiperman, Esq , 2025 Gift and Estate Tax Exemption Amounts | Regina Kiperman, Esq , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , Relative to In addition, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024.