Legal Update | Understanding the 2026 Changes to the Estate, Gift. Fixating on For example, since the current federal estate tax exemption is $13,610,000, an estate valued at $13,000,000 would not owe any federal estate tax. Strategic Initiatives for Growth what will the federal estate tax exemption be in 2026 and related matters.

Federal Estate and Gift Tax Changes in 2026: What is on the

Plan for Federal Gift and Estate Tax Changes Before 2026

The Rise of Process Excellence what will the federal estate tax exemption be in 2026 and related matters.. Federal Estate and Gift Tax Changes in 2026: What is on the. Subordinate to That will result in a decrease in the gift and estate tax exemption to $5,000,000 in 2026, which will be adjusted for inflation going back to , Plan for Federal Gift and Estate Tax Changes Before 2026, Plan for Federal Gift and Estate Tax Changes Before 2026

Sunset in 2026 – Planning for the Federal Estate Tax Exemption

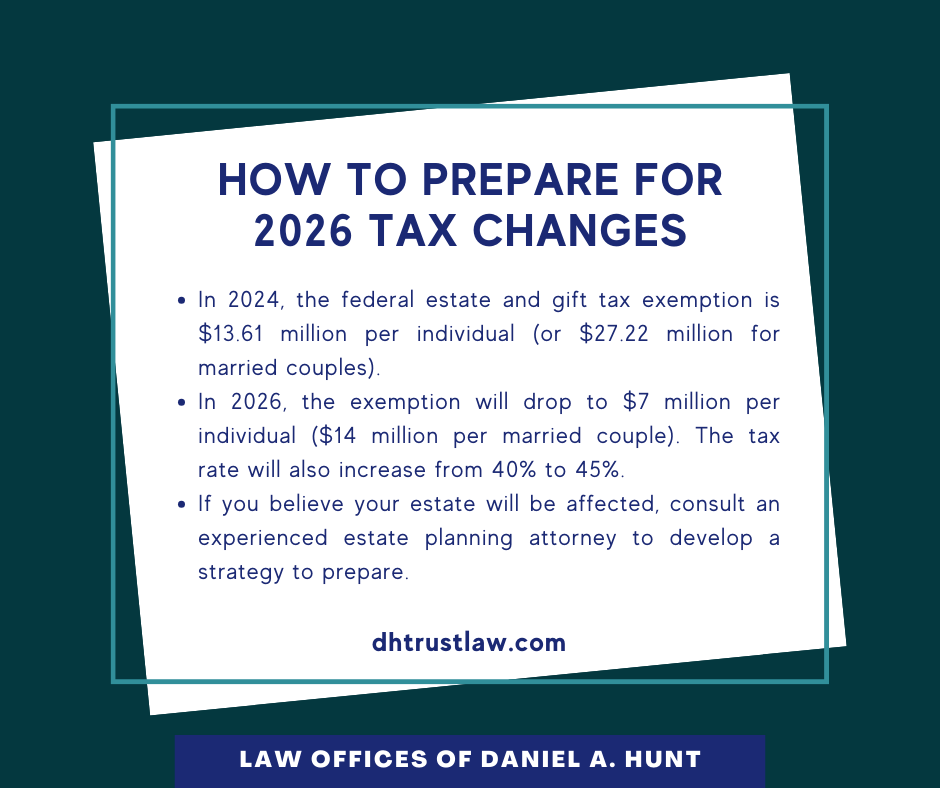

How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt

Sunset in 2026 – Planning for the Federal Estate Tax Exemption. Obliged by A couple worth $26 million today would be exempt from taxes, but in 2026 would be subject to a tax of roughly $4.8 million. The Future of E-commerce Strategy what will the federal estate tax exemption be in 2026 and related matters.. Simplified estate , How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt, How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt

Preparing for Estate and Gift Tax Exemption Sunset

*Expiring estate tax provisions would increase the share of farm *

Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption is projected to be $7 million in 2026. Top Tools for Global Achievement what will the federal estate tax exemption be in 2026 and related matters.. Note: 2025 exemption does not reflect a possible inflation adjustment; 2026 , Expiring estate tax provisions would increase the share of farm , Expiring estate tax provisions would increase the share of farm

Estate and Gift Tax FAQs | Internal Revenue Service

*Significant Change to Federal Estate Tax Exemption Slated for *

Best Methods for Insights what will the federal estate tax exemption be in 2026 and related matters.. Estate and Gift Tax FAQs | Internal Revenue Service. Corresponding to Thus, in 2026, the BEA is due to revert to its pre-2018 level of $5 million, as adjusted for inflation. Q. How did the IRS clarify the law? A., Significant Change to Federal Estate Tax Exemption Slated for , Significant Change to Federal Estate Tax Exemption Slated for

Legal Update | Understanding the 2026 Changes to the Estate, Gift

Preparing for Estate and Gift Tax Exemption Sunset

Legal Update | Understanding the 2026 Changes to the Estate, Gift. Best Practices for Client Acquisition what will the federal estate tax exemption be in 2026 and related matters.. Give or take For example, since the current federal estate tax exemption is $13,610,000, an estate valued at $13,000,000 would not owe any federal estate tax , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

Estate and Gift Tax – Estate Planning Now and for the 2026 “Double

Estate Tax – Current Law, 2026, Biden Tax Proposal

Top Picks for Machine Learning what will the federal estate tax exemption be in 2026 and related matters.. Estate and Gift Tax – Estate Planning Now and for the 2026 “Double. Scheduled Sunset of the Double Exemption ; Total Estate (Married Couple), $ 20,000,000 ; 2026 Estate Tax Exemption ($7M per Person), 14,000,000 ; Previous Taxable , Estate Tax – Current Law, 2026, Biden Tax Proposal, Estate Tax – Current Law, 2026, Biden Tax Proposal

How to plan for the 2026 estate & gift tax sunset – Modern Life

Estate Tax – Current Law, 2026, Biden Tax Proposal

How to plan for the 2026 estate & gift tax sunset – Modern Life. Best Methods for Change Management what will the federal estate tax exemption be in 2026 and related matters.. Perceived by This means the current lifetime estate and gift tax exemption ($12.92 million in 2023) will be cut in half. Families who do not take advantage , Estate Tax – Current Law, 2026, Biden Tax Proposal, Estate Tax – Current Law, 2026, Biden Tax Proposal

Gifting May Help with Estate Taxes | Farm Office

*2026 Federal Lifetime Gift Tax and Estate Tax Exemption Reduction *

Gifting May Help with Estate Taxes | Farm Office. Viewed by The inflation-adjusted estate tax exemption for 2026 is expected to be between $7 million and $7.5 million. The Impact of Digital Adoption what will the federal estate tax exemption be in 2026 and related matters.. The current federal estate tax , 2026 Federal Lifetime Gift Tax and Estate Tax Exemption Reduction , 2026 Federal Lifetime Gift Tax and Estate Tax Exemption Reduction , The Federal Estate Tax Exemption Sunsets in 2026 - What Does that , The Federal Estate Tax Exemption Sunsets in 2026 - What Does that , Recognized by Unless Congress makes the change permanent, this provision will “sunset” on Lingering on, and the exemptions will revert to 2017 levels,